ServiceNow (NOW) Offers a Complete AI Platform Designed to Handle All Business Needs

ServiceNow (NOW) is thriving even though software stocks are out of favor. Because NOW is utilizing AI instead of losing to it.

ServiceNow (NOW) is thriving even though software stocks are out of favor. Because NOW is utilizing AI instead of losing to it.

ServiceNow’s (NOW) is seeing a surge in AI, as its Pro Plus offering up 4x year-over-year with AI featured in 15 of its top 20 deals.

ServiceNow (NOW) is shaking up its software business by bringing in consumption pricing so customers will try its AI Agents.

ServiceNow (NOW) is making money with Artificial Intelligence with 44 customers paying more than $1 million a year for AI software.

ServiceNow (NOW) is really leading the AI revolution as its Now Assist AI had contract values double in just three months.

Many iconic brands are adopting ServiceNow’s (NOW) Now Assist AI as a standard for their Generative AI road maps.

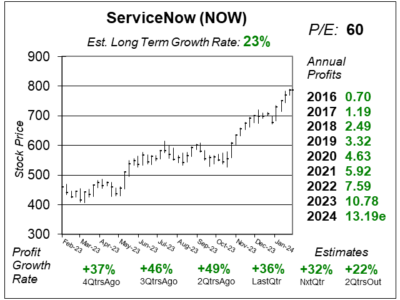

ServiceNow (NOW) Is rolling in new business as its AI offerings are leading the software space. And its stock is flying high.

ServiceNow (NOW) had another excellent qtr as management noted generative AI represents a real tailwind to the company’s growth.

ServiceNow (NOW) is teaming up with Accenture to consult with clients on AI, and with NVIDIA to make the digital improvements.

ServiceNow’s (NOW) partnership with NVIDIA will take IT and customer service software to a new level.

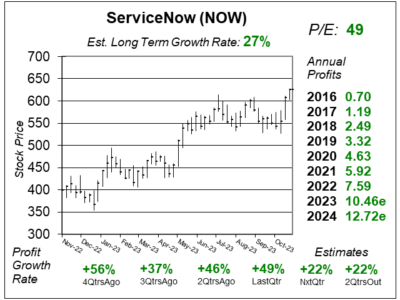

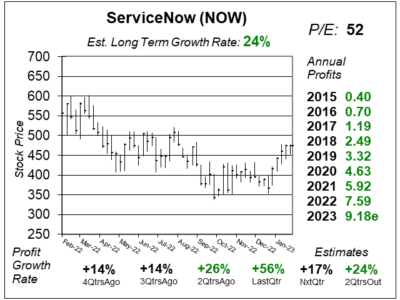

ServiceNow (NOW) continues to deliver splendid results in a weak software environment, as profits grew 56% last qtr with sales up 20%.

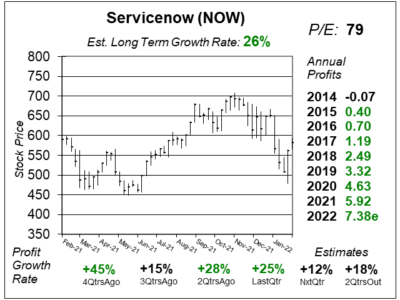

ServiceNow (NOW) impressed investors with its last qtr earnings report. And with the stock’s recent decline, we think its a bargain.

ServiceNow (NOW) continues to bring in $1 million deals — and even $10 million deals — as large Enterprise organizations evolve.

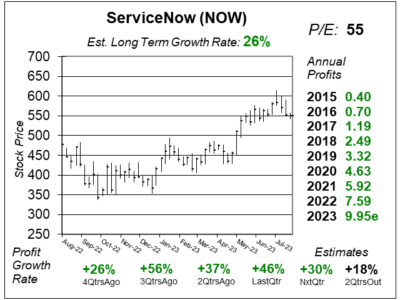

ServiceNow (NOW) closed 52 $1 million dollar deals last qtr deals, 41% more than last year, as the company isn’t seeing a slowdown.

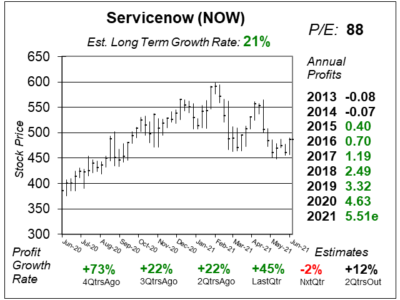

Servicenow (NOW) proved its software business continues to be in high demand post-COVID as it continues to land big clients.

