The stock market increased on Tuesday as investors remained optimistic on next year’s interest rate cuts. Note, however, that the central bank would cut rates if inflation continued to slow consistently.

The stock market increased on Tuesday as investors remained optimistic on next year’s interest rate cuts. Note, however, that the central bank would cut rates if inflation continued to slow consistently.

Overall, S&P 500 grew 0.6% to 4,768 and is approaching its record high. NASDAQ rose 0.7% to 15,003.

Tweet of the Day

$NVDA – Hearing 3p boutique calling out mixed demand feedback in 1H24 this morning….

Hearing they are citing US CSPs lowering AI server forecasts for CY24. Unclear why it’s happening – they speculate it likely is mix shift towards H200 causing some customers to pause ST before…

— TMT Breakout (@heartbreakout) December 19, 2023

Chart of the Day

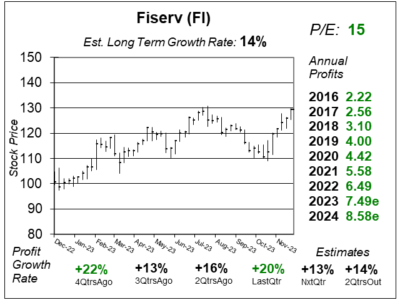

Here is the one-year chart of Fiserv (FI) as of November 29, 2023, when the stock was at $129.

Here is the one-year chart of Fiserv (FI) as of November 29, 2023, when the stock was at $129.

Fiserv reported great results last quarter as profits increased a solid 20%. This growth was led by acceleration in organic revenue growth for its Merchant Acceptance and FinTech segments, with increases of 20% and 6%, respectively.

In addition, Fiserv is teaming up with PayPal (PYPL). It is a massive deal that puts Fiserv right at the heart of PayPal’s U.S. payment services.

What is nice about Fiserv is that the stock has a P/E of only 15. That low valuation gives the stock good upside.

FISV is part of the Conservative Growth Portfolio and Growth Portfolio. With a P/E of 15, the stock seems like a bargain even as it is around All-Time highs. David Sharek, Founder of School of Hard Stocks, thinks that FI has close to 70% upside over the next 24 months.