Stock (Symbol) |

ServiceNow (NOW) |

Stock Price |

$625 |

Sector |

| Technology |

Data is as of |

| November 8, 2023 |

Expected to Report |

| January 23 |

Company Description |

ServiceNow, Inc. is a digital workflow company. ServiceNow, Inc. is a digital workflow company.

The Company helps global enterprises across industries, universities and governments to digitize their workflows. Its technology platform, Now Platform, enables it to connect systems, silos, departments and processes with digital workflows. It categorizes the workflows it provides into four primary areas, such as information technology (IT), employee, customer, and creator. Its IT workflows give IT departments the ability to plan, build, operate, and service across the entire IT lifecycle. Its employee workflows help customers simplify how their employees get the services they need, creating a familiar, consumer-like way to get work done from wherever an employee may be at home, in the workplace or in the field. Its customer workflows help organizations reimagine the customer experience and increase customer loyalty. Its creator workflows enable its customers to create, test, and deploy their own applications on the Now Platform. Source: Refinitiv |

Sharek’s Take |

ServiceNow (NOW) had another excellent quarter, delivering earnings above estimates and raising its revenue outlook for 2023. Profits grew a whopping 49% on 25% revenue growth. Management said generative AI represents a real tailwind to the company’s growth. ServiceNow has greater than 300 customers lined up to acquire ServiceNow’s AI offerings. In September, the company launched the Vancouver release which integrates generative AI across all workflows in the Now Platform. Despite Vancouver being released a day before the end of the qtr, ServiceNow signed 4 large deals with the new release. This has led to the highest number of customer requests for a pre-released product in the company’s history. Early adopters include real estate leader CBRE, NVIDIA, and Teleperformance. On top of the Vancouver release, NOW also launched NowAssist, an expanding family of generative AI features to increase productivity with the Now Platform. ServiceNow (NOW) had another excellent quarter, delivering earnings above estimates and raising its revenue outlook for 2023. Profits grew a whopping 49% on 25% revenue growth. Management said generative AI represents a real tailwind to the company’s growth. ServiceNow has greater than 300 customers lined up to acquire ServiceNow’s AI offerings. In September, the company launched the Vancouver release which integrates generative AI across all workflows in the Now Platform. Despite Vancouver being released a day before the end of the qtr, ServiceNow signed 4 large deals with the new release. This has led to the highest number of customer requests for a pre-released product in the company’s history. Early adopters include real estate leader CBRE, NVIDIA, and Teleperformance. On top of the Vancouver release, NOW also launched NowAssist, an expanding family of generative AI features to increase productivity with the Now Platform.

Here are some financial highlights from last qtr:

ServiceNow builds applications that help automate processes and create efficient workflows, to enable work to flow naturally across different departments of a business. Its product portfolio is on a single cloud platform called the Now Platform. The Now Platform integrates easily with other enterprise systems including Microsoft Teams and Azure, Amazon Web Services, Splunk, SAP, Oracle, YouTube, Google Cloud, and Crowdstrike among others. Non-tech staff can drag-and-drop interfaces into place on pages and build the platform without the need for a developer. NOW’s specialty is working with large organizations, and the company has a niche in government organizations. ServiceNow has FedRamp High authorization. In late 2021, NOW landed the Internal Revenue Service (IRS) as a new client. NOW is working with the IRS to consolidate 12 complex systems into a single platform. And the company recently won a $250 million five-year contract with the US Department of Health & Human Services. Earlier in 2023, ServiceNow teamed up with NVIDIA and Accenture to launch AI Lighthouse, which unites NOW’s automation platform, NVIDIA’s supercomputing, and Accenture’s consulting services to allow users to architect custom generative AI. NOW’s product portfolio is currently focused on:

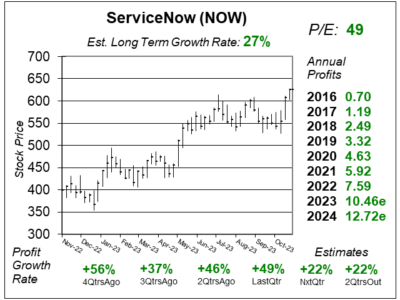

NOW is one of the best companies in the world. And its a prime benificiary of the power of generative AI as that will assist the company in improving effeciency within organizations by accomplishing tasks workers would normally do (like customer service). When I look at the financials, I see revenue has increased on a qtrly basis for years. The stock has an Est. LTG of 27% per year and I feel this is a 30% grower. This quarter the stock has a rich P/E of 49, but I think it’s deserved. Years ago, Salesforce was a 35% grower and it was earning P/Es in the 70s and 80s. NOW is a core holding in the Growth Portfolio and Aggressive Growth Portfolio. |

One Year Chart |

This stock broke out in May after the company announced AI initiatives with NVIDIA. Last qtr, the stock broke out again after the company released its earnings on 10/25. We may have just entered a new Bull Market this month, and with NOW breaking out to a new 52-week high, it looks like a stock market leader. This stock broke out in May after the company announced AI initiatives with NVIDIA. Last qtr, the stock broke out again after the company released its earnings on 10/25. We may have just entered a new Bull Market this month, and with NOW breaking out to a new 52-week high, it looks like a stock market leader.

