Alphabet (GOOGL) Incorporates its AI Platform Gemini Across All its Divisions

Alphabet (GOOGL) is implimenting AI into al its products. And this looks to be paying dividends in Search, Cloud and YouTube Ads.

Alphabet (GOOGL) is implimenting AI into al its products. And this looks to be paying dividends in Search, Cloud and YouTube Ads.

Alphabet’s (GOOGL) biggest segment, Google Search, showed investors the ad market is good. But Google’s Cloud business slowed.

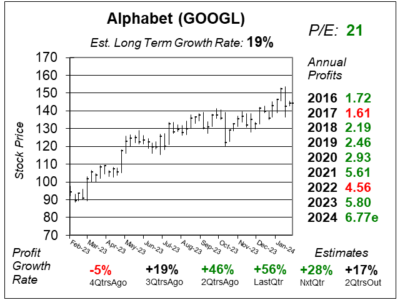

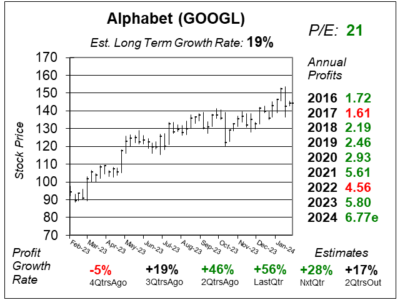

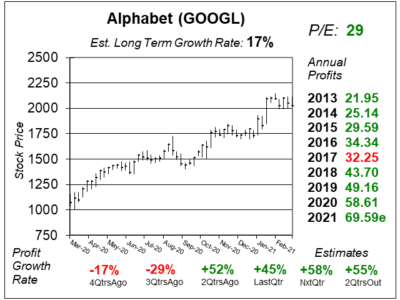

Aplhabet (GOOGL) delivered an excellent earnings report, with lots of accelerated revenue growth and AI features galore.

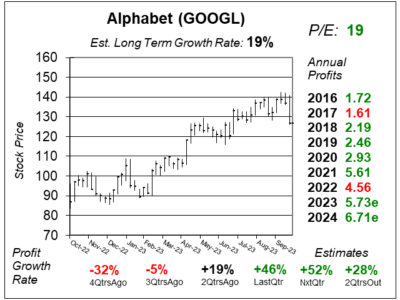

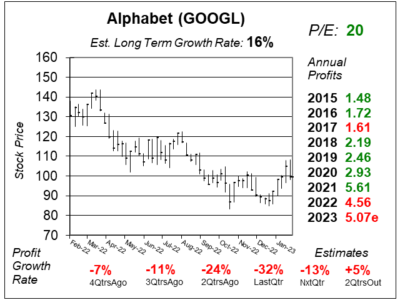

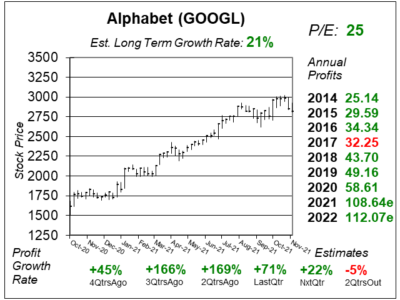

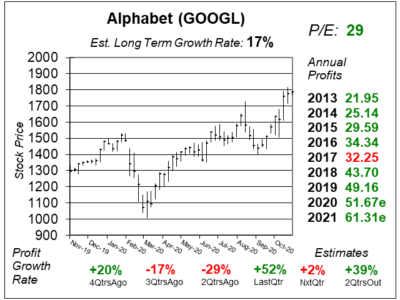

The trend of Alphabet’s (GOOGL) stock has turned higher, but profit growth hasn’t. Yet. But the quarters ahead are looking good.

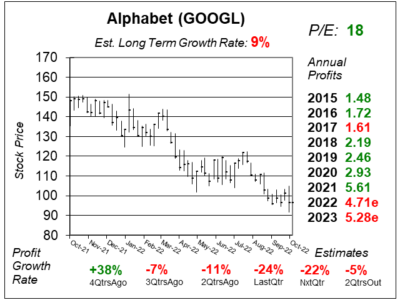

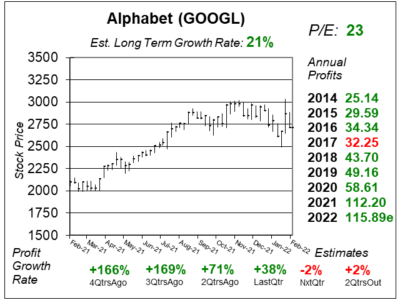

Headlines say AI will hurt Google’s (GOOGL) search dominance. But the REAL story is how GOOGL’s profit growth has gone astray.

