Stock (Symbol) |

Apple (AAPL) |

Stock Price |

$143 |

Sector |

| Technology |

Data is as of |

| September 22, 2020 |

Expected to Report |

| October 27 |

Company Description |

Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial |

Sharek’s Take |

Apple (AAPL) stock has good momentum right now, and the good times should continue with the advancements the company is making in terms of its product line. On September 14 the company debuted the new iPhone 13, Apple Wathc 7, the iPad 9 and he iPad Mini 6. These products all have noticable upgrades, but are at similar prices to their predecessors, which will be welcome news to those who use the Apple ecosystem. The iPhone 13 will have a better camera, longer life battery, and beautiful display, more storage, and high water resistance in a 5G phone. The Watch 7 will have a bigger display within the screen and faster charging. Apple (AAPL) stock has good momentum right now, and the good times should continue with the advancements the company is making in terms of its product line. On September 14 the company debuted the new iPhone 13, Apple Wathc 7, the iPad 9 and he iPad Mini 6. These products all have noticable upgrades, but are at similar prices to their predecessors, which will be welcome news to those who use the Apple ecosystem. The iPhone 13 will have a better camera, longer life battery, and beautiful display, more storage, and high water resistance in a 5G phone. The Watch 7 will have a bigger display within the screen and faster charging.

And the company already has high momentum going into these new launches. Last qtr, Apple delivered super results with iPhone revenue up 50%, with Mac up 16%, iPad up 12%, wearables up 36%, and services up 33%. Overall, profits jumped 100% from the year-ago period, as revenue soared 36%. Last qtr’s results were truly amazing. Each geographic segments achieved double digit record revenues last qtr, with each rising at least 28%. Here’s some AAPL stats from last qtr:

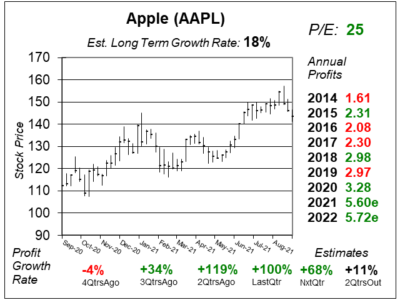

Apple stock has an Estimated Long-Term Growth Rate of 18% a year, in addition to a yield of less than 1%. And with a P/E of 25, the shares are very reasonable. Management also buys back billions in stock. During the past two years (2018-2020) shares outstanding have decreased from 20 billion to 17.5 billion. Last qtr, management repurchased $23 billion of its common stocks and paid dividends of $4 billion. AAPL is part of the Conservative Growth Portfolio. |

One Year Chart |

Profit growth has been exceptional the past two qtrs. And next qtr is setting up good as well. I’m surprised this stock has a P/E of just 25. Profit growth has been exceptional the past two qtrs. And next qtr is setting up good as well. I’m surprised this stock has a P/E of just 25.

The Est. LTG of 18% is very good for a conservative growht stock, but its not the 20% growth I like for a traditional growth stock. AAPL has a Fiscal Year-End on September 30th. That’s tomorrow. Thus, I’m looking ahead to 2022 estimates when calculating my P/E in this chart. |

Earnings Table |

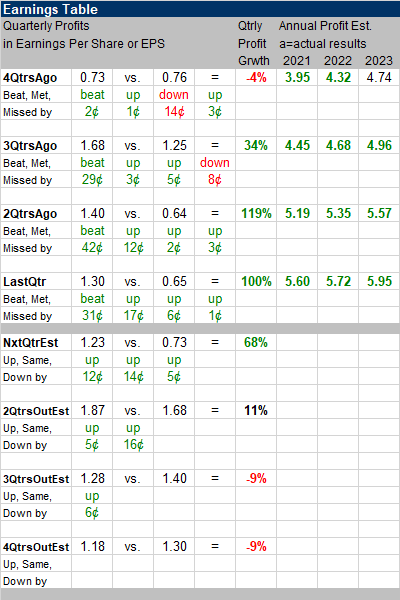

Last qtr, AAPL delivered 100% profit growth beating estimates of 52%. Total revenues grew 36%. When I saw that 100% figure was profits were probably pulled down from COVID a year ago. But in the year-ago period, profit growth was a respectable 18%. So last qtr’s growth was legit! Last qtr, AAPL delivered 100% profit growth beating estimates of 52%. Total revenues grew 36%. When I saw that 100% figure was profits were probably pulled down from COVID a year ago. But in the year-ago period, profit growth was a respectable 18%. So last qtr’s growth was legit!

Sales growth was driven by growth in all Products and Services categories. iPhone net sales increased due to higher sales of new iPhone 12 models. Mac net sales increased due to higher sales of MacBook Air and iMac. iPad net sales increased due to higher sales of iPad Air. Wearables, Home, and Accessories net sales increased due to higher sales of Apple Watch and accessories. Services net sales increased due to higher sales from advertising, App Store, and AppleCare. Annual Profit Estimates increased across the board. Do notice next year’s profits are expected to cimb just 2%. That seems way too low. I think management is setting up to underpromise and overdeliver. Qtrly Profit Estimates are for 68%, 11%, -9%, and -9% growth the next 4 qtrs. I double growth will go negative 3QtrsOut and 4QtrsOut. Momentum is strong. |

Fair Value |

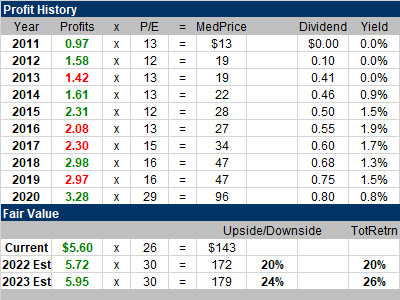

AAPL was increadibly undervalued a decade ago. The stock’s median P/E was 12 to 13 during fiscal years 2011-2016 and then it was 16-17 during 2017-2019. In 2020 the median P/E jumped to 29. The higher valuation (P/E) was the main reason why AAPL was such a hot stock from 2019 to 2020, note the median stock price jumped from $47 to $96. The stock currently has a 26 P/E on 2020 estimates. AAPL was increadibly undervalued a decade ago. The stock’s median P/E was 12 to 13 during fiscal years 2011-2016 and then it was 16-17 during 2017-2019. In 2020 the median P/E jumped to 29. The higher valuation (P/E) was the main reason why AAPL was such a hot stock from 2019 to 2020, note the median stock price jumped from $47 to $96. The stock currently has a 26 P/E on 2020 estimates.

I feel this stock is worthy of a 30 P/E, which equates to $172 a share this year and $179 next year. But I will likely bump up next year’s price target in the upcoming qtrs as I think profit estimates will continue to climb. |

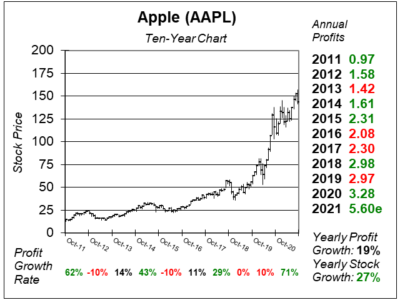

Bottom Line |

Apple (AAPL) stock has had a very good decade. Notice profits only grew 19% during the decade while the stock went up 27% a year. The added boost for the stock was because the P/E also rose, from 13 to 26. Apple (AAPL) stock has had a very good decade. Notice profits only grew 19% during the decade while the stock went up 27% a year. The added boost for the stock was because the P/E also rose, from 13 to 26.

This company has some serious momentum right now. And more improved products are coming within months. These should provide fueld to keep the growth going. I think the stock will continue to trend higher. AAPL remains at 6th in the Conservative Growth Portfolio Power Rankings. I increased my position last qtr. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 6 of 37 |