Stock (Symbol) |

Nike (NKE) |

Stock Price |

$107 |

Sector |

| Retail & Travel |

Data is as of |

| July 5, 2023 |

Expected to Report |

| September 27 |

Company Description |

NIKE, Inc. is engaged in the designing, marketing and distributing of athletic footwear, apparel, equipment and accessories and services for sports and fitness activities. NIKE, Inc. is engaged in the designing, marketing and distributing of athletic footwear, apparel, equipment and accessories and services for sports and fitness activities.

The Company’s operating segments include North America; Europe, Middle East & Africa (EMEA); Greater China; and Asia Pacific & Latin America (APLA). It sells a line of equipment and accessories under the NIKE Brand name, including bags, socks, sport balls, eyewear, timepieces, digital devices, bats, gloves, protective equipment and other equipment designed for sports activities. It also designs products specifically for the Jordan Brand and Converse. The Jordan Brand designs, distributes and licenses athletic and casual footwear, apparel and accessories predominantly focused on basketball performance and culture using the Jumpman trademark. It also designs, distributes and licenses casual sneakers, apparel and accessories under the Chuck Taylor, All Star, One Star, Star Chevron and Jack Purcell trademarks. Source: Refinitiv |

Sharek’s Take |

Nike (NKE) has resolved the challenges it faced with high inventory levels. During the Summer/Fall of 2022, NKE had a bunch of excess inventory as stores had over ordered due to slow shipping. So management made price cuts to lower these inventory levels, but that hurt profit margins. This maneuver was successful. China sales have also improved. Last year, COVID lockdowns and the reluctance of Chinese to shop outside hampered NKE’s China sales. Now sales are bouncing back, with China revenue up 16% last qtr. But sales growth slowed throughout most of the world. During the past three months, North America sales declined from 27% to 5%, Europe, Middle East & Africa slowed from 26% to 3%, and Asia Pacific, & Latin America went from 15% to 1%. NKE is still a best-in-class brand and its long-term outlook is bright with momentum building for its Jordan brand. It grew mid-30s with impressive growth across men’s, women’s, and kids, footwear, and apparel and in both North America and internationally. Nike (NKE) has resolved the challenges it faced with high inventory levels. During the Summer/Fall of 2022, NKE had a bunch of excess inventory as stores had over ordered due to slow shipping. So management made price cuts to lower these inventory levels, but that hurt profit margins. This maneuver was successful. China sales have also improved. Last year, COVID lockdowns and the reluctance of Chinese to shop outside hampered NKE’s China sales. Now sales are bouncing back, with China revenue up 16% last qtr. But sales growth slowed throughout most of the world. During the past three months, North America sales declined from 27% to 5%, Europe, Middle East & Africa slowed from 26% to 3%, and Asia Pacific, & Latin America went from 15% to 1%. NKE is still a best-in-class brand and its long-term outlook is bright with momentum building for its Jordan brand. It grew mid-30s with impressive growth across men’s, women’s, and kids, footwear, and apparel and in both North America and internationally.

Nike is considered the world’s largest sports apparel company and it is popularly known for its footwear, apparel, and equipment such as Nike, Converse, and Jordan brands. Nike was founded in 1964 as Blue Ribbon Sports by Bill Bowerman and Phil Knight and they initially sold imported Japanese running shoes. Later on, the company rebranded Nike when they introduced the famous Nike Cortez, a lightweight and comfortable family of footwear, to the public. On December 2, 1980, Nike had its IPO and started selling at $22 per share to the public. In 1984, Michael Jordan signed a $500,000 per year NBA sneaker deal for Nike to design and market Air Jordan shoes, and after that, it propelled him to become a cultural icon. As a result, Nike became a dominant player in the sneaker business. Nike currently has two catalysts: Nike Direct and Nike Digital:

NKE is a Blue Chip stock that doesn’t move in sync with its earnings. Sometimes the stock climbs higher even though results are poor. Analysts give NKE’s Estimated Long-Term Growth Rate 15% right now, which is around where I think it should be. The stock also has a dividend yield of 1%. The dividend has increased for 21 consecutive years. In fiscal 2022, management paid a total of $1.8 billion in dividends to shareholders and repurchased $4 billion of NKE shares. Nike is part of the Conservative Growth Portfolio. Profit margins are set to improve now that inventory is back where it should be. |

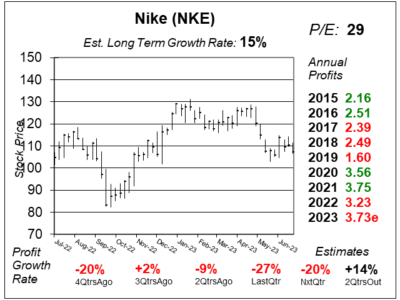

One Year Chart |

This stock tanked last Fall after the high inventory news came out, then it immedicably rallied as the measures management took to cut inventory worked. Recently, the stock fell after it reported last quarter’s earnings because of weakness in the wholesale channel. This stock tanked last Fall after the high inventory news came out, then it immedicably rallied as the measures management took to cut inventory worked. Recently, the stock fell after it reported last quarter’s earnings because of weakness in the wholesale channel.