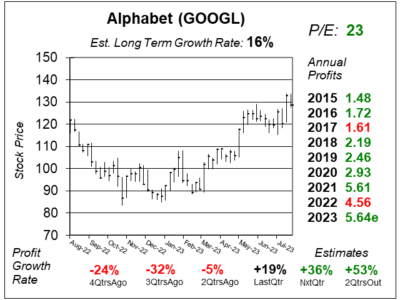

Alphabet (GOOGL) is seeing some slowdown in ad spend, but the main reason profits are down is because they were up big last year.

Alphabet’s (GOOGL) profit growth is coming in weak due to tough comparisons from a year-ago. Still, Search and Cloud are strong.

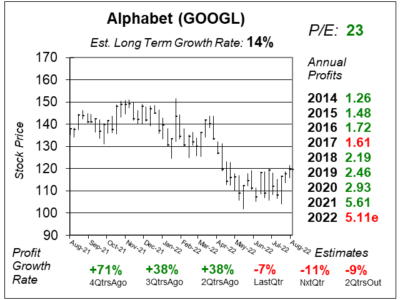

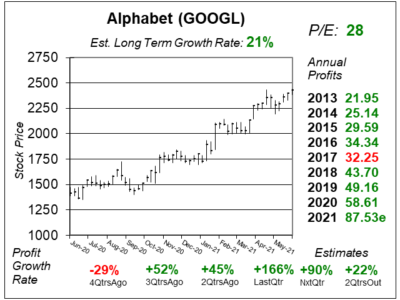

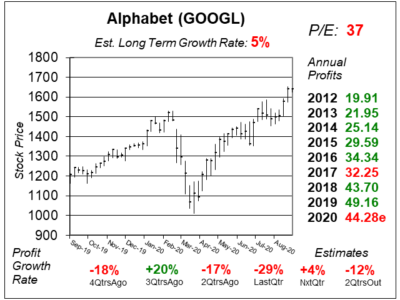

Here’s our thesis how Alphabet (GOOGL) stock could be $600 four years from now (2026). This could be the buy of the Bear Market.

Alphabet (GOOGL) delivered 38% profit growth on 32% revenue growth last qtr, but growth is expected to slow next qtr.

Alphabet (GOOGL) stock has stays strong through a stock market correction, as Google Search revenue soared 44% last qtr.

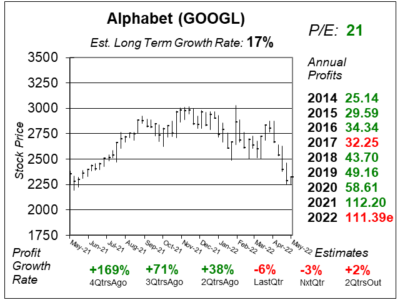

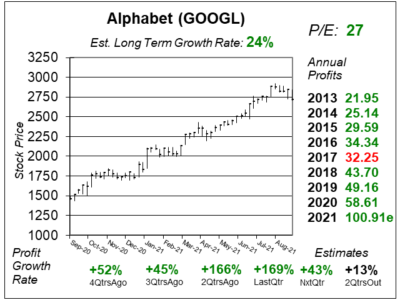

Alphabet (GOOGL) is seeing excellent results in Google search, Ads Manager, YouTube and Google Cloud. Let’s take a look.

Alphabet (GOOGL) is rolling in the profits as Google Search, YouTube, and Google Cloud grew revenue at least 30% last qtr.

Alphabet (GOOGL) is firing on all cylinders as the number of retailers using its ad services are up 80% from a year-ago.

Alphabet (GOOGL) is having a slew of success with YouTube, Google Cloud and Pixel phone. The stock has momentum.

Alphabet (GOOGL) is the slowest-grower in the FANG group. Still, GOOGL has growth opportunity in YouTube, Cloud and Waymo.

Alphabet’s (GOOGL) YouTube and Google Cloud are doing great, but this stock still might not go anywhere for a while.

Coronavirus fears are pushing a lot of people to stay home — and perhaps watch Google’s (GOOGL) YouTube.

