Advance Micro Devices (AMD) is Seeing Strong Demand for its AI Processors

AMD (AMD) is seeing strong demand for its new AI infrastructure from big enterprises including Meta, Amazon and Microsoft.

AMD (AMD) is seeing strong demand for its new AI infrastructure from big enterprises including Meta, Amazon and Microsoft.

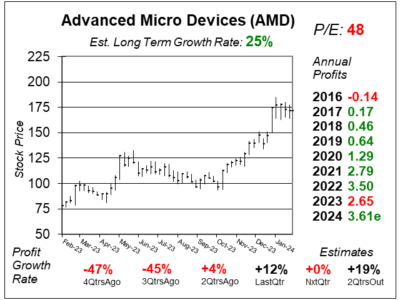

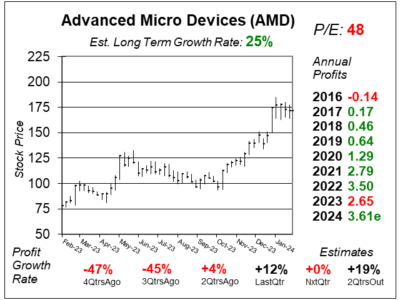

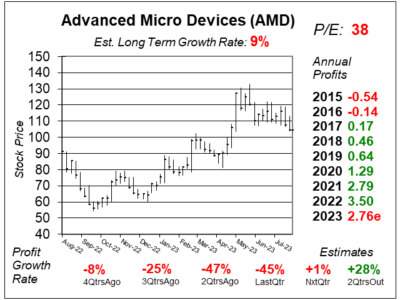

Shares of AMD (AMD) broke out after the company introduces its MI300 line of AI chipsets. But now shares of NVIDIA look better.

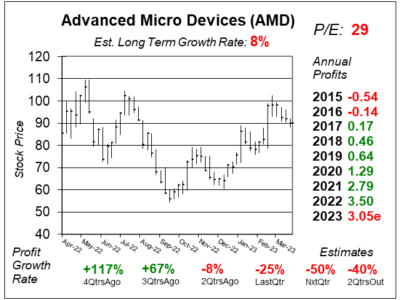

Advanced Micro Devices (AMD) is getting into AI with the upcoming release of the MI300 chipsets to compete against NVIDIA’s H100.

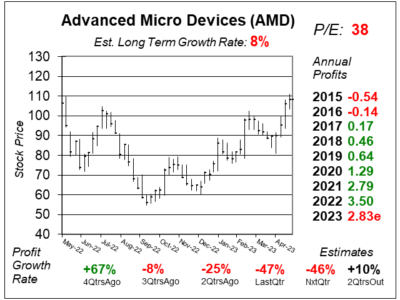

Advanced Micro Devices (AMD) isn’t nearly as pricey as NVIDIA’s stock is. But is AMD on NVIDIA’s level when it comes to AI?

AMD (AMD) is seeing strong demand from big Dacacenter customers, with weakness in PCs and big Enterprise customers.

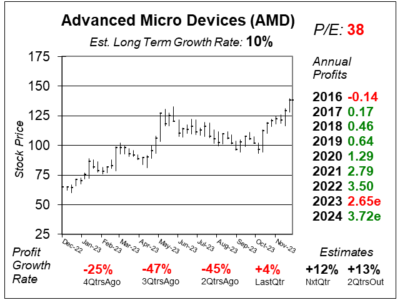

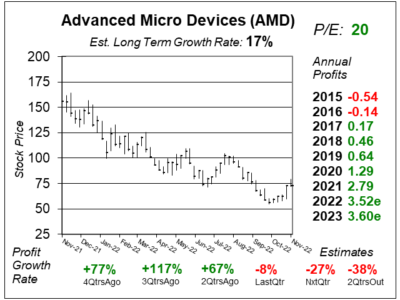

With a P/E of only 20, Advanced Micro Devices (AND) seems like a bargain with huge upside. Here’s why it could go lower.

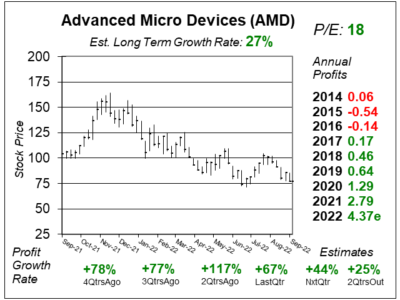

Advanced Micro Devices (AMD) stock seems like a great value now with a P/E of 18. But the chart suggests the stock could go lower.

Advanced Micro Devices (AMD) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $0.60 vs. $0.60 = +0%

Revenue Est: +1%