The stock’s P/E is 29. My Fair Value is a P/E of 32. So this stock has some upside potential. My Fair Value is $119. The Est. LTG increased from 7% last qtr to 9% and now 15% this company seems to be a high-teens profit grower to me. |

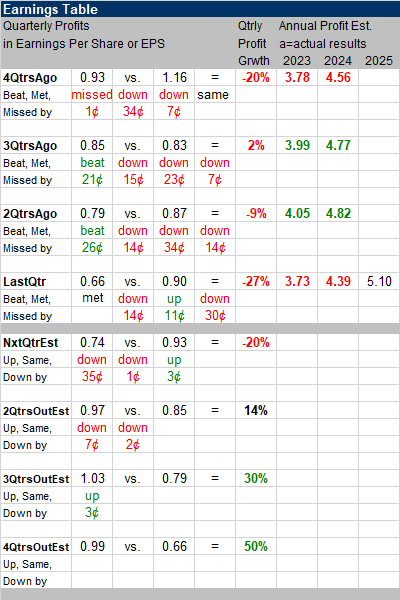

Earnings Table |

Last qtr, Nike reported -27% profit growth and met analyst estimates. Revenue increased 5%, year-on-year, and missed estimates of 8%. Excluding adverse impact from FX, revenue growth was 8%. Gross margin declined to 43.6% from 45.0% a year ago. Last qtr, Nike reported -27% profit growth and met analyst estimates. Revenue increased 5%, year-on-year, and missed estimates of 8%. Excluding adverse impact from FX, revenue growth was 8%. Gross margin declined to 43.6% from 45.0% a year ago.

Greater China, which had been a concern in previous quarters, demonstrated significant improvement last quarter. While the wholesale channel faced challenges, NIKE Direct, performed well as revenue in this segment increased by 18%. This success can be attributed to NKE’s investments in its digital channels over the past few years. The digital share of NKE’s total business reached 26% in fiscal year 2023, a significant increase from 10% in fiscal year 2019. Here’s a quick breakdown of NKE’s regions, with the percentage of overall brand sales after F/X (excluding Converse):

Annual Profit Estimates decreased this qtr. That stinks as these figures had been increasing. Qtrly Profit Estimates for the next 4 qtrs are -20%, 14%, 30%, and 50%. For the next qtr, management expects revenue to grow flat to low single-digit as they anticipate slower growth due to inventory reduction 6 months ago. Analysts think that Nike’s revenue will grow by 2%. |

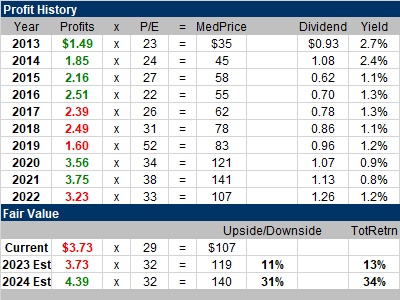

Fair Value |

My Fair Value P/E remains at 32. The stock has around 11% upside for this year (which I’m calling Fiscal 2023). Note, NKE’s Fiscal year-end is May 31. So for me, the company is in 2023 Q1 as most of the months are in calendar year 2023. My Fair Value P/E remains at 32. The stock has around 11% upside for this year (which I’m calling Fiscal 2023). Note, NKE’s Fiscal year-end is May 31. So for me, the company is in 2023 Q1 as most of the months are in calendar year 2023.

At one time, analysts felt NKE would earn $5.64 in profits in 2023. Now that estimate is $3.73. So if, hypothetically, the company earns $5 in 2023 and gets a 30 P/E it could be a $150 stock. |

Bottom Line |

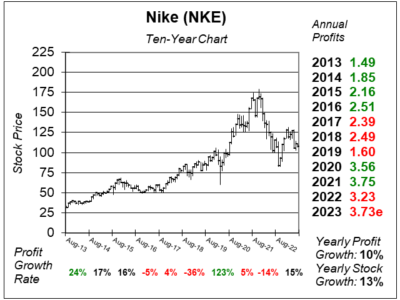

Nike (NKE) was having a very good decade. But the shares got overvalued, then undervalued, and now undervalued again. Nike (NKE) was having a very good decade. But the shares got overvalued, then undervalued, and now undervalued again.

Nike’s recent problems include logistics issues, high inventory, and slow sales in China. Now the company is moving past these issues, but global demand is slowing. I think its best to take a step back and just think of this stock as a mid-to-high teens grower then just buy and hold. NKE slides from 10th to 15th in the Conservative Portfolio Power Rankings. The reason for the drop is strength of tech stocks have moved those stocks up in the rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 11 of 31 |