Stock (Symbol) |

ServiceNow (NOW) |

Stock Price |

$639 |

Sector |

| Technology |

Data is as of |

| September 14, 2021 |

Expected to Report |

| October 26 |

Company Description |

ServiceNow, Inc. is provider of enterprise cloud computing solutions that define, structure, manage and automate services for global enterprises. The Company offers a set of cloud-based services that automate workflow within and between departments in an enterprise. It provides workflow solutions, and focuses on service management for customer support, human resources, security operations and other enterprise departments. Source: Thomson Financial ServiceNow, Inc. is provider of enterprise cloud computing solutions that define, structure, manage and automate services for global enterprises. The Company offers a set of cloud-based services that automate workflow within and between departments in an enterprise. It provides workflow solutions, and focuses on service management for customer support, human resources, security operations and other enterprise departments. Source: Thomson Financial |

Sharek’s Take |

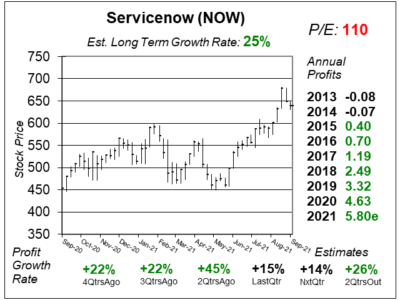

ServiceNow (NOW) is executing beautifully as this large company continues to grow revenue at 30% a qtr. But the stock may be a little too-high to buy as the P/E of 110 is lofty by historical measures. And hte best historical measure is looking back to my past qtrly reports to check out the P/E ratio, which you can do here. Since I started covering the stock on a quarterly basis in 2017 Q3, NOW has had a P/E of 83, 94, 68, 77, 80, 78, 53, 74, 89, 82, 59, 50, 89, 112, 87, 87,and 88. Note the 112 P/E is in bold. That was last September, when the stock was around $500. And during the following 8 months, the stock went sideways. Now, with a P/E of 110, I think the shares have 20% downside. ServiceNow (NOW) is executing beautifully as this large company continues to grow revenue at 30% a qtr. But the stock may be a little too-high to buy as the P/E of 110 is lofty by historical measures. And hte best historical measure is looking back to my past qtrly reports to check out the P/E ratio, which you can do here. Since I started covering the stock on a quarterly basis in 2017 Q3, NOW has had a P/E of 83, 94, 68, 77, 80, 78, 53, 74, 89, 82, 59, 50, 89, 112, 87, 87,and 88. Note the 112 P/E is in bold. That was last September, when the stock was around $500. And during the following 8 months, the stock went sideways. Now, with a P/E of 110, I think the shares have 20% downside.

ServiceNow builds applications that help automate processes and create efficient workflows, to enable work to flow naturally across different departments of a business. It’s product portfolio is on a single cloud platform called the Now Platform. The Now Platform integrates easily with other enterprise systems including Microsoft Teams and Azure, Amazon Web Services, Splunk, SAP, Oracle, YouTube, Google Cloud, and Crowdstrike among others. Non-tech staff can drag-and-drop interfaces into place on pages and build the platform without the need for a developer. ServiceNow’s specialty is working with large organizations, and the company has a niche in government organizations. I think ServiceNow is the King of Customer Service software. ServiceNow’s product portfolio is currently focused on

During the last qtr, NOW introduced the Now Buying Program which provides for a quick and simple buying process, flexible usage, and improve business impact. The company also announced integration of the platform with Microsoft’s new Windows 365 to let users easily acces cloud PCs directly through Mircosoft Teams. NOW also released new solutions to enhance the manufacturing and healthcare industries. In addition, the company acquired Lightstep to help customers in the digital transformation. Here are some financial highlights as of last qtr:

ServiceNow is one of the best companies in the world. The stock reminds me of Microsoft back-in-the-day. Forbes recognized ServiceNow on its World’s Most Admired Companies list in 2020, and Fortune ranked ServiceNow #1 on the Fortune 50 list of companies with the best long-term growth potential. When I look at the financials, I see revenue has increased on a qtrly basis for years. The stock has an Est. LTG of 25% per year and I feel this is a 35% to 40% grower. Years ago, Salesforce was a 35% grower and it was earning P/Es in the 70s and 80s. My Fair Value on NOW is a P/E of 88, and with the P/E currently at 110, the stock seems overvalued. NOW is part of the Growth Portfolio. |

One Year Chart |

Note a year ago in September the stock had a P/E of 112. That’s the point on the left side of this chart when the stock first touches $500. Notice the stock went through an 8 month base aftwerwards. Now, with a P/E of 110, I see a repeat performance ahead. Note a year ago in September the stock had a P/E of 112. That’s the point on the left side of this chart when the stock first touches $500. Notice the stock went through an 8 month base aftwerwards. Now, with a P/E of 110, I see a repeat performance ahead.

