American Express (AXP) Blasts to Record Highs as Delinquencies Remain Low

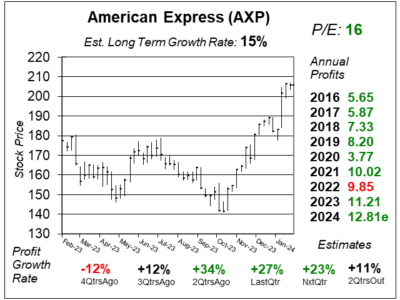

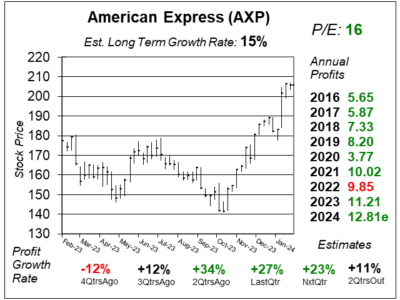

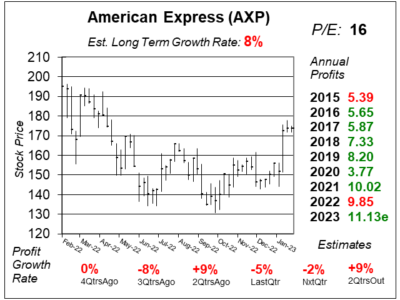

American Express (AXP) stock shot higher after the company reported earnings last qtr. And with a PE of 16, AXP is still cheap.

American Express (AXP) stock shot higher after the company reported earnings last qtr. And with a PE of 16, AXP is still cheap.

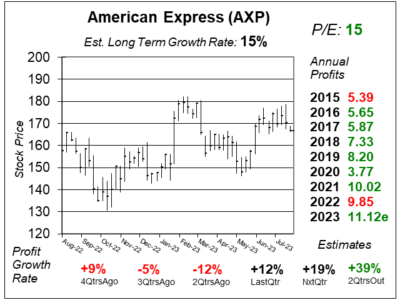

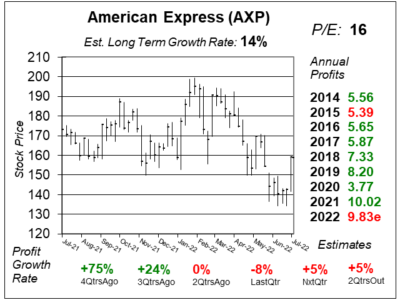

American Express (AXP) stock has been weak due to risks of higher write-offs ahead. Meanwhile, growth continues to be impressive.

American Express (AXP) continued to rake in record revenues for the 5th straight quater as revenue & profits grew 12% year-over-year.

American Express (AXP) is growing revenue nicely due to tremendous demand for travel. Millennials and Gen Zers are signing up.

American Express (AXP) is seeing success with Millennials and Zoomers as these consumers spent 30% more than they did a year ago.

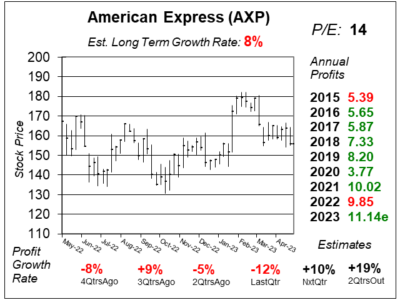

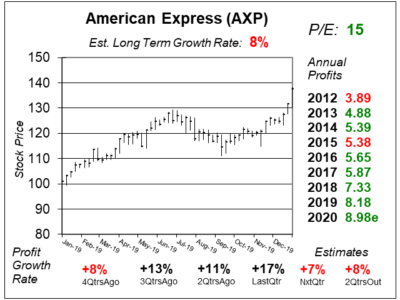

In my first look at American Express (AXP) in 2 years it seems to be like this is a 10% grower long-term (if that’s good enough for you).

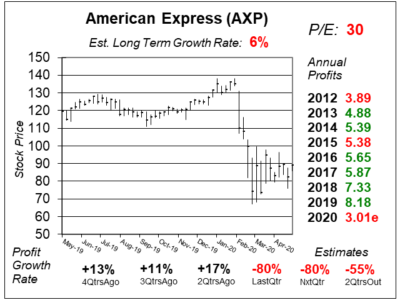

American Express (AXP) is seeing softness in this Coronavirus market, and it may take a while to bounce-back.

American Express (AXP) has a P/E of only 15, compared to the S&P 500’s 19 P/E. And AXP is growing faster than the S&P.