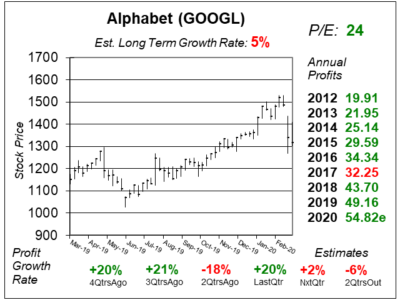

Alphabet’s (GOOGL) sales grew a solid 20% last qtr, but profits declined 18% as the stocks and bonds it owns decreased in value.

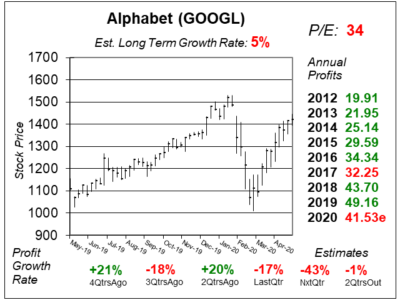

Alphabet (GOOGL) grew profits a solid 19% last qtr as profits increased 21%. So why are profit estimates so poor?

Forget Uber stock, Alphabet’s (GOOGL) autonomous ride-share company Waymo is the force to be reckoned with in ride-sharing.

Alphabet’s (GOOGL) YouTube has grown into being a networks of sorts. Imagine when it gets movies and sporting events.

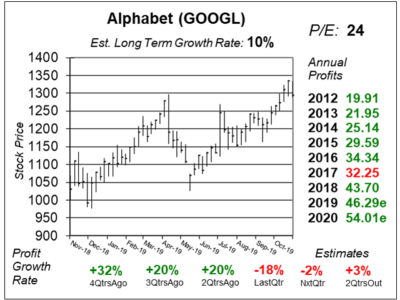

Alphabet (GOOGL) is down around 15% from its highs, which is OK as the stock market’s down. But what I don’t like is profit estimates.

Google (GOOGL) is planning to re–enter China with a search engine — and cloud computing — that will comply with Chinese authorities.

I expect shares of Alphabet (GOOGL) to be hitting new highs shortly — and eventually going to $1200 per share. Here’s my reasons why.

Facebook’s under pressure for selling user data, and companies are reacting by pulling ads from that site, which is good news for Google (GOOGL).

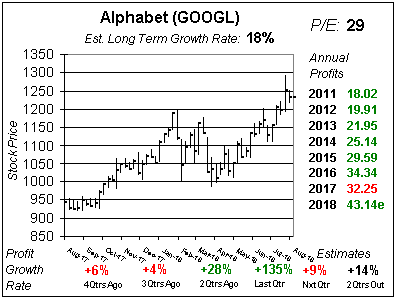

Alphabet (GOOGL) has revenue growth accelerate to 24% last qtr — the best qtr in years. Now I feel this stock’s P/E could rise to 30, which could mean a $1500 stock sometime in 2019.

For the second time in the past year Alphabet’s (GOOGL) profit estimates got slashed. GOOGL was expected to make $40 in profits this year, now it’s looking like $30.

Alphabet (GOOGL) has shot past my Fair Value as it rose from $850 to $1000 during the last qtr. Now with the P/E at 29, the stock’s over my Fair Value.

Alphabet’s (GOOGL) profit estimates just got slashed, now negative profit growth is expected the next 3 qtrs. Why? Business is good? Let’s take a look.

Alphabet (GOOGL) has grown profits 21% per year the last decade, including 23% last qtr, yet has a P/E of just 19. It’s time Wall Street gave it the multiple it deserves.

Alphabet (GOOGL) just broke out as the Internet stocks continue to roll higher. Here’s my take on the world’s largest search engine.

Google (GOOGL) gets you all excited about the future, then lets you down during game time, just as your favorite sports team would.

Shares of Alphabet (GOOGL) are breaking out today ahead of earnings next week, and I’m adding to my position.

Google (GOOGL) looks to have a solid 2016 in store, with high-teens profit growth expected for the year.

Google (GOOGL) is now doing things right, like controlling expenses and buying back stock.

Google (GOOGL) is making a concerted effort to reign in spending, too bad GOOGL stock’s this high.

Google (GOOGL)missed estimates again, and I will sell the stock from the Growth Portfolio as I see growth slowing.

Google (GOOGL) didn’t have a good qtr, and now the stock doesn’t have much upside going into 2015.

Google (GOOGL) just put out its best profit growth in three years, here’s where I think GOOGL is headed.

Although Google (GOOGL) is almost $100 off its highs, GOOGL’s is looking really good.

Google (GOOGL) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $1.50 vs. $1.17 = +28%

Revenue Est: +13%