Stock (Symbol) |

Adobe (ADBE) |

Stock Price |

$508 |

Sector |

| Technology |

Data is as of |

| March 26, 2024 |

Expected to Report |

| June 13 |

Company Description |

Adobe Inc. is a software company. It offers a line of products and services used by professionals, communicators, businesses, and consumers for creating, managing, delivering, measuring, optimizing, engaging and transacting with content and experiences across various digital media formats. Adobe Inc. is a software company. It offers a line of products and services used by professionals, communicators, businesses, and consumers for creating, managing, delivering, measuring, optimizing, engaging and transacting with content and experiences across various digital media formats.

Its segments include Digital Media, Digital Experience and Publishing and Advertising. The Digital Media segment provides products, services and solutions that enable individuals, teams and enterprises to create, publish and promote their content anywhere. Digital Media segment is centered around Adobe Creative Cloud and Adobe Document Cloud. The Digital Experience segment provides an integrated platform and set of applications and services through Adobe Experience Cloud that enable brands and businesses to create, manage, execute, measure, monetize and optimize customer experiences. The Publishing and Advertising segment consists of products and services that address diverse market opportunities. Source: Refinitiv |

Sharek’s Take |

Adobe (ADBE) has become one of the big benefactors of Generative AI. In last qtr’s earnings release, the CEO stated the company has “done an incredible job harnessing the power of Generative AI to deliver groundbreaking innovation across the product portfolio.” ADBE’s AI model is named Firefly. For improving photos, Photoshop now includes Generative Fill (placing props into existing photos) and Generative Expand (expanding the margins of a photo and using AI to create a larger image). Last qtr ADBE saw the highest adoption of Firefly tools in Photoshop since the release of Generative Fill in May 2023. For improving logos and icons, Adobe Illustrator has seen advancements with the beta introduction of Text to Vector, allowing users to generate icons, scenes, subjects, patterns, and gradients. AI Assistant generates summaries from documents within Adobe Reader and Acrobat. Despite its success, Adobe must be wary of its competitor, Canva, as its growth has accelerated since 2022. There are a considerable number of new companies which utilize Canva teams in their workplace. Adobe (ADBE) has become one of the big benefactors of Generative AI. In last qtr’s earnings release, the CEO stated the company has “done an incredible job harnessing the power of Generative AI to deliver groundbreaking innovation across the product portfolio.” ADBE’s AI model is named Firefly. For improving photos, Photoshop now includes Generative Fill (placing props into existing photos) and Generative Expand (expanding the margins of a photo and using AI to create a larger image). Last qtr ADBE saw the highest adoption of Firefly tools in Photoshop since the release of Generative Fill in May 2023. For improving logos and icons, Adobe Illustrator has seen advancements with the beta introduction of Text to Vector, allowing users to generate icons, scenes, subjects, patterns, and gradients. AI Assistant generates summaries from documents within Adobe Reader and Acrobat. Despite its success, Adobe must be wary of its competitor, Canva, as its growth has accelerated since 2022. There are a considerable number of new companies which utilize Canva teams in their workplace.

Adobe’s software is making the Internet work from videos, images, movies, ecommerce to marketing. The company has two main segments: Digital Media and Digital Experience:

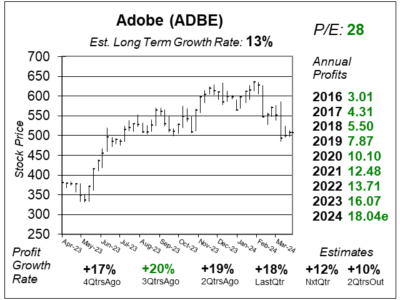

I believe ADBE is a tech stock that’s suitable for conservative investors. The stock currently has a Estimated Long-Term Growth Rate of 13% per year, and a reasonable P/E of 28. Although Adobe hasn’t paid dividends since 2005, management buys back stock. ADBE is part of the Conservative Growth Portfolio. I think profits — and perhaps the stock — could grow 12% to 15% a year long-term. Last year, Adobe was trying to acquire Figma, which allows multiple people to work on a project at the same time. But regulators would not allow the deal to pass. Adobe and Figma will try and work on other ways to partner up. |

