Adobe’s (ADBE) Generative AI Advances Are Driving Innovation Across its Products

Adobe (ADBE) is harnising the power of Generative AI in its software applications. This company has a bright future ahead.

Adobe (ADBE) is harnising the power of Generative AI in its software applications. This company has a bright future ahead.

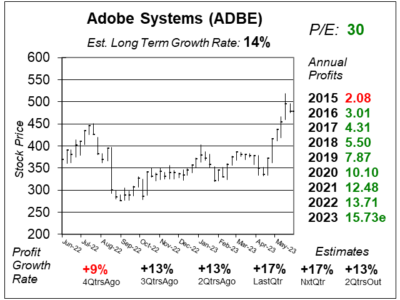

Adobe (ADBE) has some great new AI features like Adobe Firefly for digital artists, and that’s helping boost the stock higher.

Adobe (ADBE) has made generative AI tool Firefly commercial available and integrated its features into several Creative Cloud apps.

Adobe’s (ADBE) new Artificial Intelligence app Firefly is a huge success already. But the company’s future relies on acquiring Figma.

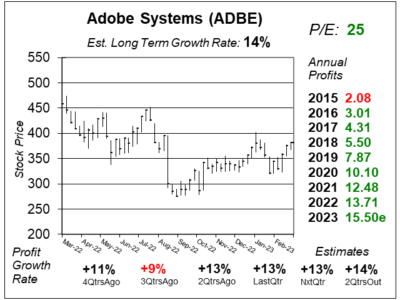

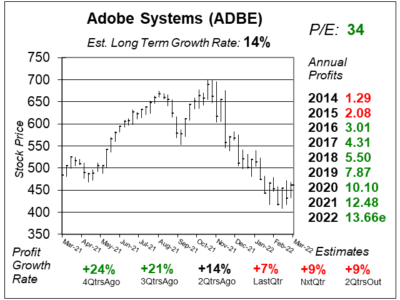

Adobe (ADBE) delivered a surprisingly strong quarter as its software is proving to be quite resilient in weak economic times.

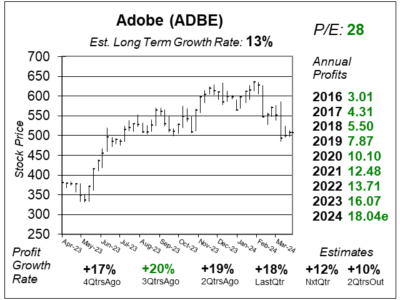

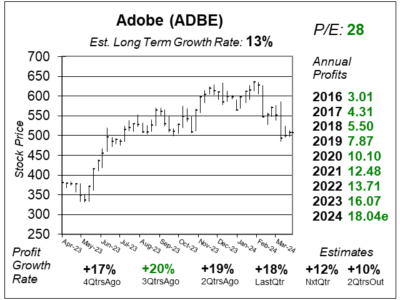

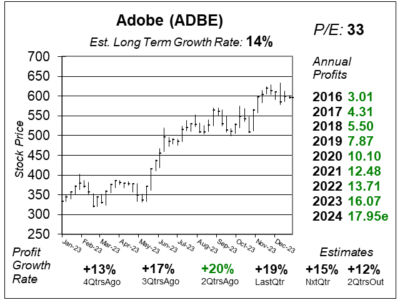

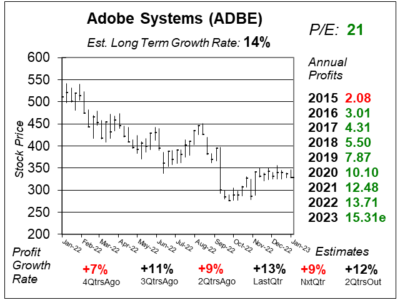

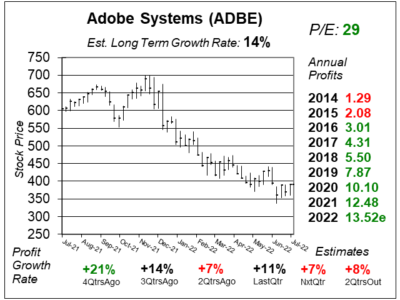

Adobe’s (ADBE) growth rate has been falling. But with a P/E of only 21, and an estimated growth rate of 14%, the stock looks good.

Adobe (ADBE) is making waves with its planned acquisition of Figma, which will allow designers to collaborate simultaneously.

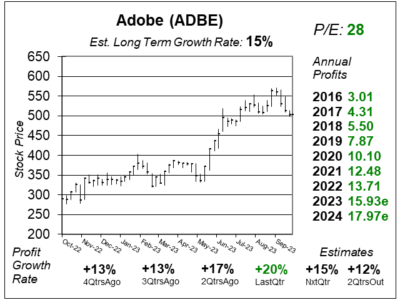

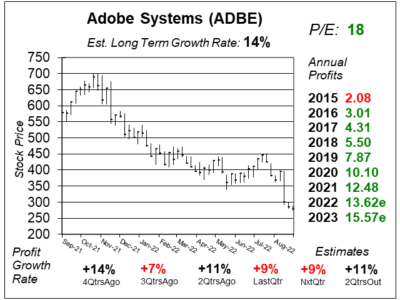

Adobe’s (ADBE) stock lost half its value from peak to trough. But this company has what it takes (real profits) to bounce back.

