The stock market slid on Tuesday after disappointing data from China raised concerns on the global economy. In addition, an analyst from Fitch Ratings said that outlook for the entire U.S. banking industry could be lowered.

The stock market slid on Tuesday after disappointing data from China raised concerns on the global economy. In addition, an analyst from Fitch Ratings said that outlook for the entire U.S. banking industry could be lowered.

Meanwhile, July’s retail sales data came in higher than expected at 0.7% from the previous months versus 0.4% estimates. Such indicated stronger-than-expected consumer.

Overall, S&P 500 declined 1.2% to 4,438, while NASDAQ fell 1.1% to 13,631.

Tweet of the Day

$SE This delusional “growth” pump grew rev a whopping +5% y/y & +2% Q/Q. 😒 The game biz still collapsing (-41% 😱), while ecom is a promo-driven cash-flow sh*tshow. Credit losses ramping fast in the bank biz. But: Will increase “investments”! Flush this 💩 down the toilet. 🚽 pic.twitter.com/rTJV99QQc1

— Wasteland Capital (@ecommerceshares) August 15, 2023

Chart of the Day

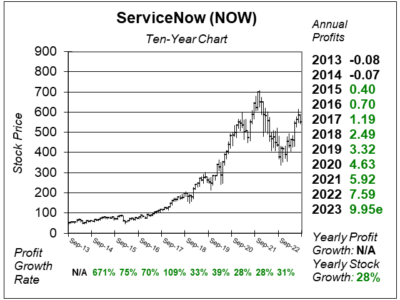

Here is the ten-year chart of ServiceNow (NOW) as of August 8, 2023, when the stock was at $550.

Here is the ten-year chart of ServiceNow (NOW) as of August 8, 2023, when the stock was at $550.

ServiceNow builds applications that help automate processes and create efficient workflows, to enable work to flow naturally across different departments of a business. Its product portfolio is on a single cloud platform called the Now Platform. The Now Platform integrates easily with other enterprise systems including Microsoft Teams and Azure, Amazon Web Services, Splunk, SAP, Oracle, YouTube, Google Cloud, and Crowdstrike among others.

ServiceNow delivered another excellent earnings report, with all key performance metrics above both analyst and the management expectations. Profit was up 46%, way above analyst expectations of 26%. Together with NVIDIA and Accenture, the three companies launched AI Lighthouse. This unites NOW’s automation platform, NVIDIA’s (NVDA) supercomputing, and Accenture’s (ACN) consulting services to allow users to architect custom generative AI. AI is now a catalyst for ServiceNow software, and the company is already offering AI applications, such as Now Assist – a virtual agent that searches for information. NOW is also partnering with accounting firm KPMG for the finance and supply chain workflow which the company announced in last quarter’s earnings call.

NOW is a core holding in the Growth Portfolio and Aggressive Growth Portfolio.