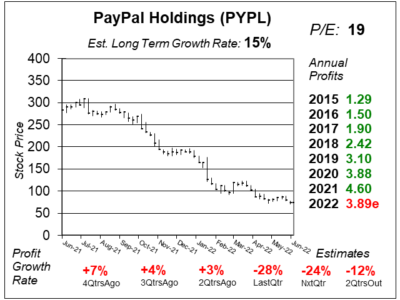

PayPal’s (PYPL) Results Have Been Poor, This Quarter Was Terrible

This PayPal (PYPL) report is terrible. Some of it is from eBay paying sellers directly. Maybe competition from Apple Pay and Zelle is hurting?

This PayPal (PYPL) report is terrible. Some of it is from eBay paying sellers directly. Maybe competition from Apple Pay and Zelle is hurting?

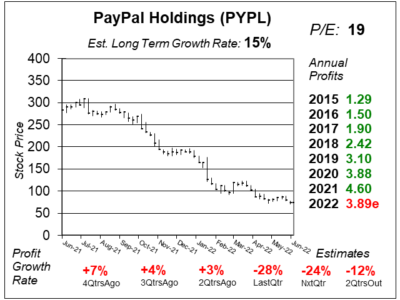

PayPal (PYPL) stock is totally out of favor, due to losing eBay’s business and COVID. Profit growth is set to return later in 2022.

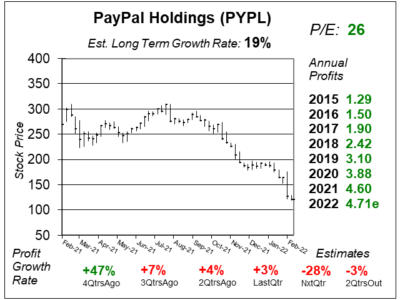

PayPal’s (PYPL) stock has fallen hard. But now, with a P/E of 34, PYPL looks like it could to return to its +20% annual growth days.

PayPal (PYPL) is expanding its Buy-Now, Pay-Later offering into Japan. But losing eBay’s business will likely hurt results for 3 qtrs.

PayPal (PYPL) is launching a new digital wallet that will be a game changer. Imagine getting 1% back on PayPal/Venmo purchases.

PayPal (PYPL) is trying to be your “bank” by offering direct deposit, bill pay, cryptocurrency, buy now & pay later, and more.

PayPal (PYPL) is vying to be the best electronic bank with direct deposit, bill pay, crypto, a credit card, and buy now/pay later,

PayPal (PYPL) is taking major market share in merchant services while also becoming the preferred bank to millions.

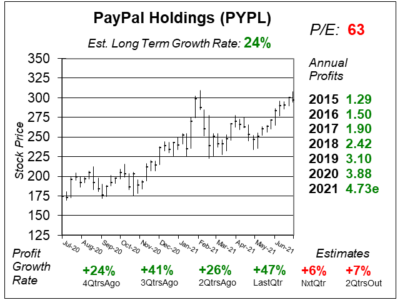

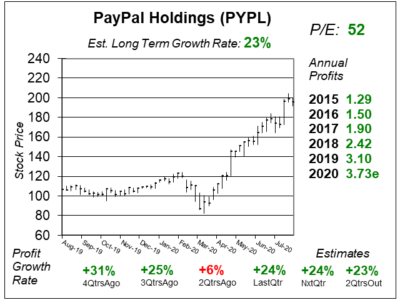

PayPal (PYPL) just delivered such an impressive qtr that investors bought in at record rates. Let’s take a look.