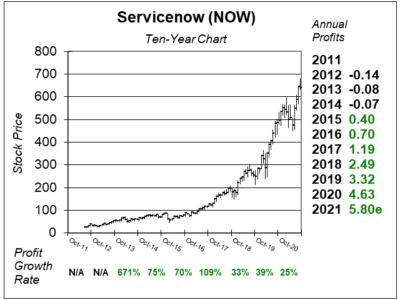

Profit growth slowed to 15% last qtr, but that’s ok as growth was 73% in the year-ago period. So comparisons were very tough. I’m surprised the company was able to grow year-over-year profits at all. In terms of Annual Profits, NOW is expected to make around $5.80 per share in 2021. This will be more than ten-fold increase from six years ago. NOW has an Est. LTG of 25% per year, up from 21% 2QtrsAgo. |

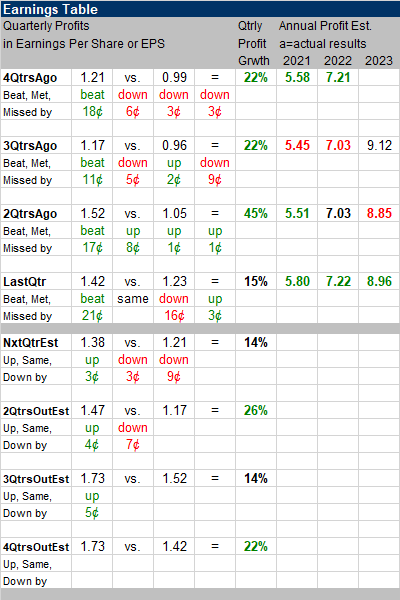

Earnings Table |

Last qtr, NOW reported profit growth of 15% and beat estimates of -2%. Total revenues grew 32%, up from 30% 2QtrsAgo. Subscription revenues increased 31%, while professional services and others jumped 41%. Last qtr, NOW reported profit growth of 15% and beat estimates of -2%. Total revenues grew 32%, up from 30% 2QtrsAgo. Subscription revenues increased 31%, while professional services and others jumped 41%.

The growth in subscription revenues was primarily driven by increased purchases by existing customers and an increase in customer count. The growth in professional services and others was due to the increase in services and trainings provided to new and existing customers. Annual Profit Estimates increased this qtr, and 2021’s broke out of a range. But 2022’s and 2023’s estimates are similar to where they had been. Management’s 2021 revenue growth estimate was raised to around 30%. Qtrly Profit Estimates are for 14%, 26%, 14%, and 22% growth the next 4 qtrs. I think the company will continue to beat the street, and deliver around 30% to 40% profit growth the next 4 qtrs. |

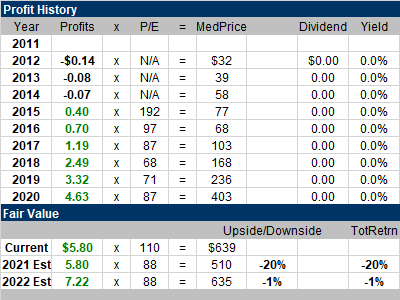

Fair Value |

My Fair Value on the stock is a P/E of 88. The stock had a P/E of 87 ot 88 the prior three qtrs. There’s 20% downside to 2021’s Fair Value. The stock is selling around my 2021 Fair Value, but I feel this number may be too low as it looks as though the company will continue to beat the street. I can imagine the stock rising 30% in the next year. My Fair Value on the stock is a P/E of 88. The stock had a P/E of 87 ot 88 the prior three qtrs. There’s 20% downside to 2021’s Fair Value. The stock is selling around my 2021 Fair Value, but I feel this number may be too low as it looks as though the company will continue to beat the street. I can imagine the stock rising 30% in the next year. |

Bottom Line |

ServiceNow (NOW) is one of the world’s finest software stocks. I’m amazed the company continues to pump-out 30% revene growth. And with billings up 30% this past qtr, I see that trend continuing. ServiceNow (NOW) is one of the world’s finest software stocks. I’m amazed the company continues to pump-out 30% revene growth. And with billings up 30% this past qtr, I see that trend continuing.

The company did $4.5 billion in revenue last year and analyst estimates are for $13.6 billion in 2025. I think the stock is still one to hold. But in the meantime, investors need to be patient as the shares look 20% overvalued here. NOW stays at 30th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

30 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |