Investors were impressed with earnings from blue chip stocks today. 3M (MMM), Coca-Cola (KO), General Electric (GE) and Verizon (VZ) all had good results. Strength in these stocks pushes the market higher on the day.

Investors were impressed with earnings from blue chip stocks today. 3M (MMM), Coca-Cola (KO), General Electric (GE) and Verizon (VZ) all had good results. Strength in these stocks pushes the market higher on the day.

Overall, S&P 500 grew 0.7% to 4,248, while NASDAQ increased 0.9% to 13,140.

Tweet of the Day

Regional bank carnage and recent rise in auto delinquencies to long-term historical highs indicate U.S. economy slowing significantly.

Recession in 4th quarter.

Best investments are equity arbs (CPRI and SGEN. VMW a long shot). I’m seriously considering regional banks again. 1/2— Bill Gross (@real_bill_gross) October 23, 2023

Chart of the Day

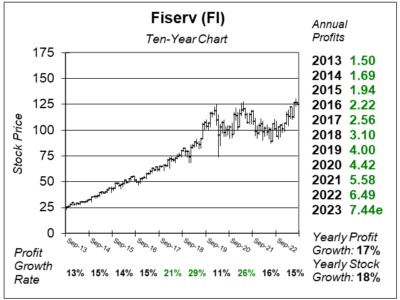

Here is the ten-year chart of Fiserv (FI) as of August 2, 2023, when the stock was at $125.

Here is the ten-year chart of Fiserv (FI) as of August 2, 2023, when the stock was at $125.

Fiserv software controls ATM transactions, money transfers, and mobile banking to more than 13,000 banks and credit unions around the world. The company manages nearly 6 million merchant locations, 10,000 financial institutions, 140 million deposit accounts, 80 million online U.S. banking users, via nearly 1,000 products and services.

Fiserv is proving to be one of the best FinTech stocks around. A few years ago, investors were saying PayPal (PYPL) and Square (SQ) would usher in a new era of digital payments. However, that has yet to materialize, with SQ and PYPL stock well off their highs. Meanwhile, Fiserv just hit an All-Time High.

Overall, the company’s profits grew a solid 15% last quarter while revenue was up 7%. Those figures are fine for a stock with a P/E of only 17. Revenue growth was led by the Merchant Acceptance segment, specifically in Latin America and other International markets. Management spoke a lot about Latin America being a strong opportunity for growth. The region currently comprises 6% of the company’s total adjusted revenue. To grow in this region, Fiserv is partnering with Caixa Econômica Federal to enable card payments for more than 13,000 bill payments agencies in Brazil. The company is also enabling Person-to-Business payments through Pix, a popular payment platform in Brazil.

FISV is part of the Conservative Growth Portfolio and Growth Portfolio. With a P/E of 17, the stock seems like a bargain even as it’s around All-Time highs. David Sharek, Founder of School of Hard Stocks, thinks FI has 50% upside over the next 18 months.