The stock market sank on Friday, pressured by rising oil prices and inflation expectations. In addition, investors looked at closely on the conflict in the Middle East.

The stock market sank on Friday, pressured by rising oil prices and inflation expectations. In addition, investors looked at closely on the conflict in the Middle East.

Overall, S&P 500 declined 0.5% to 4,328, while NASDAQ fell 1.2% to 13,407.

Tweet of the Day

“.. price inflation is turning out to be transitory after all. .. The really good news is that headline and core #CPI inflation rates excluding shelter rose just 2.0% .. These two measures of inflation have already scored bullseyes on the Fed's 2.0% target!”

– @yardeni pic.twitter.com/7UwwTwDD1M

— Carl Quintanilla (@carlquintanilla) October 12, 2023

Chart of the Day

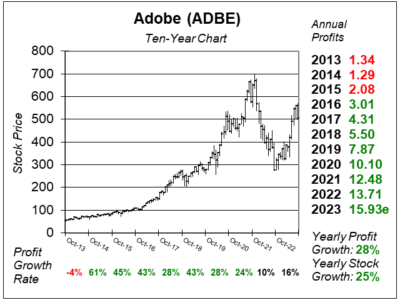

Here is the ten-year chart of Adobe (ADBE) as of September 27, 2023, when the stock was at $503.

Here is the ten-year chart of Adobe (ADBE) as of September 27, 2023, when the stock was at $503.

Adobe’s software is making the Internet work from videos, images, movies, eCommerce to marketing. The company is setting itself up for the next wave of high-tech development with its planned acquisition of Figma. Such is a collaborative software that has the unique ability to allow multiple users to design and develop an item at the same time. This is vastly different from Adobe’s platform, which doesn’t allow multiple people to collaborate on a design at the same time.

Adobe’s Firefly is the company’s Generative AI model that allows user to generate images via detailed text, while utilizing Adobe’s stock images. Last quarter, Firefly became commercially available. It can use Generative Expand to create additional components to an artwork simply by expanding the digital canvas in any direction. There is also the Generative Fill feature which allows users to generate assets that naturally fit in an existing artwork. These features have now also been integrated into various Creative Cloud Apps. While the use of Firefly remains free, management announced a credit-based model for monetizing these new AI capabilities. Adobe subscription plans now include generative AI credits allowing users to generate more assets at faster speeds. Users on free plans will have a limited monthly allowance of these credits.

Firefly is a huge boost to Adobe’s portfolio. The software is great. Still, Adobe acquiring Figma is paramount to the company’s future. Regulators might not allow the deal to close.

ADBE is part of the Conservative Growth Portfolio.