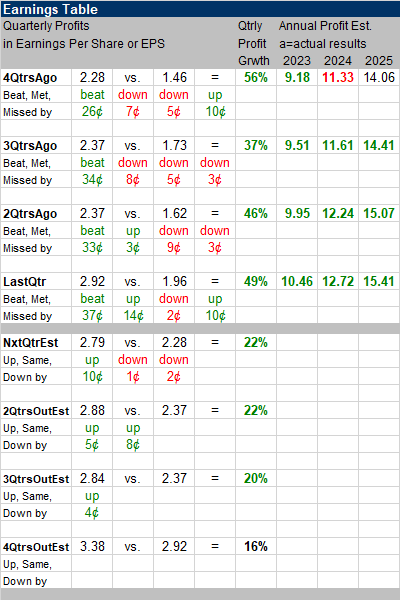

Quarterly profit growth has been good-to-great for the past four quarters. Quarterly Estimates for the next qtrs are still solid at more than 20% growth expected. NOW has an Est. LTG of 27% per year, up from 26% 2QtrsAgo. That’s a solid growth rate for a large company such as this. |

Earnings Table |

Last qtr, ServiceNow delivered 49% profit growth and beat expectations of 30% growth. Revenue increased 25%, year-on-year, and beat estimates of 24%. Current Remaining Performance Obligation grew 27%. Last qtr, ServiceNow delivered 49% profit growth and beat expectations of 30% growth. Revenue increased 25%, year-on-year, and beat estimates of 24%. Current Remaining Performance Obligation grew 27%.

Management highlighted the role of US Federal Government to revenue last qtr. NOW had its best Federal Government qtr in the company’s history with 19 deals over $1 million in annual contract value and 3 deals with over $10 million in value. The top deal was the US Air Force, the 3rd largest deal in government history. Annual contract value for US Federal deals was up 75% year-over-year. Other industries such as transportation and logistics, education, and manufacturing also displayed robust growth. 18 of the company’s top 20 deals contained 8 products or more. Annual Profit Estimates improved this qtr. Qtrly Profit Estimates are for 22%, 22%, 20%, and 16% growth the next 4 qtrs. Analysts predict ServiceNow’s revenue will grow 24% next qtr. |

Fair Value |

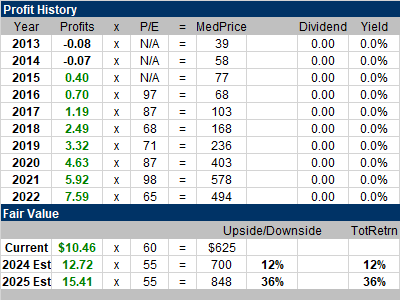

My Fair Value is a P/E of 60, up from 55 last qtr. My Fair Value is a P/E of 60, up from 55 last qtr.

The stock has a 12% upside to 2024’s Fair Value of $700. But keep in mind 2024 profit estimates have been climbing. |

Bottom Line |

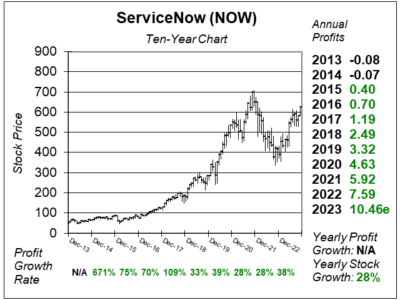

ServiceNow (NOW) is one of the world’s finest software stocks. In 2021, the stock went on a parabolic run higher, and the P/E went past 100 as you can see here. That was too high, and the stock’s since come down, digested those gains, and is now in another uptrend. ServiceNow (NOW) is one of the world’s finest software stocks. In 2021, the stock went on a parabolic run higher, and the P/E went past 100 as you can see here. That was too high, and the stock’s since come down, digested those gains, and is now in another uptrend.

ServiceNow is building AI capabilities into its IT and customer service software will make the platform even more valuable by saving time and improving productivity for its customers. NOW moves up from 22nd to 17th in the Growth Portfolio Power Rankings. I wish I could putit higher, but the upside isn’t that great. The stock moves stays at12th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

17 of 30Aggressive Growth Portfolio 12 of 17Conservative Stock Portfolio N/A |