Broadcom’s (AVGO) Alternative AI Solution Could Be Stiff Competition for NVIDIA.

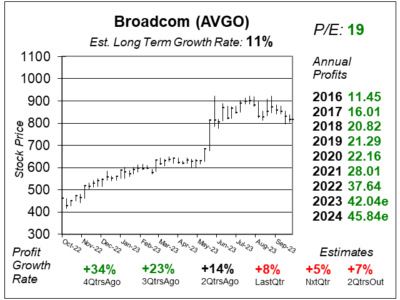

Broadcom (AVGO) is already reigning in revenue from AI infrastructure. Now it seems the company can compete with NVIDIA.

Broadcom (AVGO) is already reigning in revenue from AI infrastructure. Now it seems the company can compete with NVIDIA.

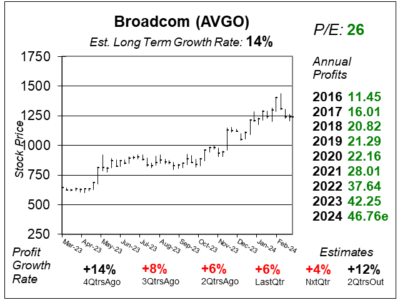

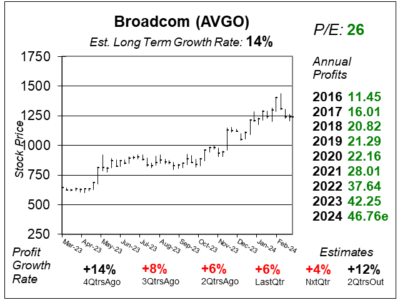

Broadcom (AVGO) is expected to have revenue jump 40% 2024, but profits are estimated to rise just 10% as it integrates VMware.

Broadcom’s (AVGO) would have had flattish year-over-year revenue growth last quarter if it were not for sales for generative AI.

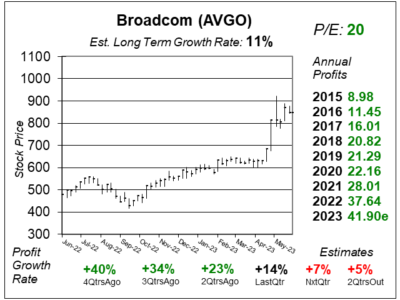

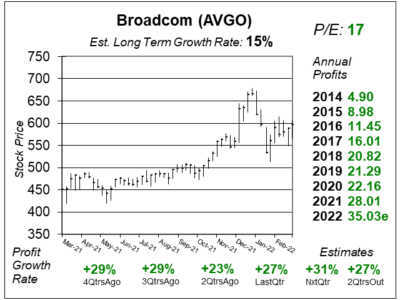

Broadcom Inc (AVGO) enjoyed a near-vertical rally to its all-time highs after it anounced an agreement with Apple to produce 5G chips.

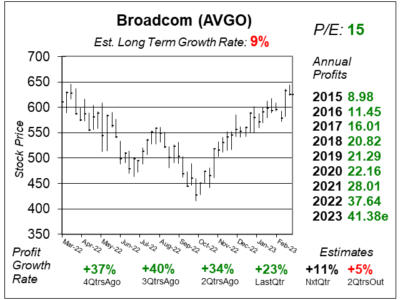

Broadcom (AVG) is seeing urgency and excitement for its AI switching and routing hardware used in data-intensive workloads.

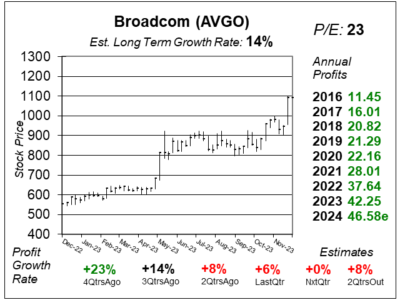

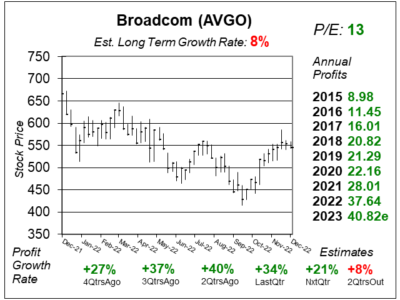

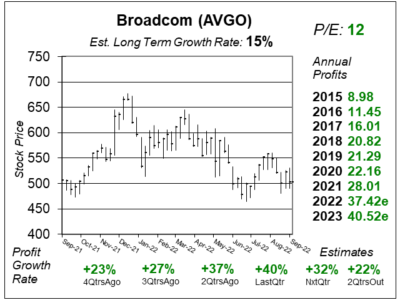

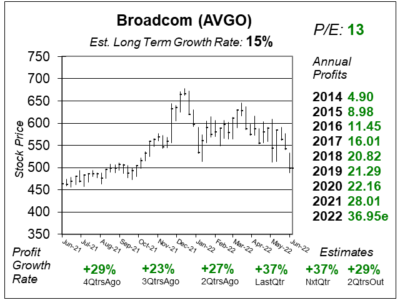

Broadcom (AVGO) is one tech stock that continues to deliver good results. And with a P/E of 13, this stock has good upside.

This Bear Market has given investors lots of stocks that are values. Broadcom (AVGO) seems to be one of the best deals out there.

Broadcom (AVGO) is expected to acquire VMware, which will increase the company’s software revenue from 1/4 of total sales to 1/2.

Broadcom (AVG) is a semiconductor company, an electronic device manufacturer, and a cybersecurity stock wrapped in one.

Broadcom (AVGO) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $10.73 vs. $10.32 = +4%

Revenue Est: +38%