The Magnificent 7 stocks are all the rage this year. These 7 stocks have accounted for much of the gains in the stock market (S&P 500) in 2023.

The Magnificent 7 stocks are all the rage this year. These 7 stocks have accounted for much of the gains in the stock market (S&P 500) in 2023.

But past performance isn’t an indication of future gains. What I want to know is what the stocks could be selling for in 2024.

My team and I have computed what these stocks could be next year.

Note we hold shares of these stocks in client accounts (and added AMZN today).

These charts & tables were created during the past quarter, and the stocks have moved in price since then:

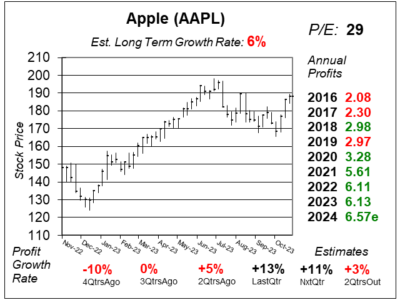

In last quarter’s earnings call, Apple (AAPL) management stated that the Apple Vision Pro would be in the hands of customers in early next year (2024).

In last quarter’s earnings call, Apple (AAPL) management stated that the Apple Vision Pro would be in the hands of customers in early next year (2024).

That’s fantastic because it gives this company a catalyst to look forward to, as the current product lineup doesn’t spark much excitement.

Last quarter, Apple’s revenue was -1% as iPhone sales increased a paltry 3%.

During the quarter, Mac sales declined 34% and iPad sales fell by 10% year-over-year.

The only good operating segment was Services, which delivered sales growth of 16%.

The Vision Pro could be a catalyst for profits and the stock in 2024. I feel this stock is worthy of a 26 P/E, which equates to $171 for 2024. The stock is above that now.

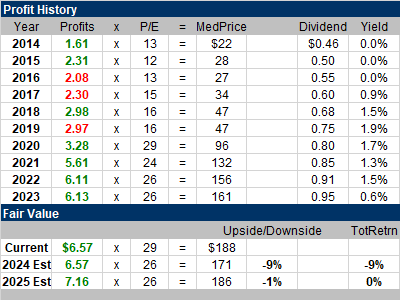

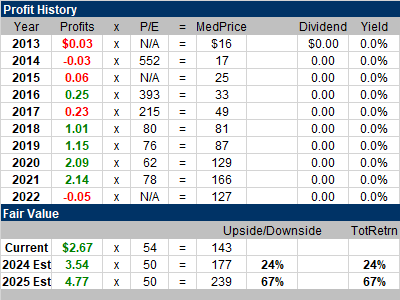

Amazon (AMZN) is implementing Artificial Intelligence (AI) across its Amazon Web Services (AWS) network.

Amazon (AMZN) is implementing Artificial Intelligence (AI) across its Amazon Web Services (AWS) network.

Management sees AI adding tens of billions of dollars in revenue per year to AWS.

In terms of current results, AMZN is saving on shipping costs as it transitioned the fulfillment network from 1 national network in the US to 8 separate regions. This is helping profits and profit margins climb.

Shorter distances and fewer touches helped profits come in at $0.94 per share and beat estimates of $0.58 last quarter.

Quarterly profit growth has been exceptional the past two quarters and that’s expected to continue.

My Fair Value P/E increases to 50 from 45. That gives the stock 24% upside to my 2024 Fair Value.

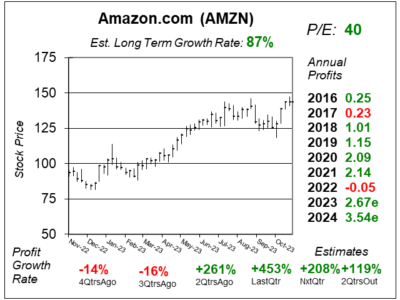

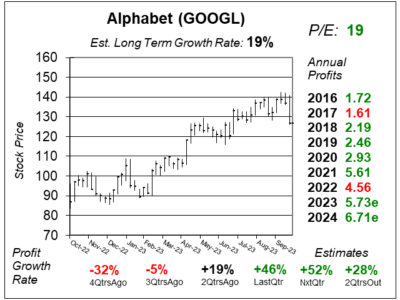

Alphabet (GOOGL) enjoyed an advertising rebound last quarter, but Google Cloud revenue slowed.That news has been bringing down the stock.

Alphabet (GOOGL) enjoyed an advertising rebound last quarter, but Google Cloud revenue slowed.That news has been bringing down the stock.

Google Search, which is the company’s largest segment making up 57% of its revenues, delivered 11% revenue growth versus 5% 2QtrsAgo. That’s great!

Cloud is just 11% of total revenue, but growth slowed to 22% from 28% a quarter earlier.

Overall, I think Alphabet delivered an impressive quarter, with 47% profit growth on 11% revenue growth. Investors felt otherwise.

My Fair Value P/E is 25. I believe this stock has 34% upside for 2024.

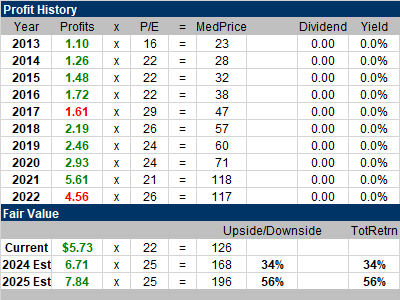

NVIDIA’s (NVDA) profits surged last quarter due to the insatiable thrust for Artificial Intelligence (AI) Systems.

NVIDIA’s (NVDA) profits surged last quarter due to the insatiable thrust for Artificial Intelligence (AI) Systems.

Last quarter’s profits jumped 593% year-over-year.

