b

Stock (Symbol) |

Broadcom (AVGO) |

Stock Price |

$1238 |

Sector |

| Technology |

Data is as of |

| March 19, 2024 |

Expected to Report |

| June 6 |

Company Description |

Broadcom designs, develops and supplies a range of semiconductor and infrastructure software solutions. Broadcom designs, develops and supplies a range of semiconductor and infrastructure software solutions.

It operates through two segments: semiconductor solutions and infrastructure software. Its semiconductor solutions segment includes semiconductor solution product lines, as well as its Internet protocol (IP) licensing. It provides semiconductor solutions for managing the movement of data in data center, telecom, enterprise and embedded networking applications. It also provides a variety of radio frequency (RF) semiconductor devices, wireless connectivity solutions and custom touch controllers for the wireless market. Its infrastructure software segment includes its mainframe, distributed and cyber security solutions, and its fiber channel storage area networking (FC SAN) business. Its mainframe software provides DevOps, AIOps, Security and Data Management Systems solutions. Source: Refinitiv |

Sharek’s Take |

Broadcom’s (AVGO) alternative AI interface could become stiff competition to NVIDIA. Last month, AVGO hosted an Enabling AI Infrastructure Investor Meeting. I was blown away a the info the company delivered. Broadcom’s method for building AI infrastructure is different, as its building a general product that fits everyone’s needs, with hardware from different manufacturers used in the datacenter. There is essentially a network inside an AI server, with 8 to 12 XPUs, ethernet devices, CPUs, and solid state hard drives. Much of this is manufactured by Broadcom already. And the company feels it can make AI networks that are designed specifically for the customer that require less energy. Instead of using GPUs for AI, Broadcom utilizes application-specific intregrated circuits, or ASICs, that use less energy. In addition, Broadcom refers to AI accelerators as XPUs instead of NVIDIA’s GPUs. Aspects os an XPU include compute (optimizing flow), memory (the correct size, cooling, testing), and input/output (chiplets that match precision and ratio for workloads), and packaging (coded software to run like a machine). Broadcom is getting a lot of revenue from AI buildouts as well. Last quarter, in semiconductors, AI revenue quadrupled year-over-year. Broadcom is a semiconductor and software company that designs thousands of products for home connectivity, cloud data centers, and enterprise businesses. It is a conglomerate that was formed over 50 years of mergers and acquisitions including old-school tech companies AT&T/Bell Labs, Lucent, Hewlett-Packard and its semiconductor division, and younger industry leaders (including Broadcom, LSI, Broadcom Corporation, Brocade, CA Technologies and Symantec). The majority of AVGO’s silicon wafer manufacturing operations are designed in North America or Europe, then outsourced by the company to external foundries in Asia, such as Taiwan Semiconductor. AVGO has two business segments:

The great thing about AVGO stock is the company is making good profits and the stock is reasonable with a P/E of 26. The Estimated Long-Term-Growth (LTG) Rate is 14%. AVGO also pays a nice dividend of 2%. Management even buys back stock. The company buys back stock and has a dividend policy of pacing 50% of the prior-year’s free cash flow to investors. In late 2023 management increased the dividend 4% to a targeted $21 for Fiscal 2024, the 13th consecutive year of increases. AVGO is part of the Growth Portfolio. |

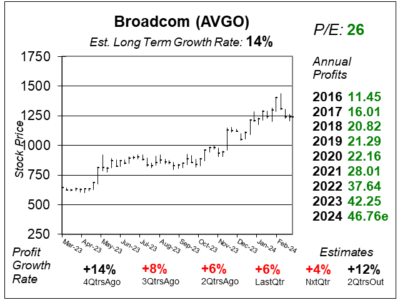

One Year Chart |

This stock continues to push higher. Just a steady climb, even as profit growht has slowed. Note these charts were dont on 3/19 when the stock was $1238. Today, 4/3, the shares are $1371. This stock continues to push higher. Just a steady climb, even as profit growht has slowed. Note these charts were dont on 3/19 when the stock was $1238. Today, 4/3, the shares are $1371.