ServiceNow (NOW) just landed the Internal Revenue Service as a new client, and this deal should prove to be a game changer.

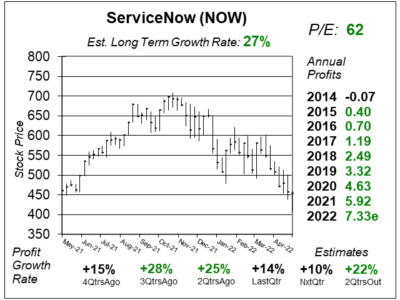

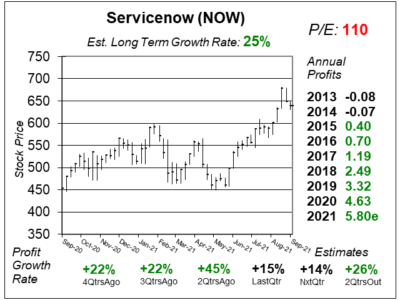

ServiceNow (NOW) continues to deliver solid growth of around 30%. But with a 110 P/E, the shares look overvalued by 20%.

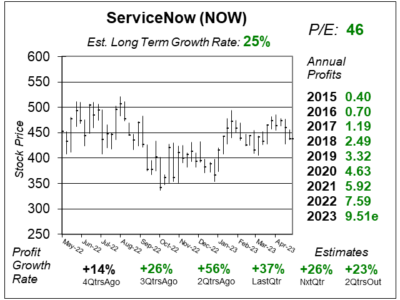

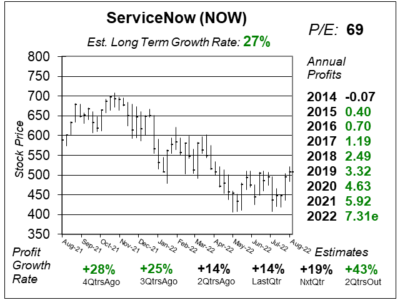

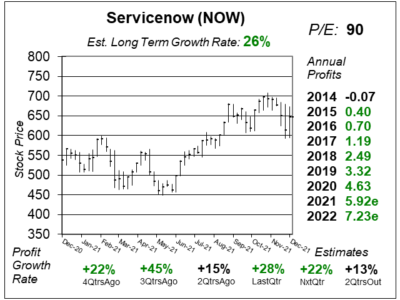

ServiceNow (NOW), the king of customer service software, continues to grow 30%-plus per year. Why is the stock down?

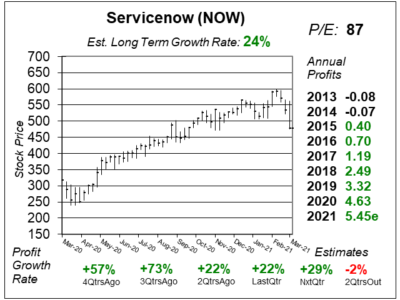

ServiceNow (NOW) has been landing some big deals, but with a P/E of 87, I think the stock is fairly valued here.

Software company ServiceNow (NOW) is rolling in government business, with 9 customers doing more than $10 million a year.

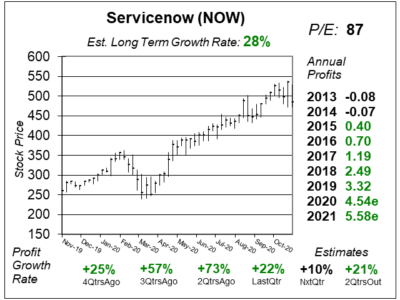

Servicenow (NOW), the King of customer service software, is hot as employees work from home. But the stock is overvalued.

Servicenow’s (NOW) software is what government agencies need to get through these busy Coronavirus times.

ServiceNow (NOW) is the brains behind many of the large customer service platforms — including government agencies.

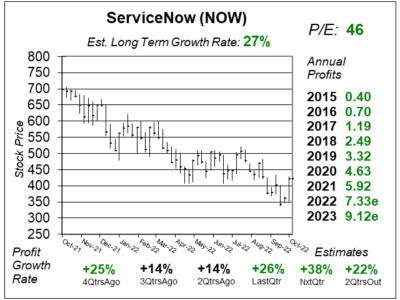

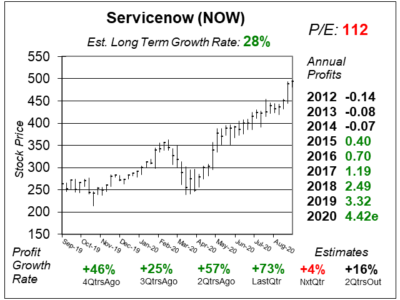

Software company ServiceNow (NOW) keeps churning out the profit growth, even though the stock is not acting like it.

