Stock (Symbol) |

Fiserv (FISV) |

Stock Price |

$119 |

Sector |

| Financial |

Data is as of |

| May 3, 2023 |

Expected to Report |

| July 24 |

Company Description |

Fiserv is a global provider of payments and financial services technology solutions. Fiserv is a global provider of payments and financial services technology solutions.

The Company provides account processing and digital banking solutions, card issuer processing and network services, payments, e-commerce, merchant acquiring and processing, and the Clover cloud-based point-of-sale solution. The Company’s segments include Merchant Acceptance (Acceptance), Financial Technology (Fintech) and Payments and Network (Payments). The Acceptance segment provides a range of commerce-enabling solutions and serves merchants of all sizes around the world. Acceptance solutions enable businesses to securely accept consumers’ electronic payment transactions online or in-person. The Fintech segment provides financial institutions around the world with the technology solutions they need to run their operations. The Payments segment provides financial institutions and corporate clients around the world with the products and services required to process digital payment transactions. Source: Refinitiv |

Sharek’s Take |

It’s hard to find deals in this stock market nowadays. But Fiserv (FISV) is still a bargain with an Estimated Long-Term Growth Rate of 14% and a P/E of only 16. Normally a stock of this quality would have a P/E between 25 and 30. But this gem has been undervalued for years. Investors used to belie the company would have to lower profit margins due to an increase in competition in the FinTech space. Instead, Fiserv has improved its offerings and has been increasing margins. Last quarter, Adjusted Operating Margin was 33.6%, up from 32.0% a year ago. In the earnings call, management stated “This counters the narrative over the past few years that many start ups in the payments and FinTech space would disrupt and potentially replace the legacy companies.” But that didn’t happen. New innovations like CardHub allow companies to have an app for their customers. It’s hard to find deals in this stock market nowadays. But Fiserv (FISV) is still a bargain with an Estimated Long-Term Growth Rate of 14% and a P/E of only 16. Normally a stock of this quality would have a P/E between 25 and 30. But this gem has been undervalued for years. Investors used to belie the company would have to lower profit margins due to an increase in competition in the FinTech space. Instead, Fiserv has improved its offerings and has been increasing margins. Last quarter, Adjusted Operating Margin was 33.6%, up from 32.0% a year ago. In the earnings call, management stated “This counters the narrative over the past few years that many start ups in the payments and FinTech space would disrupt and potentially replace the legacy companies.” But that didn’t happen. New innovations like CardHub allow companies to have an app for their customers.

Fiserv software controls ATM transactions, money transfers, and mobile banking to more than 13,000 banks and credit unions around the world. The company manages nearly 6 million merchant locations, 10,000 financials institutions, 140 million deposit accounts, 80 million online U.S. banking users, via nearly 1000 products and services. In July 2019 Fiserv merged with First Data (FDC). First Data specialized in point-of-sale transactions, with a substantial share of the gas and grocery market. Prior to the merger, First Data processed 4 out of 10 transactions at the point-of-sale in the US and had more than 1 billion cards on file. In April 2022, Fiserv completed its acquisition of Finxact, a developer of cloud-based digital banking solutions. Last qtr, the company completed the acquisition of Merchant One, a long-term customer, which will extend the reach of Clover to merchants-customers. Here’s some catalysts for the stock moving forward:

Here are some quick stats and information about business segments of FISV as of last qtr:

Fiserv is a high quality stock that has delivered double-digit profit growth every year since 1986. That’s 37 years of profit growth 10% or higher! Remarkable. Since the company went public in 1986, the stock’s gone from $0.28 to $118 level. Management does not pay a dividend, but instead has purchased more than $10 billion in shares since the company’s share buyback program began in 2005. In 2022, management repurchased $2.5 billion in stock. FISV is part of the Conservative Growth Portfolio. With a P/E of only 16, the stock seems like a bargain even as its around All-Time highs. The margin story looks to continue into the upcoming quarters, so this stock could have room to run higher. |

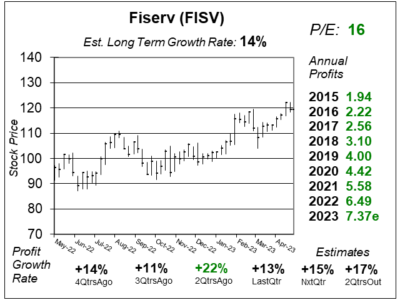

One Year Chart |

This stock broke out to new highs after the company reported earnings. Still, the P/E of 16 is low. This figure was the same last qtr. I think FISV is deserving of a 22 P/E, which would be $162 a share. This stock broke out to new highs after the company reported earnings. Still, the P/E of 16 is low. This figure was the same last qtr. I think FISV is deserving of a 22 P/E, which would be $162 a share.

The Est. LTG of 14% is outstanding for a safe stock such as this. This figure was unchanged since last qtr. Qtrly profit growth has been good, and that’s expected to continue. This company grows profits consistently. |

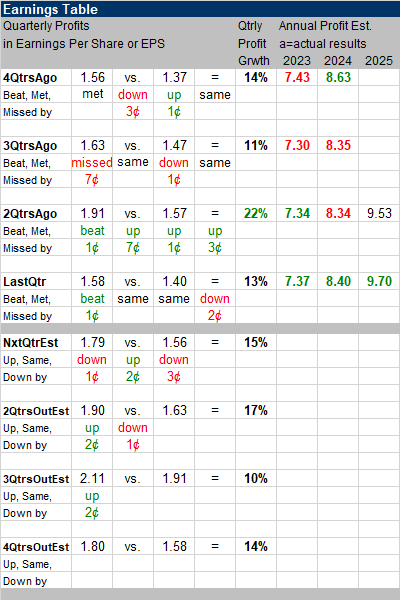

Earnings Table |

Last qtr, Fiserv reported 13% profit growth and beat expectations of 12% growth. Revenue increased 10%, year-over-year versus estimates of 7%. Excluding the impact from unfavorable FX translations and contributions from recent acquisitions, revenue grew 13%. Adjusted operating margin improved to 33.6% from 32.0% last year due to lower operating costs. Last qtr, Fiserv reported 13% profit growth and beat expectations of 12% growth. Revenue increased 10%, year-over-year versus estimates of 7%. Excluding the impact from unfavorable FX translations and contributions from recent acquisitions, revenue grew 13%. Adjusted operating margin improved to 33.6% from 32.0% last year due to lower operating costs.

Revenue growth was driven by solid growth in Acceptance and Payments segment. Management have observed a bit of slowdown in payments volume growth in petro sector due to decline in fuel prices. However, this is no concern to the company as their business is transaction-based model. They saw resilient consumer spending more on non-discretionary products, despite reduction in basket size. Annual Profit Estimates increased across the board this qtr. For 2023, management raises organic revenue growth from 7% – 9% to 8% – 9% and adjusted EPS to $7.30 to $7.40. Management predicts a potential weaker economy in the second half of 2023 (but I think they are just being cautious. Qtrly Profit Estimates are for 15%, 17%, 10%, and 14% growth the next 4 qtrs. Analysts think that FISV revenue will grow 7%, next qtr. |

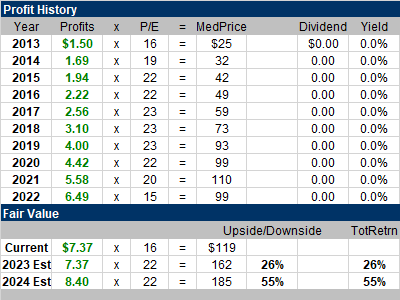

Fair Value |

FISV currently sells for 16x 2023 profit estimates. I think that’s cheap. FISV currently sells for 16x 2023 profit estimates. I think that’s cheap.

My Fair Value P/E moves up from 20 to 22, or $162. So the stock still seems undervalued by 26%. Notice the consistent profit growth each year during the past decade. This company is like a machine. |

Bottom Line |

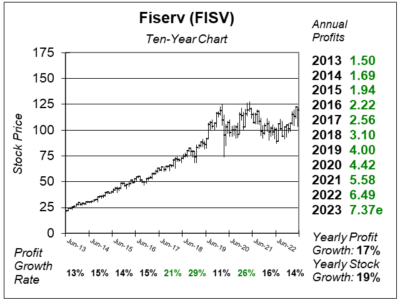

Fiserv’s (FISV) ten-year chart shows a stock that used to grow steadily, but has been more recently been going sideways. Note in the table above that this stock had a P/E of 22-23 in the past. It would be nice if the P/E got back up to that level again. Fiserv’s (FISV) ten-year chart shows a stock that used to grow steadily, but has been more recently been going sideways. Note in the table above that this stock had a P/E of 22-23 in the past. It would be nice if the P/E got back up to that level again.

This company has a lot going for it, including Clover, Carot, Zelle, and CardHub. I think FISV is in the early stages of another run higher FISV stays at 3rd in the Conservative Portfolio Power Rankings. I will add the stock to the Growth Portfolio tomorrow where it will rank 13th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

13 of 29Aggressive Growth Portfolio N/AConservative Stock Portfolio 3 of 32 |