Stock (Symbol) |

ServiceNow (NOW) |

Stock Price |

$786 |

Sector |

| Technology |

Data is as of |

| January 30, 2024 |

Expected to Report |

| April 24 |

Company Description |

ServiceNow, Inc. is a digital workflow company. ServiceNow, Inc. is a digital workflow company.

The Company helps global enterprises across industries, universities and governments to digitize their workflows. Its technology platform, Now Platform, enables it to connect systems, silos, departments and processes with digital workflows. It categorizes the workflows it provides into four primary areas, such as information technology (IT), employee, customer, and creator. Its IT workflows give IT departments the ability to plan, build, operate, and service across the entire IT lifecycle. Its employee workflows help customers simplify how their employees get the services they need, creating a familiar, consumer-like way to get work done from wherever an employee may be at home, in the workplace or in the field. Its customer workflows help organizations reimagine the customer experience and increase customer loyalty. Its creator workflows enable its customers to create, test, and deploy their own applications on the Now Platform. Source: Refinitiv |

Sharek’s Take |

ServiceNow (NOW) stock is flying high as Generative AI is injecting new life into the company’s business. ServiceNow is a prime beneficiary of the power of generative AI as that will assist the company in improving efficiency within organizations by accomplishing tasks workers would normally do (like customer service). Management claimed that NOW is well positioned, not only to lead AI movement, but to define it. Last qtr in the earnings call the CEO mentioned Gartner forecasts that between 2023 and 2027 $3 trillion will be spent on AI. And this company has has been investing in AI for years, which is why they are catching it so early. Last September, the company launched the Vancouver release which integrates generative AI across all workflows in the Now Platform. ServiceNow (NOW) stock is flying high as Generative AI is injecting new life into the company’s business. ServiceNow is a prime beneficiary of the power of generative AI as that will assist the company in improving efficiency within organizations by accomplishing tasks workers would normally do (like customer service). Management claimed that NOW is well positioned, not only to lead AI movement, but to define it. Last qtr in the earnings call the CEO mentioned Gartner forecasts that between 2023 and 2027 $3 trillion will be spent on AI. And this company has has been investing in AI for years, which is why they are catching it so early. Last September, the company launched the Vancouver release which integrates generative AI across all workflows in the Now Platform.

Here are some financial highlights from last qtr:

ServiceNow builds applications that help automate processes and create efficient workflows, to enable work to flow naturally across different departments of a business. Its product portfolio is on a single cloud platform called the Now Platform. Non-tech staff can drag-and-drop interfaces into place on pages and build the platform without the need for a developer. Its Gererative AI offering is called Now Assist. NOW’s specialty is working with large organizations, and the company has a niche in government organizations. In 2023, ServiceNow teamed up with NVIDIA and Accenture to launch AI Lighthouse, which unites NOW’s automation platform, NVIDIA’s supercomputing, and Accenture’s consulting services to allow users to architect custom generative AI. NOW’s product portfolio includes:

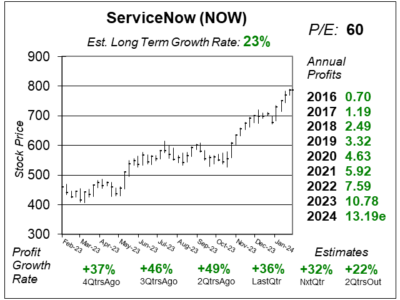

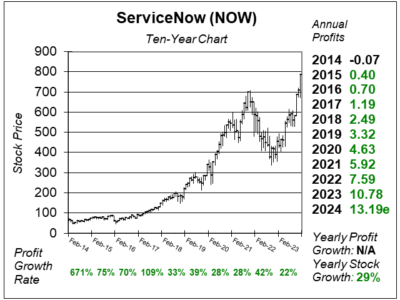

NOW is one of the best companies in the world. When I look at the financials, I see revenue has increased on a qtrly basis for years. Management also buys back stock. The stock has an Est. LTG of 23% per year and I feel this is a 30% grower. This quarter the stock has a rich P/E of 60, but I think it’s deserved. Years ago, Salesforce was a 35% grower and it was earning P/Es in the 70s and 80s. NOW is a core holding in the Growth Portfolio and Aggressive Growth Portfolio. |

One Year Chart |

So, this stock has been doing really well and is now in a Bull Market uptrend. This stock has gone from around $450 to almost $800 ain a year. And the recent rise has been swift. I feel this stock needs to settle back. It’s gone too far too fast. So, this stock has been doing really well and is now in a Bull Market uptrend. This stock has gone from around $450 to almost $800 ain a year. And the recent rise has been swift. I feel this stock needs to settle back. It’s gone too far too fast.

