This Bear Market has brought down a lot of good stocks. Even the best stocks have fallen hard. And that could be a good thing, as it gives us opportunities to buy great stocks while they’re down. If you’re bold enough.

This Bear Market has brought down a lot of good stocks. Even the best stocks have fallen hard. And that could be a good thing, as it gives us opportunities to buy great stocks while they’re down. If you’re bold enough.

Here’s my list of 7 of the best stocks that could become leaders in the next Bull Market:

Arista Networks (ANET) makes network switches that help computer servers communicate in datacenters.

Arista Networks (ANET) makes network switches that help computer servers communicate in datacenters.

ANET looks like the leader in cloud networking equipment. Despite uncertainty in their supply chain, Arista Networks delivered strong revenue growth driven by healthy demand from cloud titans like Microsoft and Meta and other small-to-medium enterprises, robust multi-year purchase commitments, and strength in the US region as customers made partnerships with the company for next-gen networking architectures, platforms, and features.

My Fair Value is a 35 P/E, or $140 a share.

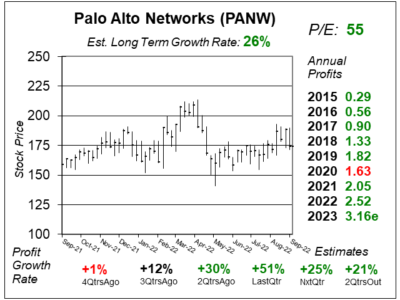

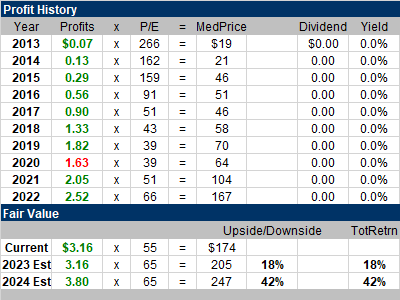

Palo Alto Networks (PANW) has the industry’s most comprehensive platform for large organizations, and delivers both hardware and software to prevent and/or stop breaches. This company is the top cyber-security provider within the Network Security business.

Palo Alto Networks (PANW) has the industry’s most comprehensive platform for large organizations, and delivers both hardware and software to prevent and/or stop breaches. This company is the top cyber-security provider within the Network Security business.

Cybersecurity hasn’t seen much of a slowdown in deland in this recession. Last qtr, Palo Alto Networks had large deal momentum fueled billings growth an astounding 44%. Next-generation security was more than 38% of billings. Overall, the company delivered 51% year-over-year profit growth while revenue grew a more realistic 27%.

My Fair Value for this stock is $205 a share.

Enphase Energy (ENPH) is a global energy technology company that designs, manufacture, and sells solar energy microinverters and battery storage packs to homeowners and commercial owners.

Enphase Energy (ENPH) is a global energy technology company that designs, manufacture, and sells solar energy microinverters and battery storage packs to homeowners and commercial owners.

Enphase Energy is benefiting from the adoption of cleaner energy. Solar stocks have been hote recently after the US government passed legislation promoting clean energy.

My Fair Value on ENPH is $262 a share. But this is a tough stock to put a valuation on.

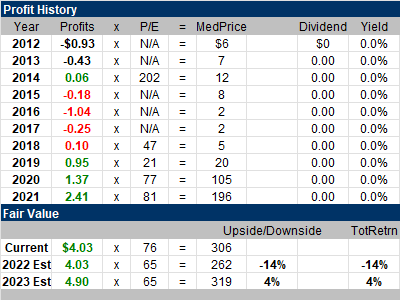

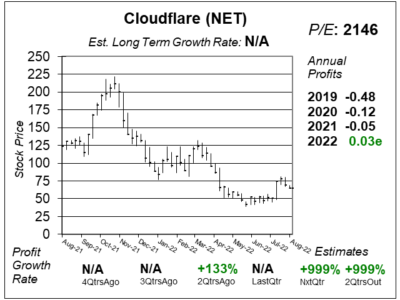

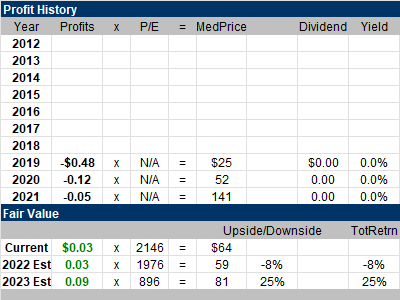

Cloudfare (NET) is one of the world’s fastest growing technology companies. The company speeds up data across your website/network and has cybersecurity functions as well.

Cloudfare (NET) is one of the world’s fastest growing technology companies. The company speeds up data across your website/network and has cybersecurity functions as well.

NET is a consistent rapid grower, with revenue growth of 50% or greater the past five years. Last qtr was no exception as revenue jumped 54%.

