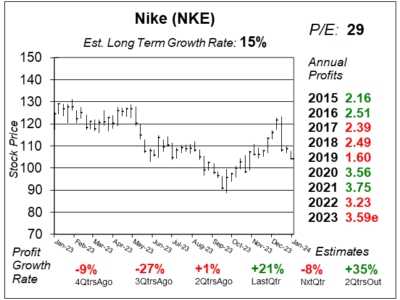

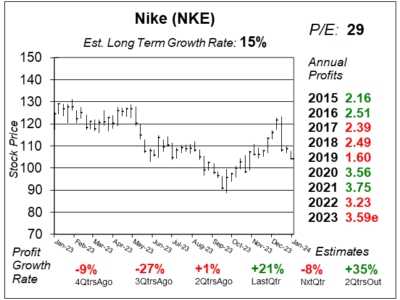

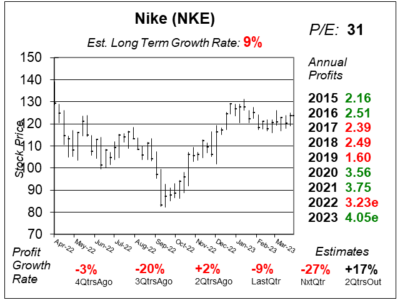

Nike (NKE) Gets Back on its Feet as Quarterly Profit Growth Hits 21%

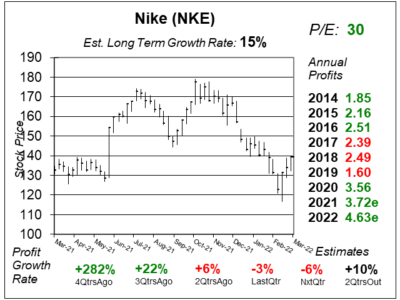

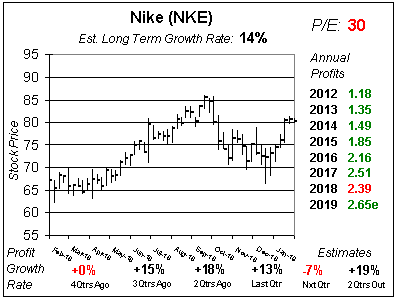

Nike (NKE) had a glut of inventory to discount during 2022 & 2023. Now that issue has passed and profits are back again baby!

Nike (NKE) had a glut of inventory to discount during 2022 & 2023. Now that issue has passed and profits are back again baby!

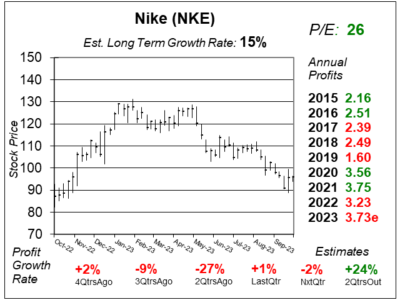

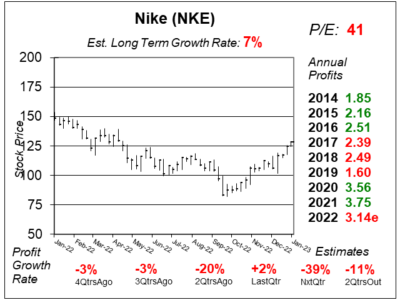

Nike (NKE) is in a slow-growth period as a tough economy is slowing consumer spending. Growth is now set to return in early 2024.

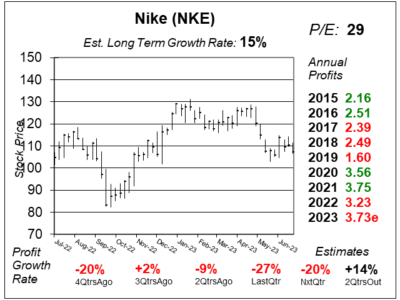

Nike (NKE) has overcome issues with China growth and high inventory. Now it has to deal with sluggish sales growth worldwide.

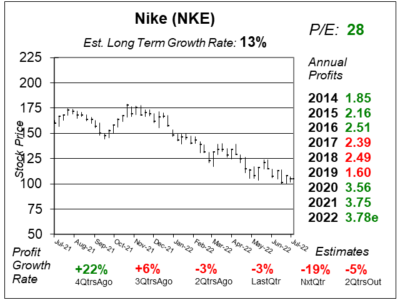

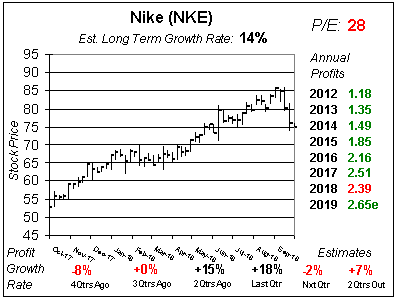

Nike (NKE) continues to grow sales at a robust rate (+14% last qtr), especially in North America (+27%) as is slashes inventory.