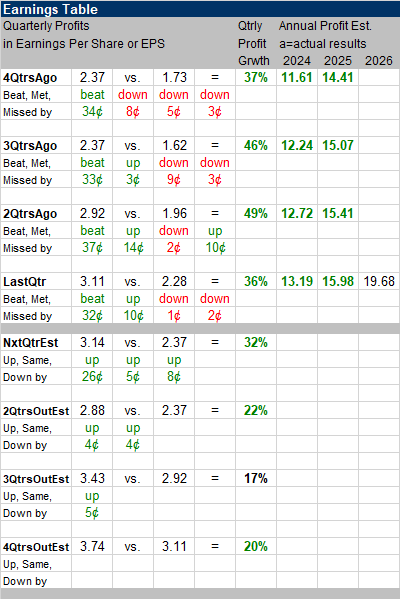

Quarterly profit growth has been good-to-great for the past four quarters. Quarterly Estimates for the next qtrs are still solid with more than 20% growth expected. NOW has an Est. LTG of 23% per year, down from 27% 2QtrsAgo. Still a solid growth rate for a large company leading in AI. |

Earnings Table |

Last qtr, ServiceNow delivered 36% profit growth and beat expectations of 22% growth. Revenue increased 26%, year-on-year, and beat estimates of 24%. The company closed 168 deals greater than $1 million annually, up from 126 a year ago (+33%). Last qtr, ServiceNow delivered 36% profit growth and beat expectations of 22% growth. Revenue increased 26%, year-on-year, and beat estimates of 24%. The company closed 168 deals greater than $1 million annually, up from 126 a year ago (+33%).

Management announced that customer workflows crossed $1 Billion in annual contract value (ACV) in Q4 and now have a 3 workflow categories generating over $1 Billion in ACV (technology, consumer, creator). ServiceNow just inked a five-year strategic alliance with Visa to transform payment services experiences. The initial phase includes the launch of ServiceNow Disputes Management. Annual Profit Estimates improved this qtr. For 2024, management raised their subscription revenues outlook to around 22% year-over-year. Qtrly Profit Estimates are for 32%, 22%, 17%, and 20% growth the next 4 qtrs. Analysts predict ServiceNow’s revenue will grow 23% next qtr. |

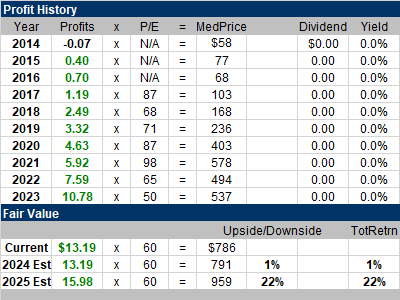

Fair Value |

My Fair Value is a P/E of 60. And the stock has a P/E of 60 this quarter. So the stock seems fairly valued now. My Fair Value is a P/E of 60. And the stock has a P/E of 60 this quarter. So the stock seems fairly valued now.

2024 profit estimates have been increasing. If that continues I will likely raise my Fair Value as well. |

Bottom Line |

ServiceNow (NOW) is one of the world’s finest software stocks. In 2021, the stock went on a parabolic run higher, and the P/E went past 100 as you can see here. That was too high, and the stock’s since come down, digested those gains, and is now in another uptrend. ServiceNow (NOW) is one of the world’s finest software stocks. In 2021, the stock went on a parabolic run higher, and the P/E went past 100 as you can see here. That was too high, and the stock’s since come down, digested those gains, and is now in another uptrend.

ServiceNow is leading the AI revolution in the software segment. NOW moves down from 18th to 21st in the Growth Portfolio Power Rankings. The run higher has zapped some of the short-term upside. The stock moves stays at 14th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

21 of 34Aggressive Growth Portfolio 14 of 17Conservative Stock Portfolio N/A |