The stock market dropped on Thursday, as investors awaited key jobs data to be released tomorrow. This could determine the Federal Reserve’s next move for interest rates.

The stock market dropped on Thursday, as investors awaited key jobs data to be released tomorrow. This could determine the Federal Reserve’s next move for interest rates.

For the week ending September 30, weekly initial jobless claims was at 207,000. This was lower than economists’ forecast of 210,000, but was higher by 2,000 than the prior week’s data.

Overall, S&P 500 and NASDAQ fell 0.1% to 4,258 and 13,220, respectively.

According to David Sharek, Founder of School of Hard Stocks, the stock market is in no man’s land right now. It could go higher if we get a big up day to trigger it, or it could go lower if we get a selloff.

Tweet of the Day

The US Treasury yield curve is de-inverting very rapidly. Was at -108 bp a few months ago. Now at -35 bp. Should put everyone on recession warning, not just recession watch. If the unemployment rate ticks up just a couple of tenths it will be recession alert. Buckle up.

— Jeffrey Gundlach (@TruthGundlach) October 4, 2023

Chart of the Day

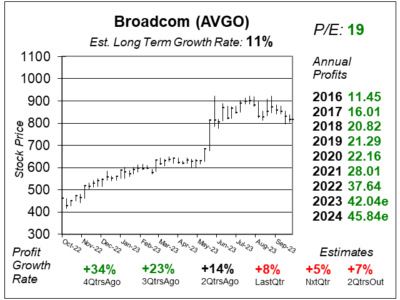

Here is the one-year chart of Broadcom (AVGO) as of September 27, 2023, when the stock was at $817.

Here is the one-year chart of Broadcom (AVGO) as of September 27, 2023, when the stock was at $817.

Broadcom is a semiconductor and software company that designs thousands of products for home connectivity, cloud data centers, and enterprise businesses. The majority of its silicon wafer manufacturing operations are designed in North America or Europe, then outsourced by the company to external foundries in Asia, such as Taiwan Semiconductor.

Broadcom relied on AI for revenue growth last quarter as the company goes through a soft landing. Management had indicated in the previous year that the company would go through a soft landing for fiscal 2023, which is now materializing. Earlier in 2023, quarterly revenues from semiconductor solutions were around $6 billion a quarter. Then last quarter, revenues from this segment grew to $6.9 billion due to AI investments for generative AI from hyperscalers. Overall, profit grew 8% last quarter, while revenue was up 5%. Such were both lower sequentially compared to previous quarters.

In the past four quarters, profit has been decelerating from +34% to +23%, +14%, and now +8%. Meanwhile, revenue growth has been dropping from +21% to +16%, +8%, and now +5%.

AVGO is part of the Growth Portfolio and the Aggressive Growth Portfolio.