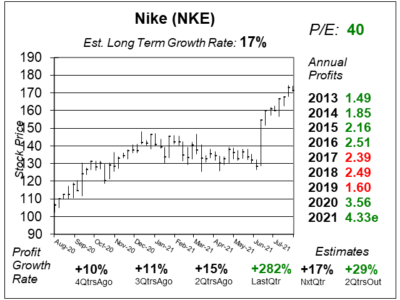

Nike (NKE) stock jumped afte rthe company delivered excellent revenue growth of 17%, including 30% growth in North America.

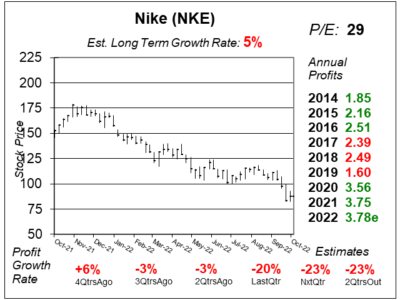

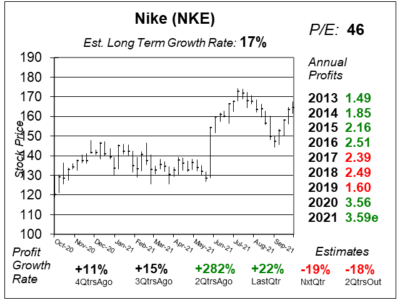

Nike (NKE) had slow delivery times shipping from Asia to America. Now it doesn’t. The result: high inventory (and markdowns).

Nike (NKE) lowered revenue guidance, as China had -19% sales growth due to COVID. The strong US Dollar is also hurting sales.

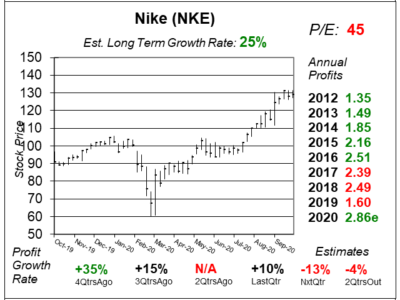

The big take on Nike’s (NKE) earnings report last quarter was that demand significantly exceeded available inventory supply.

Nike’s (NKE) expected to grow profits just 3% this year due COVID factory closures. Next year’s profits are expected to jump 31%.

Nike (NKE) has production, labor, and transportation issues. Investors still like the stock as they love the digital sales growth.

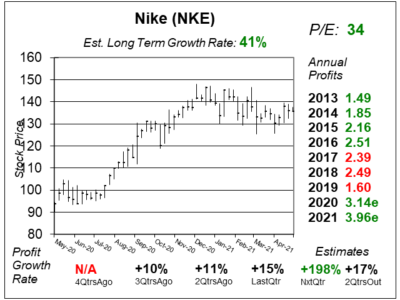

Nike (NKE) is rolling — sales-wise, profit-wise, and stock-wise — due to online sales and direct-to-consumer sales.

Nike (NKE) had slow sales a year-ago due to COVID-19. Now, stores are opening up and that could mean good profits.

Nike (NKE) is doing great with its digital revenue and sales in China. But is the good news already reflected in the stock?

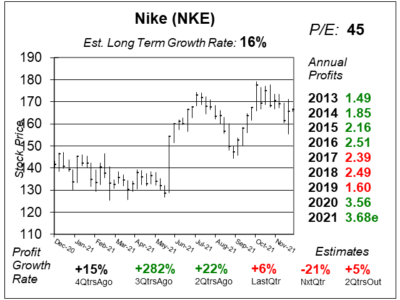

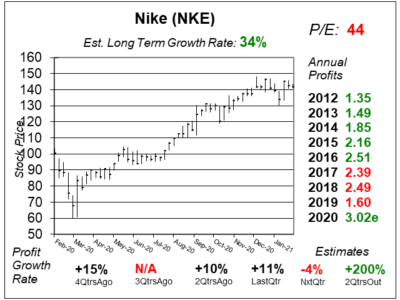

Nike (NKE) stock has been hot as its online sales jumped 82% last qtr. But with a P/E of 45, the shares are pricey.

Nike’s (NKE) Digital sales soared 75% last qtr to account for 30% of sales. But the stock seems expensive with a 43 P/E.

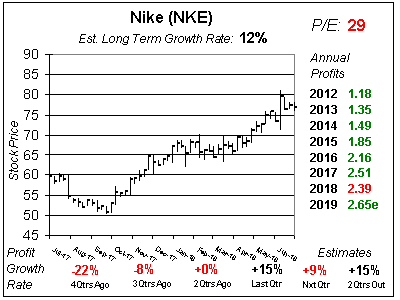

Nike (NKE) had 15% profit growth last qtr, which was quite strong. But there’s uncertainty on profits for future qtrs.