Adobe’s (ADBE) quarterly revenue growth just slid from 20% two qtr ago to 9% last qtr, but the stock is cheaper than it used to be.

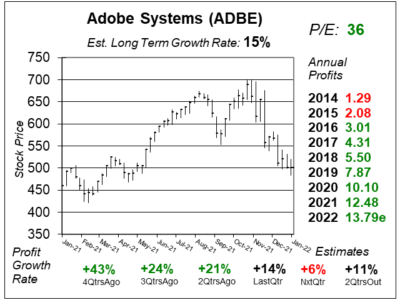

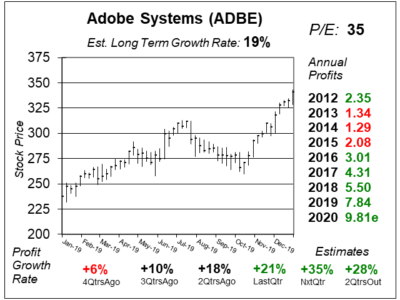

Investors fled Adobe (ADBE) stock ths past qtr after profit growth slowed from 21% to 14%. Now with a 36 P/E it seems undervalued.

The paper-to-pdf revolution is helping Adobe (ADBE) thrive, as its Document Cloud business grew revenue 31% last quarter.

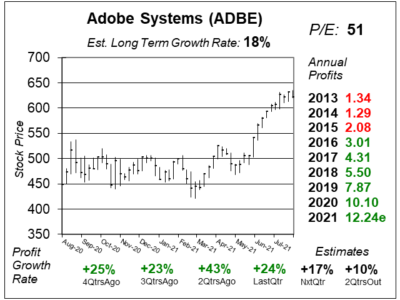

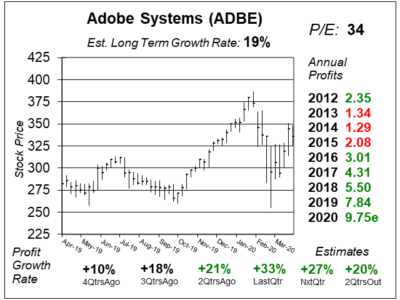

Adobe (ADBE) stock soared last qtr as Creative Cloud is the gold standard for movie makers as well as digital marketers.

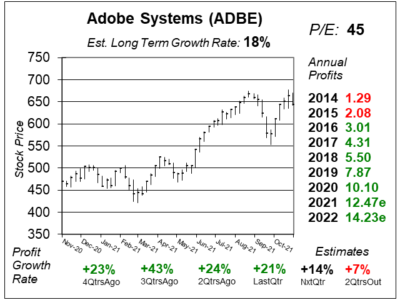

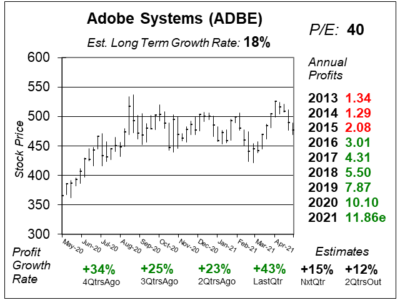

Adobe (ADBE) delivered 43% profit growth last qtr. Amazing. But with a P/E around 40, the stock is close to my Fair Value.

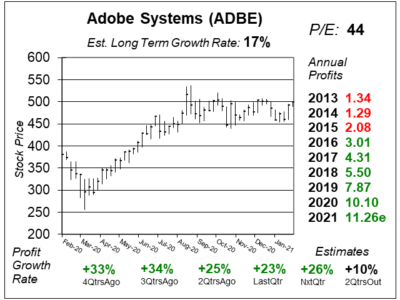

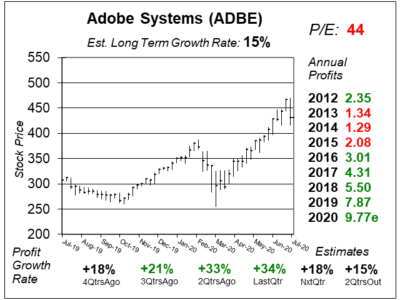

Adobe (ADBE) is growing good — 23% profit growth last qtr — but with a P/E of 44, the stock seems fairly valued here.

While offices around the world are closed due to COVID-19, Adobe’s (ADBE) PDF document software is in-demand.

Adobe (ADBE) is having a slowdown in its advertising cloud due to COVID-19, which might slow ADBE’s profit growth.

