The stock market dipped on Thursday, as investors reacted to mixed earnings data from various sector, including Tesla’s (TSLA) posted weaker-than-expected quarterly profit.

The stock market dipped on Thursday, as investors reacted to mixed earnings data from various sector, including Tesla’s (TSLA) posted weaker-than-expected quarterly profit.

Tesla stock was down 10%, hitting its lower level in almost three months, after falling short of the market’s expectations. It reported gross margins of below 20% for the first time in nearly three years.

Overall, S&P 500 declined 0.6% to 4,130, while NASDAQ fell 0.8% to 12,060.

Tweet of the Day

https://twitter.com/yardeni/status/1648521348669665281?t=R2gBalaetMLQ4wvfuoWpCA&s=08

Chart of the Day

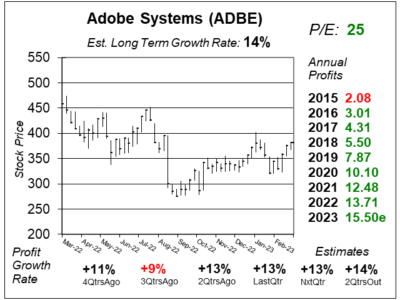

Our chart of the day is the one-year chart of Adobe (ADBE) as of April 12, 2023, when the stock was at $381.

Our chart of the day is the one-year chart of Adobe (ADBE) as of April 12, 2023, when the stock was at $381.

Adobe’s software is making the internet work from videos, images, movies, eCommerce to marketing. The company is setting itself up for the next wave of high-tech development with its planned acquisition of Figma. Figma is a collaborative software that has the unique ability to allow multiple users to design and develop an item at the same time.

Adobe delivered a surprisingly strong quarter as its software is proving to be quite resilient in weak economic times. It grew profit 13% last quarter, on a 9% rise in revenue. Revenue would have gown a solid 13% if it weren’t for foreign exchange.

In the earnings release, management said the company’s Creative Cloud, Document Cloud, and Experience Cloud are mission-critical for the digital economy.

ADBE is part of the Conservative Growth Portfolio. David Sharek thinks that profits — and perhaps the stock — could grow 12% to 15% a year long-term.