On Wednesday, the stock market sank to worst loss in months after the Federal Reserve suggested that it will not likely cut interest rates in March. Nevertheless, the central bank believes that the US policy rate is already likely at its peak.

On Wednesday, the stock market sank to worst loss in months after the Federal Reserve suggested that it will not likely cut interest rates in March. Nevertheless, the central bank believes that the US policy rate is already likely at its peak.

Overall, S&P 500 declined 1.6% to 4,846, while NASDAQ fell 2.2% to 15,164.

Tweet of the Day

Compare $NVDA vs $AMD from the last reported quarter:

– R&D: $2.3B vs $1.5B

– Net profit: $9.2B vs 0.6B$NVDA market cap is 5x of $AMD, but net profit was 15x, while r&d cost was only 1.5x higher. Nvidia is insane.If we wait until the next earnings the difference may even be… pic.twitter.com/owGFtmDXCY

— The AI Investor (@The_AI_Investor) January 31, 2024

Chart of the Day

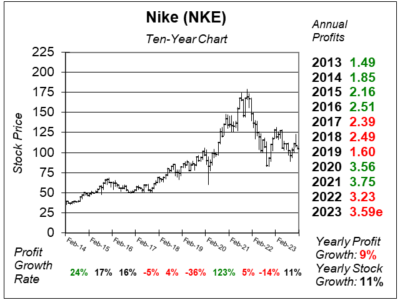

Here is the ten-year chart of Nike (NKE) as of January 3, 2024, when the stock was at $104.

Here is the ten-year chart of Nike (NKE) as of January 3, 2024, when the stock was at $104.

Nike seems to be getting back on its feet as profits rebounded last quarter. During 2021, buyers were putting in their Nike orders early as supply chain constraints made ocean shipping slow. Then in 2022, shipping speed returned to normal, but retailers had a lot of inventory old orders then caught up. So in late 2022 & early 2023, Nike Management cut prices to get rid of inventory and profits declined. Now, profitability has returned, with Nike’s profits up 21% last quarter with revenue up 1%. In the earnings release, management stated last quarter’s performance was a turning point driving more profitable growth.

NKE is part of the Conservative Growth Portfolio. David Sharek, Founder of School of Hard Stocks, believes that Nike has now returned to being a 15% grower long-term.