Notice profits have been up every year going back to 2015. The Est. LTG is 14%. The P/E of 26 is good. I think the P/E should be 30. Note qtrly profit grow hht is expected to accelerate two quarters from now. |

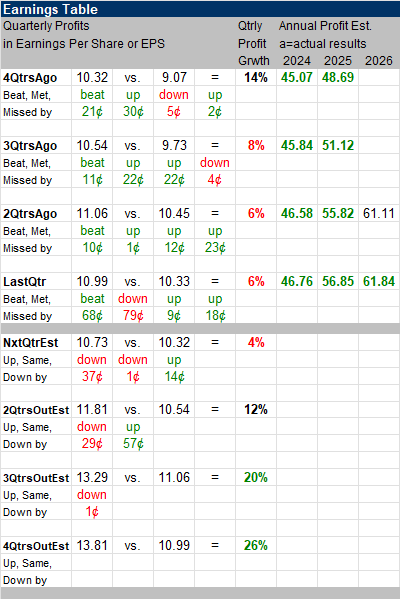

Earnings Table |

Last qtr, Broadcom Inc. posted 6% profit growth and beat expectations of 0% growth. Revenue increased 34% from a year ago beat the analysts expectation of 31%. But this was helped by the acquisition of Vmware. Excluding VMware, revenue rose 11%. Excluding the contribution from VMware. In terms of segments: Last qtr, Broadcom Inc. posted 6% profit growth and beat expectations of 0% growth. Revenue increased 34% from a year ago beat the analysts expectation of 31%. But this was helped by the acquisition of Vmware. Excluding VMware, revenue rose 11%. Excluding the contribution from VMware. In terms of segments:

Growth was driven by Infrastructure Software segment with +153% growth, which includes VMware. In semiconductor segment, growth was mainly driven by network revenue which grew 46% driven by strong demand from custom AI accelerators at AVGO’s two hyperscale customers. This strength extends beyond AI accelerators as Tomahawk 5 800G switches, Thor 2 Ethernet NICs refinements, DSPs and optical components are experiencing strong demand. Annual Profit Estimates slightly increased this qtr. For 2024 outlook, AVGO reiterate guidance for consolidated revenue to be $50 billion, which represents 40% year-on-year growth. Qtrly Profit Estimates for the next 4 qtrs are 4%, 12%, 20%, and 26%. For next qtr, analysts expect revenue to grow 38% due to VMware’s strong performance. The company is seeing cyclical weakness in broadband and server storage, but AI is making up for that. |

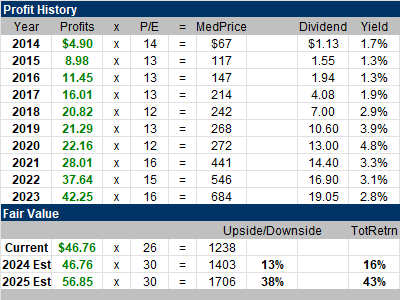

Fair Value |

AVGO stock has been undervalued for a decade now. I bought it for clients in March 2022 around $600 when the P/E was 17. AVGO stock has been undervalued for a decade now. I bought it for clients in March 2022 around $600 when the P/E was 17.

My Fair Value P/E for this stock is 30. And the stock has a 26 P/E right now. I think the shares are worth $1403 this year and $1706 in 2025. |

Bottom Line |

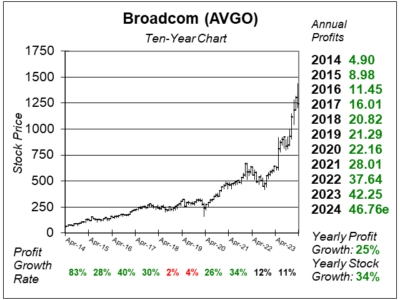

Broadcom (AVGO) has a great looking ten-year chart. But the recent success made the shares go parabolic. The stock needs to to build a healthy base. Broadcom (AVGO) has a great looking ten-year chart. But the recent success made the shares go parabolic. The stock needs to to build a healthy base.

I’m taken back by the ammount of AI info the company gave investors at its AI Infrastructure Investor Meeting. Companies are buying into this strategy. AVGO moves from 25th to 18th in the Growth Portfolio Power Rankings. The stock will be put on the radar for the Aggressive Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

18 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |