We’re (obviously) in a Bear Market for tech stocks. But I have high hopes that we are at (or around) a stock market bottom. The reason we at (or around) a market bottom is the valuations of Microsoft (MSFT) and Alphabet (GOOGL).

We’re (obviously) in a Bear Market for tech stocks. But I have high hopes that we are at (or around) a stock market bottom. The reason we at (or around) a market bottom is the valuations of Microsoft (MSFT) and Alphabet (GOOGL).

Today, Tuesday May 3, 2022, the S&P 500 was up 0.5% to close at 4175. That’s above yesterday’s low of 4063. Hey its an up day, and any up day in this environment is a big positive. Today’s action is important as the market didn’t hit a new low. Up next, we could get a follow through rally within the next week or so that could start a meaningful run higher.

MSFT and GOOGL Could Lead the Way

We’ve been through a very bad stock market. But the bright side of all this is valuations are very attractive. Here’s some P/E ratios for a handful of big tech stocks, along with their estimated long-term (profit) growth rates:

- Microsoft (MSFT): Est. LTG 16%, P/E 26

- Alphabet (GOOGL): Est LTG 17%, P/E 21

- NVIDIA (NVDA): Est. LTG 31%, P/E 35

- Apple (AAPL): Est. LTG 10%, P/E 26

This list is of companies that continue to deliver, these aren’t broken business models like Meta (FB), Netflix (NFLX) or Amazon (AMZN). actually sold all my FB and AMZN from client accounts in the last qtr, and am getting ready to sell NFLX any day.

These four stocks — which we could call MMANA — are doing very well, and are very cheap by historical standards. In fact, the stock market has a P/E of 18, yet might grow profits 6-8% per year long-term. So for slightly higher valuations, you get much faster growth.

In my opinion, this is the stock market’s bottom. I don’t think these stocks get cheaper, as institutional investors know good valuations and will likely step in and buy if prices go much lower.

Chart of the Day

Chart of the Day

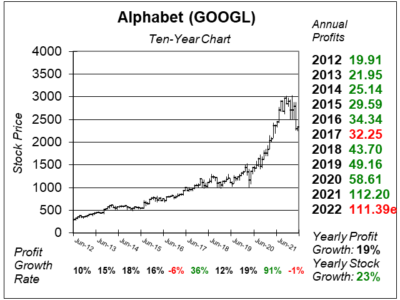

Our Chart of the Day is this ten-year chart of GOOGL. Notice the stock is on a dip.

Notice profits almost doubled last year. 2021 was an amazing year for GOOGL profit-wise. This year, profits are set to simmer down.

I want to point out GOOGL has hit a record high in profits every year since its IPO in 2004. *Except for 2017, which was down only because of a tax law change.

Here’s what Google’s median P/E ratio has been during the past ten years:

- 2012: 16

- 2013: 21

- 2014: 22

- 2015: 22

- 2016: 22

- 2017: 29

- 2018: 26

- 2019: 24

- 2020: 24

- 2021: 21

- Current: 21

Notice this is around the low for GOOGL valuation-wise. The only time the valuation was lower was in 2012, which as you can see in this chart was a great time to buy. Two years ago the P/E was 34. If you wanna view Alphabet’s P/E every qtr going back to 2014, click here.