One Year Chart |

In December 2023, the Figma deal was nixed. Despite that, the stock didn’t collapse as I thought it might. The stock sold off some after last qtr’s results were released, but I liked the quarter overall. In December 2023, the Figma deal was nixed. Despite that, the stock didn’t collapse as I thought it might. The stock sold off some after last qtr’s results were released, but I liked the quarter overall.

The stock has lowered from $596 to $508 since last quarter. During that time, the P/E has gone from 33 to 28. My Fair Value is a 32 P/E, or $577 a share. So in my eyes, the stock has gone from being fairly valued to undervalued. The Est. LTG is 13% this qtr. Qtrly profit growth has been steady the past year. |

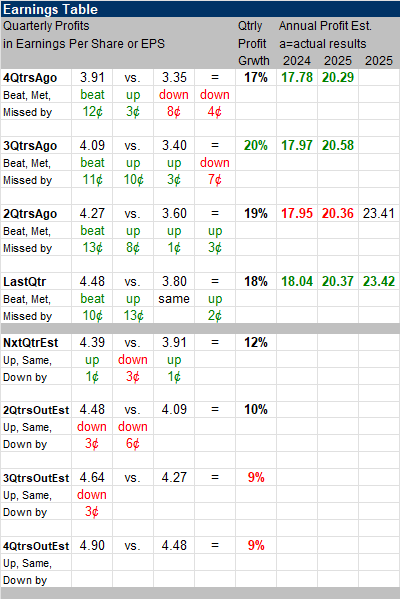

Earnings Table |

Last qtr, Adobe delivered 18% profit growth and beat expectations of 15% growth. Revenue increased 11%, year-on-year and beat estimates of 10%. Last qtr, Adobe delivered 18% profit growth and beat expectations of 15% growth. Revenue increased 11%, year-on-year and beat estimates of 10%.

Annual Profit Estimates increased this qtr. Qtrly profit Estimates are 12%, 10%, 9%, and 9% for the next 4 qtrs. Analysts believe Adobe revenue will grow 12% next quarter. |

Fair Value |

ADBE currently has a P/E of 28. My Fair Value is a P/E of 32 so I think the stock is undervalued by 14%. ADBE currently has a P/E of 28. My Fair Value is a P/E of 32 so I think the stock is undervalued by 14%.

Note the company has a November 30th Fiscal Year end. |

Bottom Line |

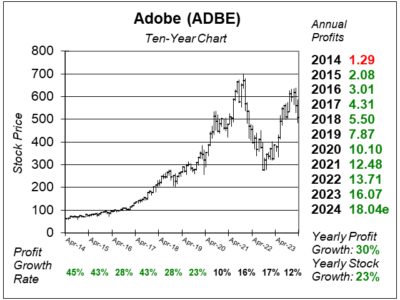

Adobe (ADBE) has been on a wild ride the past three years. The reason for the fall was the stock had a lofty P/E of 51 in August 2021. That was too high. So the stock digested its gains. In September 2022, the stock’s P/E was just 18 and that was around the bottom. Adobe (ADBE) has been on a wild ride the past three years. The reason for the fall was the stock had a lofty P/E of 51 in August 2021. That was too high. So the stock digested its gains. In September 2022, the stock’s P/E was just 18 and that was around the bottom.

Firefly has been a huge boost to Adobe’s portfolio. This company has been one of the leaders of innovation in Generative AI. ADBE stock moves up from 13th to 8th in the Conservative Growth Portfolio Power Rankings due to the stock’s decline in price since last qtr. I sold ADBE from the Growth Portfolio on February 1, 2022 and the stock was $528 that day. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 8 of 25 |