The stock market slipped on Monday as investors eyed monthly jobs report and a testimony from Federal Reserve Chair Jerome Powell.

The stock market slipped on Monday as investors eyed monthly jobs report and a testimony from Federal Reserve Chair Jerome Powell.

Overall, S&P 500 was down 0.1% to 5,131, while NASDAQ fell 0.4% to 16,208.

Tweet of the Day

Fact-check:

1. Prices have never been higher and are starting to accelerate to the upside again

2. All the jobs created in the past year have been part time.

3. There has been zero job growth for native-born Americans since 2018; all jobs have gone to immigrants (mostly illegal… https://t.co/MeX7KhbaHl pic.twitter.com/OJI79p9oLp— zerohedge (@zerohedge) February 29, 2024

Chart of the Day

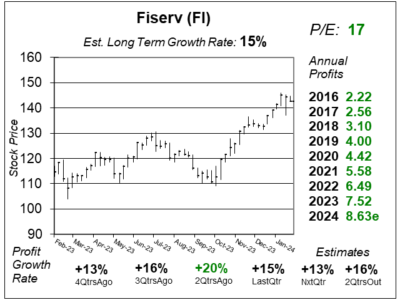

Here is the one-year chart of Fiserv (FI) as of February 13, 2024, when the stock was at $143.

Here is the one-year chart of Fiserv (FI) as of February 13, 2024, when the stock was at $143.

Fiserv delivered yet another solid quarter with 15% profit growth on just 6% revenue growth. The highlights of the quarter were point-of-sale system Clover, which had revenue growth of 30%, and money transfer app Zelle, which registered a 44% increase in transactions during the quarter as the number of clients climbed 23%.

Clover is a full point-of-sale system for merchants to ring up sales, take payments on Clover point-of-sale devices, and keep track of numbers. The company also provides omnichannel shopping/checkout solutions (such as order ahead to pick up) to 10 of the top 15 quick service restaurants including McDonald’s (MCD), Chick-fil-A, Taco Bell and Dunkin Donuts.

Zelle is a digital person-to-person payments platform that allows users to send money. It is similar to PayPal (PYPL), Venmo or Cash App. Fiserv does not actually own Zelle, but it does run payment processing for it and collects interchange fees for providing this service. Zelle looks like the new leader in the send money space. It is owned by Early Warning Systems, which is owned by JP Morgan Chase, Bank of America, Wells Fargo, and other big banks.

FI is part of the Conservative Growth Portfolio and Growth Portfolio. With a P/E of 17, the stock seems like a bargain even as it’s around All-Time highs.