Stocks declined on Wednesday after a rebound in interest rates. The market is in a correction right now. Top tech stocks, however, have reported strong results this week. This included Microsoft (MSFT), Meta (META), and ServiceNow (NOW). In contrast, Alphabet (GOOGL) reported disappointing quarterly results as its cloud business missed estimates.

Stocks declined on Wednesday after a rebound in interest rates. The market is in a correction right now. Top tech stocks, however, have reported strong results this week. This included Microsoft (MSFT), Meta (META), and ServiceNow (NOW). In contrast, Alphabet (GOOGL) reported disappointing quarterly results as its cloud business missed estimates.

Overall, S&P 500 fell 1.4% to 4,187, while NASDAQ decreased 2.4% to 12,821.

Tweet of the Day

37 straight net negative readings of New Highs/Lows. Have to go back nearly 15 years (‘08/‘09) to see this much red in a row (per @Trader_mcaruso who has data back to then). Also, today was the 2nd worst reading of the year (after Monday’s). pic.twitter.com/5jiPfcQ1WP

— John Boik (@monsterstocks1) October 25, 2023

Chart of the Day

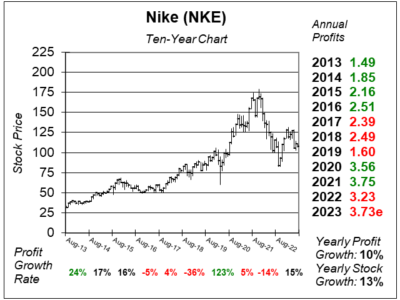

Here is the ten-year chart of Nike (NKE) as of October 5, 2023, when the stock was at $96.

Here is the ten-year chart of Nike (NKE) as of October 5, 2023, when the stock was at $96.

Nike is considered the world’s largest sports apparel company and it is popularly known for its footwear, apparel, and equipment such as Nike, Converse, and Jordan brands.

Nike is growing slowly in this tough economic environment. In the past couple of years, inflation was eating into consumers spending habits. Now, high interest rates are making house payments, car payments, and credit card payments higher.

Last quarter, the apparel company delivered only 1% profit growth on 2% sales growth. Despite such, the company’s inventory levels are healthy again. In 2022, shipping times were slow. This caused Nike’s customers to order ahead. Then in late-2022, shipping times returned to normal, which caused inventory to stack up at the wholesale and retail levels.

In last quarter’s earnings call, management said inventory is healthy, both at Nike and marketplace. Nike’s own inventory was down 10% against that of the year-ago period. Management, however, cut prices which impacted profits to get there. The company sold 5 quarters of supply in 4 quarters. Now, it looks like one more bad quarter, then a return to healthy profit growth in calendar 2024.

NKE is part of the Conservative Growth Portfolio. The stock is down a lot so this is a good time to buy.