My Fair Value on NET is $59 a share, or 20x annual revenue estimates.

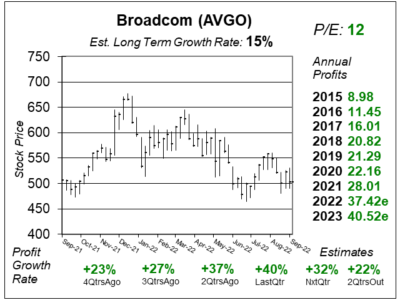

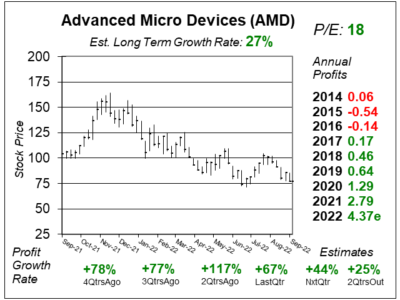

Broadcom (AVGO) is a big tech company that makes lots of different low-tech devices like routers and WiFi equipment, as well as software that integrates these devices while providing cybersecurity.

Broadcom (AVGO) is a big tech company that makes lots of different low-tech devices like routers and WiFi equipment, as well as software that integrates these devices while providing cybersecurity.

Last qtr, Broadcom reported 40% profit growth and beat expectations of 37% growth. Revenue increased 25%, year-over-year, up from 23% growth 2QtrsAgo.

My Fair Value P/E for this stock is just 18. I think this stock has HUGE upside. Also, this stock could become a new market leader if the P/E gets up to the 20s.

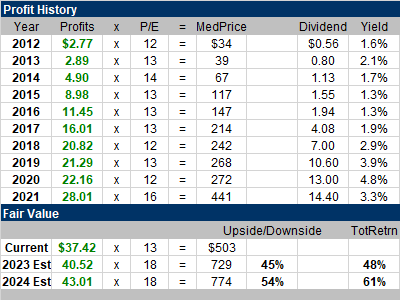

Advanced Micro Devices (AMD) is a semiconductor company that develops high performance CPUs and GPUs and integrates these with hardware and software.

Advanced Micro Devices (AMD) is a semiconductor company that develops high performance CPUs and GPUs and integrates these with hardware and software.

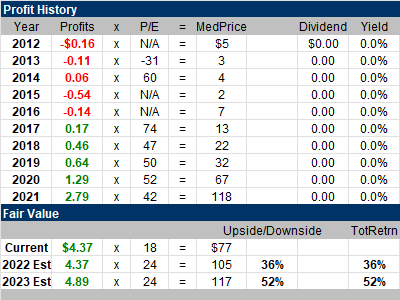

Advanced Micro Devices continues to deliver strong results even though the stock is close to 2-week lows. Last qtr, AMD delivered 67% profit growth on 70% revenue growth.

My Fair Value is a P/E of 24, which equates to $105 a share. This stock seems to have excellent upside, but the semiconductor industry might worsen over the next year.

AMD is th eonly stock in this list I don’t own for clients. AMD is on the radar, and I owuld like to buy when the industry turns up.

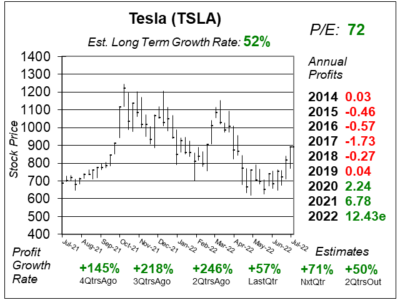

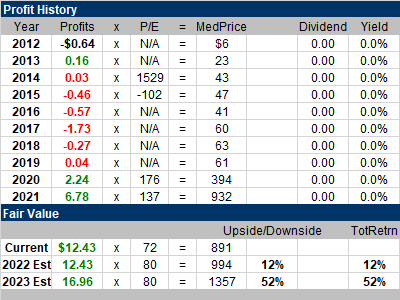

Tesla (TSLA) designs, develops, manufactures, sells, and leases high-performance fully electric vehicles, energy generation, and energy storage systems.

Tesla (TSLA) designs, develops, manufactures, sells, and leases high-performance fully electric vehicles, energy generation, and energy storage systems.

Teslas shrugged off factory shutdowns and supply chain challenges to deliver a quarter-of-a-million electronic vehicles last qtr (254,695 to be exact). That was a good quarter considering Tesla’s Shanghai plant was shutdown fully than partially during most of the quarter.

My TSLA Fair Value is $994 a share. The company also has two catalysts that could send the shares higher. One would be Full Self Driving cars that can operate without a driver. Another is the robot Optimus. Elon Musk thinks Optimus will ultimately be worth more than the car business and Full Self Driving combined.