Stock (Symbol) |

Broadcom (AVGO) |

Stock Price |

$848 |

Sector |

| Technology |

Data is as of |

| June 21, 2023 |

Expected to Report |

| August 30 |

Company Description |

Broadcom designs, develops and supplies a range of semiconductor and infrastructure software solutions. Broadcom designs, develops and supplies a range of semiconductor and infrastructure software solutions.

It operates through two segments: semiconductor solutions and infrastructure software. Its semiconductor solutions segment includes semiconductor solution product lines, as well as its Internet protocol (IP) licensing. It provides semiconductor solutions for managing the movement of data in data center, telecom, enterprise and embedded networking applications. It also provides a variety of radio frequency (RF) semiconductor devices, wireless connectivity solutions and custom touch controllers for the wireless market. Its infrastructure software segment includes its mainframe, distributed and cyber security solutions, and its fiber channel storage area networking (FC SAN) business. Its mainframe software provides DevOps, AIOps, Security and Data Management Systems solutions. Source: Refinitiv |

Sharek’s Take |

Broadcom (AVGO) is finally getting recognized as a top-tier growth stock. The company grows profits around 20% a year and management pays a big-fat dividend, meanwhile this stock has been getting overlooked by investors. The stock used to have a P/E on the teens as people thought their offerings were “too basic”. Now things have changed. On May 23, Apple announced a deal with Broadcom to produce 5G chips, which started a vertical rally after the partnership was announced. The stock has since jumped from $625 to $848 since last quarter, and the P/E has expanded from 15 to 20. Generative AI is around 15% of Broadcom’s semiconductor business, up from just 0% in 2022. Management believes it could become over 25% of its semiconductor revenue in 2024. Broadcom is a semiconductor and software company that designs thousands of products for home connectivity, cloud data centers, and enterprise businesses. It is a conglomerate that was formed over 50 years of mergers and acquisitions including old-school tech companies AT&T/Bell Labs, Lucent, Hewlett-Packard and its semiconductor division, and younger industry leaders (including Broadcom, LSI, Broadcom Corporation, Brocade, CA Technologies and Symantec). The majority of AVGO’s silicon wafer manufacturing operations are designed in North America or Europe, then outsourced by the company to external foundries in Asia, such as Taiwan Semiconductor. AVGO has two business segments:

The great thing about AVGO stock is the company is making good profits and the stock is reasonable with a P/E of 20. But Broadcom is seen as “low tech” by investors, thus the stock had a low valuation. The Estimated Long-Term-Growth (LTG) Rate is 11%, but I think this is more of a 15% grower. AVGO also pays a big-fat dividend of greater than 3%. Management even buys back stock. The company has a dividend policy of pacing 50% of the prior-year’s free cash flow to investors. From 2013-2023, the dividend paid per year jumped from $0.80 to $18.40. In Fiscal 2022, management returned $15.5 billion capital to shareholders in the form of $7 billion in cash dividends and $8.5 billion in stock repurchases. AVGO is a top holding in the Growth Portfolio and Aggressive Growth Portfolio. |

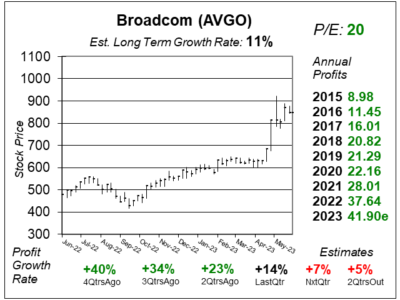

One Year Chart |

The stock’s near-vertical rally started when Broadcom and Apple announced a deal to develop 5G radio-frequency components and wireless connectivity components on May 23. Within the following three days, the stock went from $687 to $813. But some of that gain was from NVIDIA delivering blockbuster AI chip demand. Profit growth has been solid the past year, but is expected to slow in the coming two qtrs. Notice profits have been up every year going back to 2015. The Est. LTG is 11%. AVGO used to have an Est. LTG of 15% a year. The P/E of 20 is great. This stock is such a good value! |

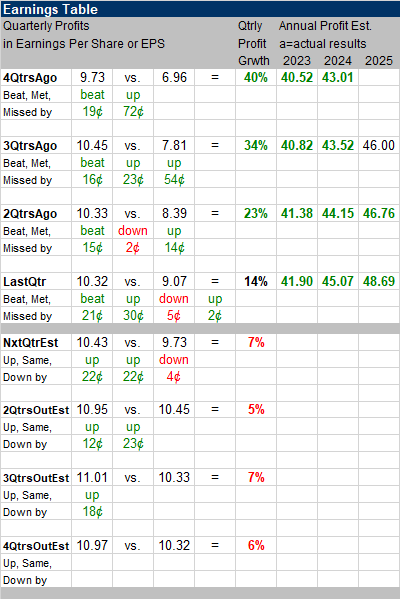

Earnings Table |

Last qtr, Broadcom Inc. posted 14% profit growth and beat expectations of 11% growth. Revenue increased 8%, year-over-year, against expectations of 7%. Growth was driven by demand for next-generation technologies from hyperscale companies, offset by the softness in the Brocade business. Management also expects AI to take up a great role in its semiconductor segment in the coming years. Revenue from AI currently represents around 15% of the semiconductor business. This figure was only 10% last year and is projected to grow to 25% by next year. Annual Profit Estimates are up again this qtr. Qtrly Profit Estimates for the next 4 qtrs are 7%, 5%, 7%, and 6%. For next qtr, management expects revenue to grow 5%, the lowest since 2020. Analysts expect AVGO revenue to grow 5%. |

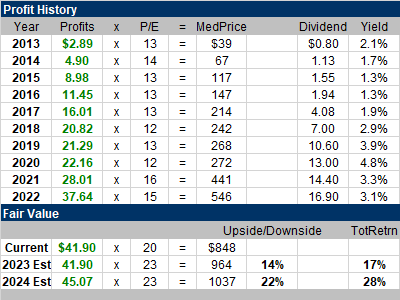

Fair Value |

My Fair Value P/E for this stock is 23, up from 18 last quarter. The stock has a 14% upside to my 2023 Fair Value of $964.

|

Bottom Line |

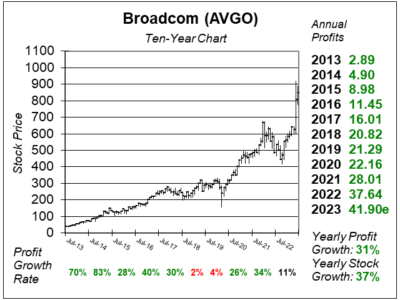

Broadcom (AVGO) has a beautiful ten-year chart. But now the stock seems extended in the chart. Broadcom (AVGO) has a beautiful ten-year chart. But now the stock seems extended in the chart.

Broadcom’s deal with Apple could be very fruitful in the coming years. And with a P/E of 20 the stock is a real value. But the shares have spiked higher during the past six weeks, so I think it needs to settle down and build a base before I add to my position. AVGO ranks 8th in the Growth Portfolio Power Rankings. The stock stays at 9th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

8 of 29Aggressive Growth Portfolio 9 of 19Conservative Stock Portfolio N/A |