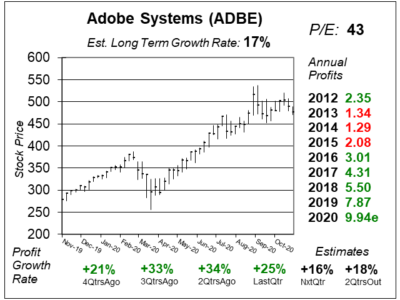

Adobe (ADBE) has seen little-if-any big drop-off in business through the Coronavirus. Wow. Let’s look at the stock.

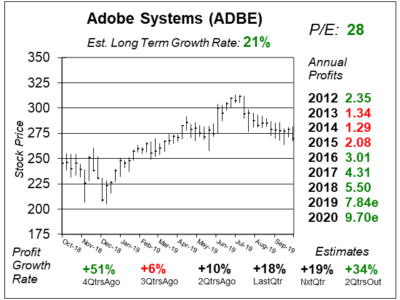

Adobe (ADBE) moves into digital marketing with its acquisition of Marketo. Here’s my updated Fair Value on ADBE stock.

Adobe (ADBE) came under pressure after management lowered sales guidance. But profit growth looks to accelerate.

Adobe Systems (ADBE) delivered 6% and 10% profit growth the past 2 qtrs. Does slower growth mean we should sell?

Adobe (ADBE) grew profits just 6% last qtr, with just 7% growth estimated for this qtr. Investors shrugged off the news.

Adobe (ADBE) was already the leader in image and movie making software. Now the company can offer website development and marketing automation software.

Adobe (ADBE) management is forecasting 20% revenue growth in 2019 (+ acquisitions). I’ll put pen to paper to estimate profit growth.

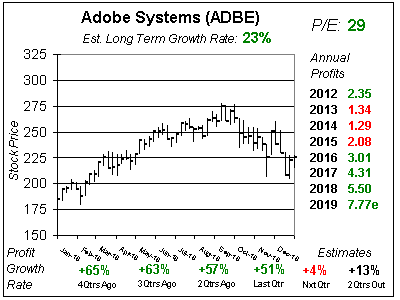

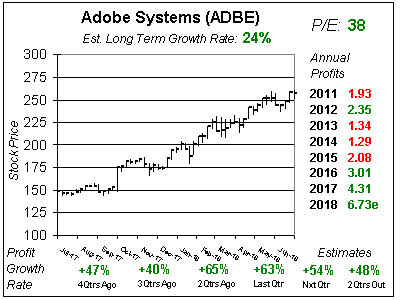

Adobe Systems (ADBE) has been on fire the past five years — going from $50 to $250 — and even now the numbers still look sensational.

Adobe Systems (ADBE) just went up five-fold in five years. So I’m questioning whether the run is close to being done. Let’s take a look.

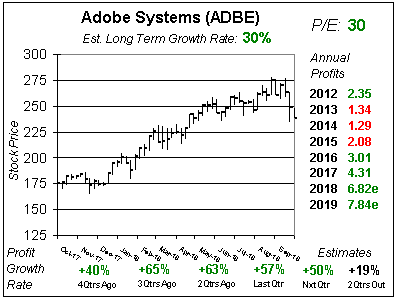

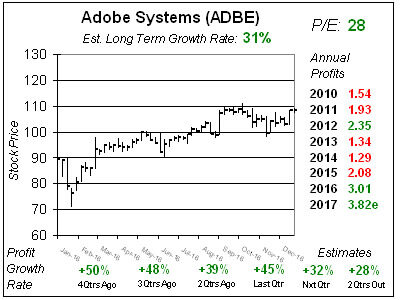

Adobe Systems (ADBE) closed out fiscal 2017 with a bang, as profits jumped 44% for the year. The stock soared 70% last year. Here’s my take on ADBE stock headed into 2018.

Adobe System’s (ADBE) numbers look amazing. But I’m a bit cautious on the stock after its recent runup. Adobe’s P/E had gone from 35 to 42 since last qtr.

Adobe Systems (ADBE) is continuing to thrive with its subscription revenue model. Subscription revenue is now 84% of sales, up from 78% a year-ago.

Adobe (ADBE) just delivered another amazing quarter with more than 40% profit growth. But at 33x earnings, this stock isn’t getting the respect it deserves.

Adobe Systems (ADBE) is thriving in this new digital age as it not only helps people with digital ads, movies and videos, but also helps digital marketers as well.

Adobe Systems (ADBE) is thriving in a digital age as its video and image producing software is bringing in the profits on a more consistent basis.

Adobe Systems (ADBE) continues to deliver strong results, but ADBE continues to be a value because stock growth Mhasn’t kept up with profit growth.

Adobe Systems (ADBE) continues to impress investors as its subscription model is delivering impressive results.

We are in a digital age, and business today is done with Adobe (ADBE) which will be added to the Growth Portfolio and Aggressive Growth Portfolio.

Adobe Systems (ADBE) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $4.39 vs. $3.91 = +12%

Revenue Est: +10%