Stock (Symbol) |

Apple (AAPL) |

Stock Price |

$271 |

Sector |

| Technology |

Data is as of |

| December 12, 2019 |

Expected to Report |

| January 27 |

Company Description |

Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial |

Sharek’s Take |

Apple (AAPL) has been a stud since my research report from last qtr. The stock’s jumped from $195 to $271 — a gain of 39% — since my August 6th report. Why did the stock go so high? The main reason is investors are giving the stock a higher P/E ratio than it had been getting. In fact, the P/E of 21 is my highest since 2009 Q4! During the past ten years, AAPL had a P/E below 20 in every qtr but one (2010 Q2). Why was this stock so cheap the past decade? One reason is investors thought of the stock as a hardware company. Computer hardware stocks such as Compaq, Nokia, HP and Dell all faded out once their industries became mature and competition brought lower profit margins. Last qtr, Apple had nice increases in Services (+18%) and Wearables (+54%) and those divisions now account for 30% of total revenue. Here’s some AAPL stats from last qtr: Apple (AAPL) has been a stud since my research report from last qtr. The stock’s jumped from $195 to $271 — a gain of 39% — since my August 6th report. Why did the stock go so high? The main reason is investors are giving the stock a higher P/E ratio than it had been getting. In fact, the P/E of 21 is my highest since 2009 Q4! During the past ten years, AAPL had a P/E below 20 in every qtr but one (2010 Q2). Why was this stock so cheap the past decade? One reason is investors thought of the stock as a hardware company. Computer hardware stocks such as Compaq, Nokia, HP and Dell all faded out once their industries became mature and competition brought lower profit margins. Last qtr, Apple had nice increases in Services (+18%) and Wearables (+54%) and those divisions now account for 30% of total revenue. Here’s some AAPL stats from last qtr:

With an Estimated Long-Term Growth Rate of 10%, this isn’t a growth stock in my opinion. It’s a value stock. I like growth stocks to have Est. LTGs of 15% or greater. AAPL does have a high safety rating, so its good for conservative investors. The stock also yields 1%. Last qtr, management bought back $18 billion in shares and paid $3.5 billion in dividends. Apple is looking good here, but the valuation (P/E) is at decade highs. One catalyst is NEW 5G phones could be coming in late 2020. 5G iPhones would be a catalyst for iPhone revenue, and possibly profit growth. AAPL stock is part of my Conservative Growth Portfolio. |

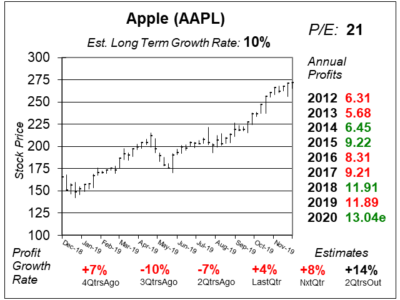

One Year Chart |

So this stock’s gone from $165 to $271 in a year when profit growth has averaged 2% the last 4 qtrs. Wow. This stock has had a low-P/E for a decade, and investors have been clamoring for a higher valuation. It’s surprising the stock finally got it when profit growth was lackluster. So this stock’s gone from $165 to $271 in a year when profit growth has averaged 2% the last 4 qtrs. Wow. This stock has had a low-P/E for a decade, and investors have been clamoring for a higher valuation. It’s surprising the stock finally got it when profit growth was lackluster.

The Est. LTG of 10% is the same as it was last qtr, and down from 12% 2QtrsAgo. When the Est. LTG declines it often leads to a lower stock price. This stock not a good case study. Notice Annual Profits hit All-Time highs in only 3 of the last 8 years. That’s bad. Looking ahead to qtrly Estimates, it looks like growth is expected to accelerate. I think a P/E of 20 is fair for this stock if profits can grow 10%. |

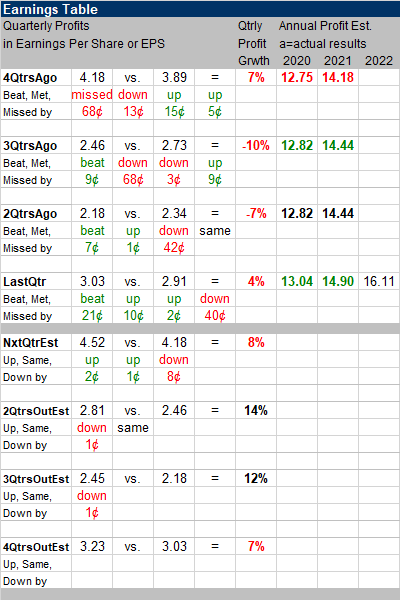

Earnings Table |

Last qtr AAPL delivered 4% profit growth, and beat estimates of -3%. Sales increased 2%. Revenue came in at the high-end of management expectations. Profit growth has been poor, but investors always look ahead. Last qtr AAPL delivered 4% profit growth, and beat estimates of -3%. Sales increased 2%. Revenue came in at the high-end of management expectations. Profit growth has been poor, but investors always look ahead.

Annual Profit Estimates got gashed five qtrs ago, and declined four qtrs ago. Last qtr they stabilized. This qtr they increased. Qtrly profit Estimates are for 8%, 14%, 12% and 7% profit growth the next 4 qtrs. A NEW 5G iPhone could be here a year from now. I assume that could boost profits. But for now, estimates just look OK. Also, since AAPL just beat the street by a good amount last qtr, analysts may need time to increase the 4QtrsOutEst, which uses comparisons from LastQtr in the equation. |

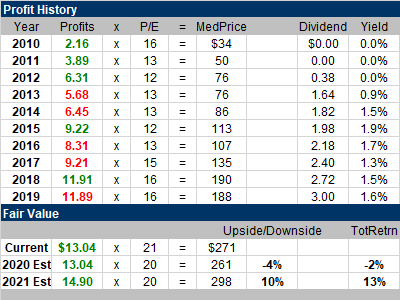

Fair Value |

Notice the stock’s median annual P/E was between 12 and 16 the past ten years. Now the P/E’s jumped to 21. The big question here is what should Apple’s P/E be? Since the stock is safe, pays a dividend, and management buys back stock it could be worthy of a P/E between 16 and 25. Notice the stock’s median annual P/E was between 12 and 16 the past ten years. Now the P/E’s jumped to 21. The big question here is what should Apple’s P/E be? Since the stock is safe, pays a dividend, and management buys back stock it could be worthy of a P/E between 16 and 25.

Since the stock’s just gone on a tear higher, my guess is it needs to cool down a bit. Thus, my Fair Value is a P/E of 20. But this is just a guess. |

Bottom Line |

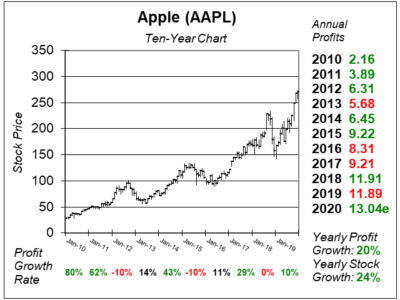

Apple (AAPL) has had its ups-and-downs the past decade, but overall it’s provided buy-and-hold investors +20% returns as profits have grown 20% a year. Apple (AAPL) has had its ups-and-downs the past decade, but overall it’s provided buy-and-hold investors +20% returns as profits have grown 20% a year.

Although profit growth has slowed, the combination of higher services/wearable revenue and a potential catalyst in the 5G iPhone has pushed the valuation (P/E) to a decade high. The stock could keep climbing until the P/E gets to 25 (a $326 stock). But just when you think a stock is easy money is when it pulls back on you. I’m honestly not impressed with 2% sales growth and 4% profit growth. I think the next move is back down, but I’m not an expert on this stock as I just sold it from the Growth Portfolio at $171 back in February 2019. I also sold it from the Conservative Portfolio around $171 and bought back around $195 this year. AAPL ranks 10th in my Conservative Growth Portfolio Power Rankings. Since this is now considered to be a 10% grower (Est. LTG) the stock doesn’t have enough expected profit growth for the Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 10 of 34 |