The stock market rose on Monday to start a crucial week of earnings and central bank decisions.

The stock market rose on Monday to start a crucial week of earnings and central bank decisions.

The central bank is expected to lift rates by another quarter-percentage points on Wednesday.

Overall, S&P 500 grew 0.4% to 4,555, while NASDAQ increased 0.2% to 14,059.

Tweet of the Day

Google's $GOOGL stock performance each full year since going public

2005: +115.2%🟢

2006: +11%🟢

2007: +50.2%🟢

2008: -55.5%🔴

2009: +101.5%🟢

2010: -4.2%🔴

2011: +8.7%🟢

2012: +9.5%🟢

2013: +58.4%🟢

2014: -5.6%🔴

2015: +46.6%🟢

2016: +1.9%🟢

2017: +32.9%🟢

2018: -0.8%🔴

2019:…— Evan (@StockMKTNewz) July 23, 2023

Chart of the Day

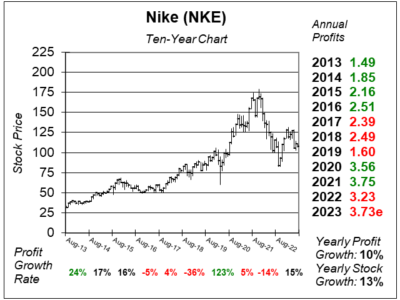

Our chart of the day is the ten-year chart of Nike (NKE) as of July 5, 2023, when the stock was at $107.

Our chart of the day is the ten-year chart of Nike (NKE) as of July 5, 2023, when the stock was at $107.

Nike is considered the world’s largest sports apparel company and it is popularly known for its footwear, apparel, and equipment such as Nike, Converse, and Jordan brands.

Nike has resolved the challenges it faced with high inventory levels. During the Summer/Fall of 2022, the company had a bunch of excess inventory as stores had over ordered due to slow shipping. As such, management made price cuts to lower these inventory levels, but that hurt profit margins. This maneuver was successful.

China sales have also improved. Last year, COVID lockdowns and the reluctance of Chinese to shop outside hampered Nike’s China sales. Now, sales are bouncing back, with China revenue up 16% last quarter. However, sales growth slowed throughout most of the world. During the past three months, North America sales declined from 27% to 5%, Europe, Middle East & Africa slowed from 26% to 3%, and Asia Pacific, & Latin America went from 15% to 1%.

Nike is still a best-in-class brand and its long-term outlook is bright with momentum building for its Jordan brand. It grew mid-30s with impressive growth across men’s, women’s, and kids, footwear, and apparel and in both North America and internationally.

NKE is part of the Conservative Growth Portfolio. Profit margins are set to improve now that inventory is back where it should be.