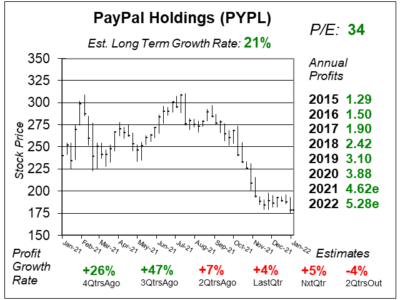

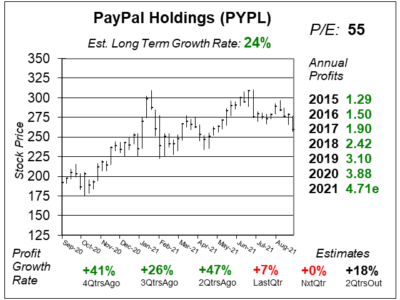

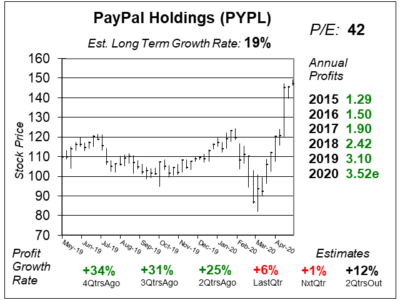

PayPal’s (PYPL) qtrly profit growth just slipped from 37% to 25% the past three qtrs, and now 0% growth is on deck.

PayPal (PYPL) is expected to be the 1st non-Chinese payments company to be licensed to provide online payment services.

PayPal (PYPL) has 40% volume growth in its person-to-person transfers, with its Venmo app leading the “charge”.

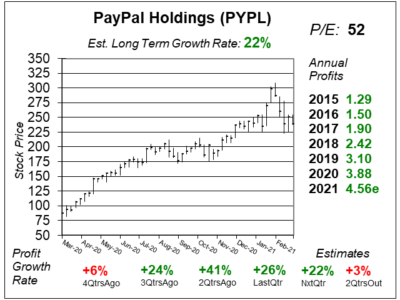

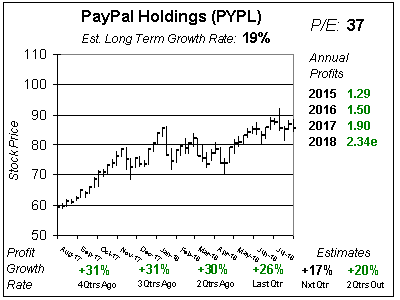

Last qtr, PayPal (PYPL) delivered 37% profit growth and whipped estimates of 19%. Next qtr’s estimate it 19%. Can it whip that too?

PayPal (PYPL) has a catalyst in its Venmo app, which just grew payment volume 80% year-over-year. Here’s Sharek’s take on PYPL stock.

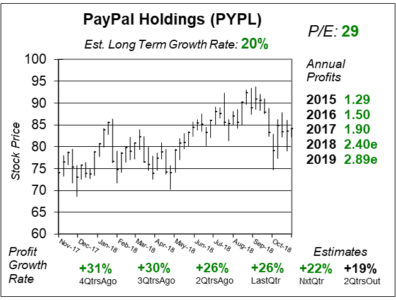

Analysts expect PayPal (PYPL) to grow profits 20% in 2019. But since the company has been beating the street, I think 25% is likely.

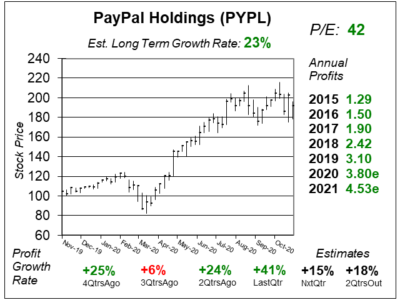

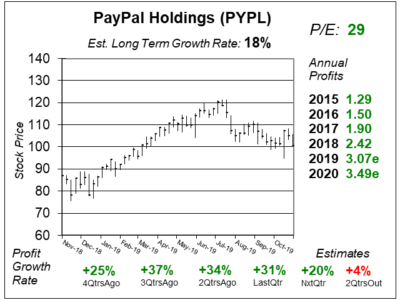

PayPal (PYPL) continues to deliver strong results. Regardless, profit growth just slowed a bit from 31% to 26%. I think it will slow more.

PayPal (PYPL) recently doubled in price, so it’s no wonder its taking a breather. With the NASDAQ looking to move higher, PYPL could too.

Ebay has decided to allow customers to have more payment choices, which sent shares of Paypal (PYPL) lower. Is heightened competition a concern for PYPL stock?

Mobile payments are increasing in popularity as people buy more things with their cell phones. PayPal’s (PYPL) Venmo app is taking a big chunk of those payments.

Payment processor Paypal (PYPL) is a tech stock, as the company is hanging the world with its mobile payment platforms that allow people to transfer money — easy.

PayPal (PYPL) and its new app Venmo are leading a digital revolution where you can pay for dinner or send money to friends via your cell phone.