About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

Fiserv, Inc. (Fiserv) is a global provider of financial services technology. The Company provides account processing systems; electronic payments processing products and services, and related services, including document and payment card production and distribution, check processing and imaging, source capture systems, and lending and risk management products and services. The Company’s Payments and Industry Products segment primarily provides debit, credit and prepaid card processing and services, electronic bill payment and presentment services, Internet and mobile banking software and services, person-to-person payment services, and other electronic payments software and services. The Company’s Financial Institution Services business segment provides account processing services, item processing and source capture services, loan origination and servicing products, cash management and consulting services. Source: Thomson Financial

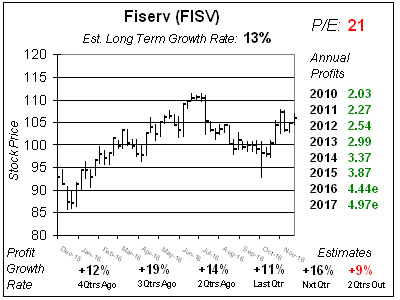

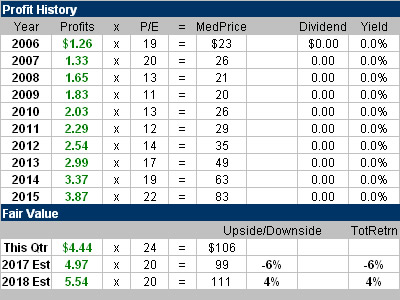

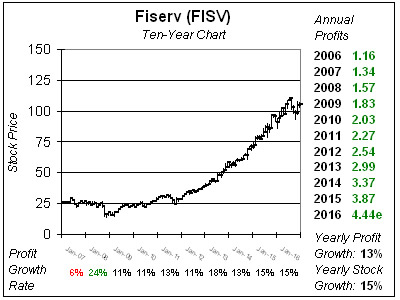

Fiserv, Inc. (Fiserv) is a global provider of financial services technology. The Company provides account processing systems; electronic payments processing products and services, and related services, including document and payment card production and distribution, check processing and imaging, source capture systems, and lending and risk management products and services. The Company’s Payments and Industry Products segment primarily provides debit, credit and prepaid card processing and services, electronic bill payment and presentment services, Internet and mobile banking software and services, person-to-person payment services, and other electronic payments software and services. The Company’s Financial Institution Services business segment provides account processing services, item processing and source capture services, loan origination and servicing products, cash management and consulting services. Source: Thomson Financial Banks are doing great! Which makes a robust shopping environment for Fiserv (FISV). Fiserv provides technology that allows withdrawing money from an ATM, money transfers and mobile banking to more than 13,000 banks and credit unions around the world. It integrates banks with billers including AT&T, Discover, T-Mobile, Chase, American Express and utilities to make paying bills online easy. This is a high quality stock that has delivered double-digit profit growth every year since 1986 and management targets 4-8% sales growth and 11-18% profit growth going forward. Again, that’s 30 straight years of double-digit profit growth. Revenues grow only around 5% a year, but the company buys back lots and lots of stock to boost EPS, and has repurchased around a third of the shares outstanding the past ten years. New technologies like chip cards have helped take profit margins up. Fiserv is a safe, conservative stock with an outstanding track record of double-digit profit growth, but the P/E of 21 is a bit higher than the ten-year average of 16 (the P/E was low during the Financial Crisis era). The stock doesn’t pay a dividend because of all the money management spends on stock buybacks. I love this company and the stock but am impatiently waiting for FISV to come down a bit so I can buy in for conservative accounts. My 2017 Fair Value is $99 a share.

Banks are doing great! Which makes a robust shopping environment for Fiserv (FISV). Fiserv provides technology that allows withdrawing money from an ATM, money transfers and mobile banking to more than 13,000 banks and credit unions around the world. It integrates banks with billers including AT&T, Discover, T-Mobile, Chase, American Express and utilities to make paying bills online easy. This is a high quality stock that has delivered double-digit profit growth every year since 1986 and management targets 4-8% sales growth and 11-18% profit growth going forward. Again, that’s 30 straight years of double-digit profit growth. Revenues grow only around 5% a year, but the company buys back lots and lots of stock to boost EPS, and has repurchased around a third of the shares outstanding the past ten years. New technologies like chip cards have helped take profit margins up. Fiserv is a safe, conservative stock with an outstanding track record of double-digit profit growth, but the P/E of 21 is a bit higher than the ten-year average of 16 (the P/E was low during the Financial Crisis era). The stock doesn’t pay a dividend because of all the money management spends on stock buybacks. I love this company and the stock but am impatiently waiting for FISV to come down a bit so I can buy in for conservative accounts. My 2017 Fair Value is $99 a share.