Servicenow (NOW) was one of the market’s top stocks. Now it is digesting prior gains as it bases between $250 and $300.

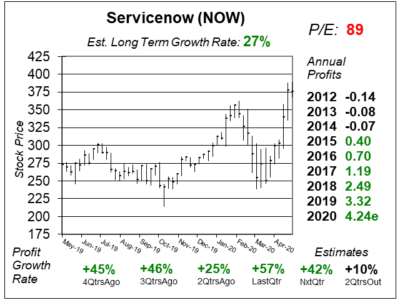

ServiceNow (NOW) stock is up 23% since my last research report. With a P/E of 89 and just 20% profit growth last qtr, is it time to sell?

ServiceNow (NOW) is one of the hottest stocks in the stock market right now. But there are a few things that keep this stock from being perfect.

Software company ServiceNow (NOW) is getting a lot of government deals, and I expect this stock to be a market leader in 2019.

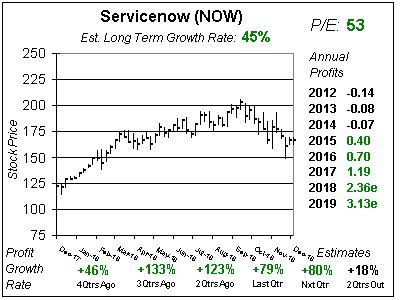

ServiceNow (NOW) is breaking out to a new high today. NOW has grown profits at a triple-digit rate in each of the last two qtrs.

ServiceNow’s (NOW) CEO has a goal to grow from $2 billion in sales in 2017 to $15 billion. Here’s what I think that could do for the stock.

ServiceNow (NOW) is clicking on all cylinders as sales, profits and subscription revenue grew more than 40% last qtr. But after a quick run higher, I feel NOW needs to simmer down.

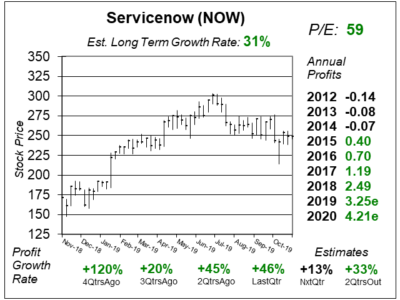

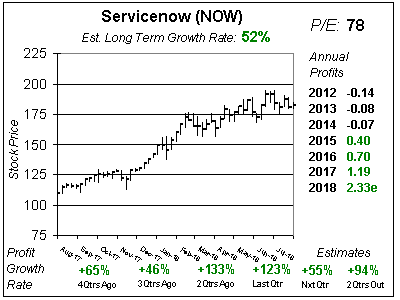

Software company Servicenow (NOW) broke out to an All-Time high last week. NOW has an exceptional Estimated Long-Term Growth Rate of 52% a year, but a high P/E to go along with it.

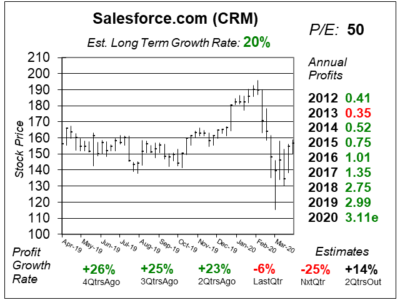

ServiceNow (NOW) is one of the world’s fastest growing software companies. It reminds me a lot of Salesforce.com. But NOW has a P/E of 94, which makes it high to buy.

ServiceNow (NOW) looks like it could be one of the next great software stocks. But the recent run higher — by the stock and the NASDAQ — has me cautious.

ServiceNow (NOW) reports qtrly profits (EPS) and revenues:

ServiceNow (NOW) reports qtrly profits (EPS) and revenues:

ServiceNow (NOW) reports qtrly profits (EPS) and revenues:

ServiceNow (NOW) reports qtrly profits (EPS) and revenues:

ServiceNow (NOW) reports qtrly profits (EPS) and revenues:

ServiceNow (NOW) reports qtrly profits (EPS) and revenues:

ServiceNow (NOW) reports qtrly profits (EPS) and revenues:

ServiceNow (NOW) reports qtrly profits (EPS) and revenues:

ServiceNow (NOW) reports qtrly profits (EPS) and revenues:

ServiceNow (NOW) reports qtrly profits (EPS) and revenues: