The stock market rebounded on Thursday after concerns on rate hikes caused consecutive declines in major indices – four consecutive days in the case of S&P 500.

The stock market rebounded on Thursday after concerns on rate hikes caused consecutive declines in major indices – four consecutive days in the case of S&P 500.

Overall, S&P 500 grew 0.5% to 4,012, while NASDAQ increased 0.7% 11,590.

Tweet of the Day

https://twitter.com/ecommerceshares/status/1628776113991188480

Chart of the Day

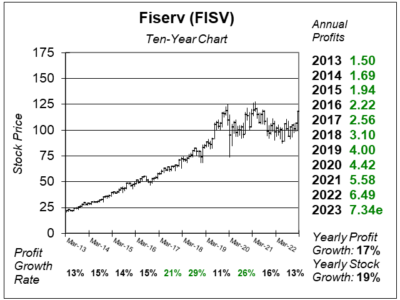

Here is the ten-year chart of Fiserv (FISV) as of February 15, 2023, when the stock was at $118.

Here is the ten-year chart of Fiserv (FISV) as of February 15, 2023, when the stock was at $118.

Fiserv software controls ATM transactions, money transfers, and mobile banking to more than 13,000 banks and credit unions around the world.

FISV’s ten-year chart shows a stock that used to grow steadily, but has been more recently been going sideways. Note that this stock had a P/E of 22-23 in the past. It would be nice if the P/E got back up to that level again.

FISV is part of the Conservative Growth Portfolio. With a P/E of only 13, the stock seems like a bargain to David Sharek, Founder of The School of Hard Stocks.