NVIDIA’s explosive growth is driven by its Data Center segment, due to the strong demand for the HGX platform which runs Generative AI and large language models.

In the company’s quarterly presentation, NVIDIA stated AWS, Google Cloud, Microsoft Azure, Oracle Cloud and a number of cloud providers are deploying HGX systems in volume.

My Fair Value is a P/E of 45. And since profits are expected to climb from ~$12 per share in 2023 to ~$20 per share in 2024, this gives me a Fair Value of greater than $900 for 2024, around double the recent price.

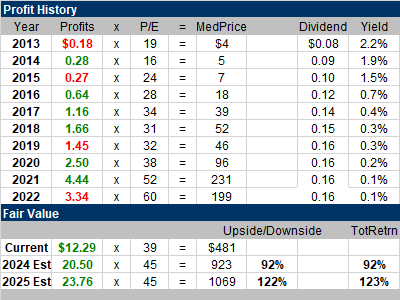

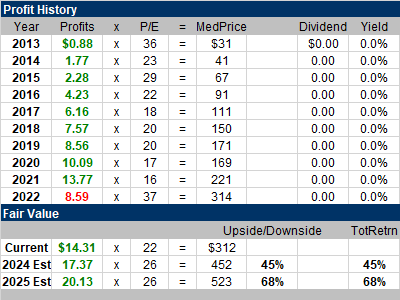

Meta Platforms (META) is cranking out the profits once again as the combination of expense cuts and AI improvements has boosted productivity big time.

Meta Platforms (META) is cranking out the profits once again as the combination of expense cuts and AI improvements has boosted productivity big time.

Last quarter, the Facebook, Instagram and WhatsApp conglomerate grew profits a whopping 168% on just 23% revenue growth.

Expense cuts in last quarter’s income statement include Marketing & Sales to $2.9 billion from $3.8 billion a year ago, as well as General & Administrative expenses to $2.1 billion from $3.4 billion during the same quarter last year.

My Fair Value P/E stays at 26 this qtr. My Fair Value for 2024 is $452, giving the stock healthy upside according to my calculations.

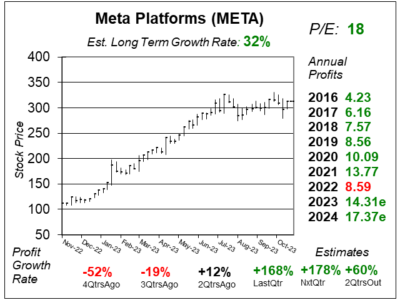

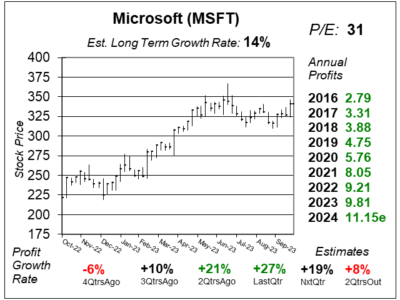

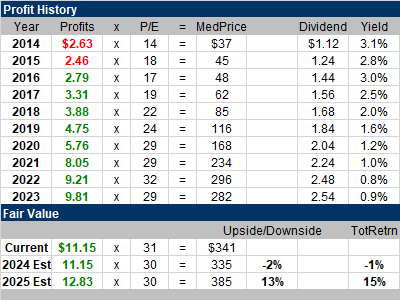

Last quarter, Microsoft (MSFT) delivered strong gains across multiple businesses, particularly Azure.

Last quarter, Microsoft (MSFT) delivered strong gains across multiple businesses, particularly Azure.

Azure is Microsoft’s public cloud platform that lets users manage cloud services such as storing data and transforming it.

Last quarter, the company’s profit grew 27% and crushed estimates of 13%.

Azure took center stage with 29% revenue growth with a decent contribution from AI services as Microsoft announced general availability of its NVIDIA H100 virtual machines just last quarter.

My Fair Value on MSFT is a P/E of 30, same with last quarter.

With the stock around $341 and my Fair Value at $335, I don’t see much upside here. But perhaps underestimating Microsoft’s AI potential?

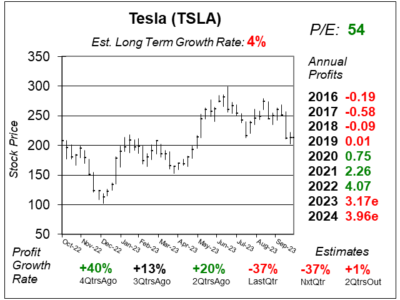

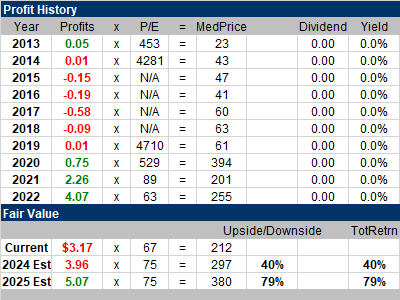

Tesla’s (TSLA) profit growth was -37% last quarter as price cuts on cars brought operating margin to 7.6% from 17.2% a year ago.

Tesla’s (TSLA) profit growth was -37% last quarter as price cuts on cars brought operating margin to 7.6% from 17.2% a year ago.

Profit growth is estimated to be -37% next quarter as auto prices must remain low to keep the monthly cost of a car low for consumers in this high interest rate environment.

Although price cuts hurt profits, the cost of production was down to $37,500 per vehicle last quarter due to lower material and freight costs. R&D expenses are also higher due to Cybertruck builds and AI expenses for the Optimus robot and Dojo supercomputer for self-driving.

My TSLA Fair Value is a 75 P/E this qtr.

The stock seems to have a great upside in 2024. But that assumes a sky-high P/E of 75 AND that profit estimates will remain the same (they have been declining).