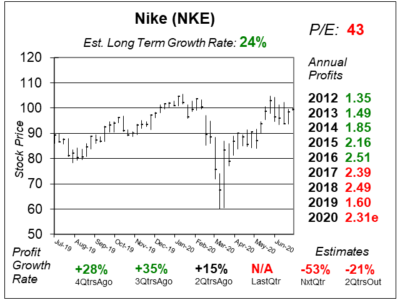

Nike (NKE) stock is on a roll as Greater China was the company’s strongest region. But will the Coronavirus slow growth?

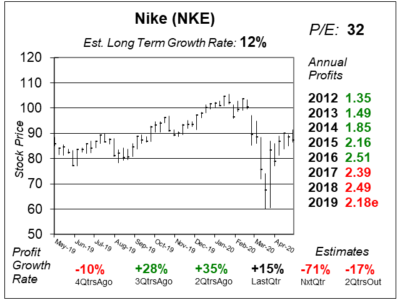

Nike (NKE) broke out after the company beat last qtr profit estimates. But with a 32 P/E the stock is rich.

Nike (NKE) beat the street last night, is breaking out this morning, and will be added to the Conservative Growth Portfolio.

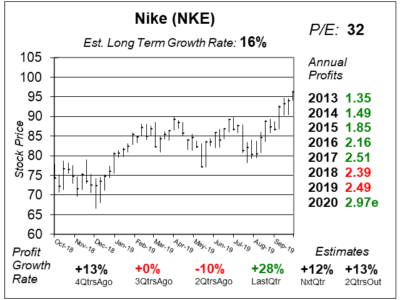

Nike (NKE) has been doing well with its online sales and expansion into China. Let’s take a look at NKE and see if it’s too-high to buy.

Nike is scoring big with its Digital platforms such as Nike.com and the Nike app. But with a rich valuation, is the good news already priced into the stock?

Nike (NKE) has this bad habit of beating qtrly profit estimates, then lowering next qtr’s estimate. I’m not a fan of that strategy.

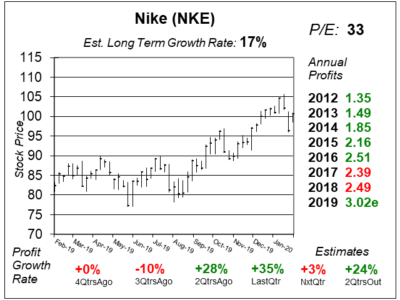

Nike (NKE) is one of the best stocks in the Dow this year as the return to sales growth in North American has boosted the stock to new highs.

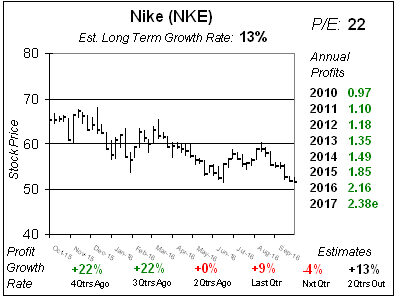

Nike’s (NKE) stock was a laggard in 2016 and 2017 as North American sales figures have been lagging. Now momentum could reverse that trend.

Nike (NKE) just had profits decline the past 2 qtrs. But that hasn’t hurt the stock as its jumped from the low-$50s to the high-$60s since last Fall.

Nike (NKE) has had fiscal year 2018 profit estimates decline for seven straight qtrs, from $2.86 to $2.32. I feel this stock could continue to be in the $50s for the next two years.

A weakening U.S. dollar could mean more profits and sales for Nike (NKE). Also, Nike will start selling a limited number products directly on Amazon.com.

Nike (NKE) is down because future orders turned negative last qtr. So is this a good buying opportunity for this Dow stock, or is it time to get out?

Nike (NKE) stock has been a huge winner this past decade. But the stock has been in a downtrend for a year as profit estimates have been eroding.

Nike (NKE) was on a roll this decade, then profit growth slowed as Adidas took market share. NKE stock is down now, but is this a good time to buy?

Nike (NKE) stock was on a roll from 2013 to 2015, but this year NKE is down due to slower profit growth and a high P/E.

Nike (NKE) is a fantastic stock. A Hall of Famer. But with slowing growth and a 24 P/E NKE is still a little too high for me to buy.

Nike (NKE) is on a roll, but profit growth is expected to moderate and I feel NKE is a little high at 27x earnings.

Nike (NKE) is killing it all over the world, but at 27x earnings I don’t think NKE is a good buy at this time.

Nike (NKE) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $0.85 vs. $0.66 = +29%

Revenue Est: +0%