UnitedHealth (UNH) Experiencing Higher Expenses as Seniors Opt For Procedures

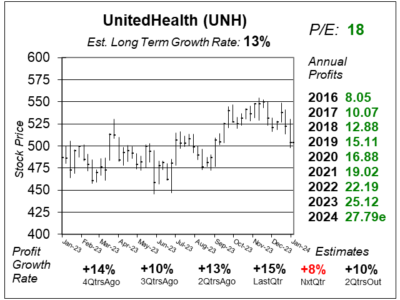

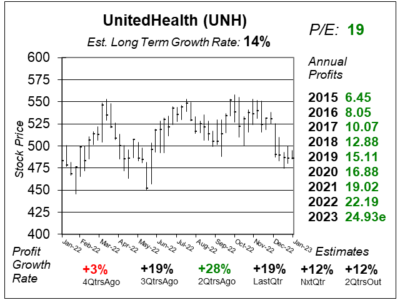

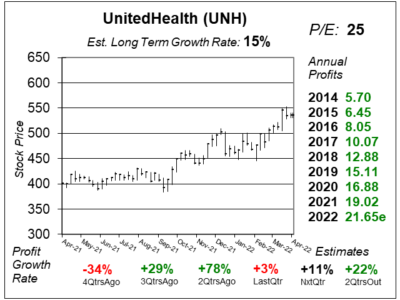

UnitedHealth (UNH) is experiencing higher costs due to Medicare Advantage. But the stock is still delivering profits like usual.

UnitedHealth (UNH) is experiencing higher costs due to Medicare Advantage. But the stock is still delivering profits like usual.

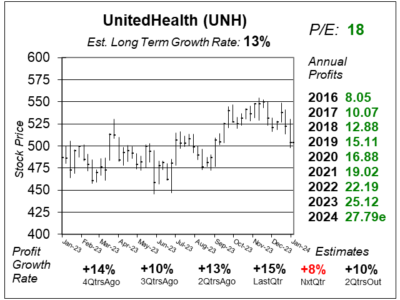

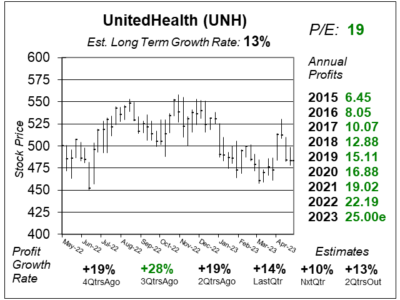

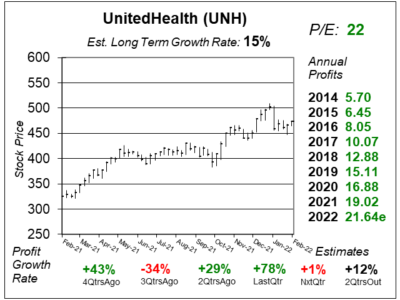

UnitedHealth (UNH) delivered a healthy qtr as profit grew 13% while sales grew 14%, helping the stock to keep its upward momentum.

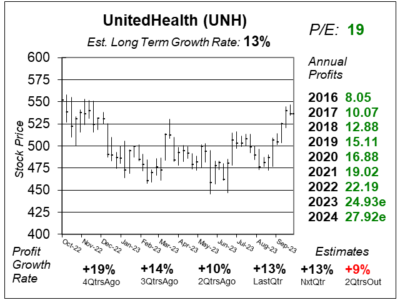

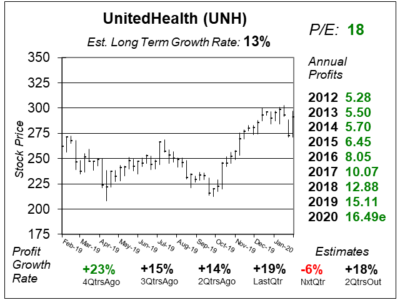

UnitedHealth (UNH) stock jumped after earnings as news was the company upped profit estimates. But we think estimates declined.

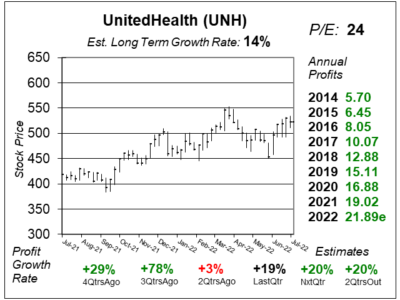

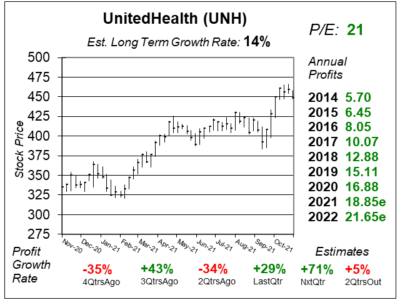

UnitedHealth (UNH) is making an effort to get more lower-margin government business. And profits are down a bit do to this.

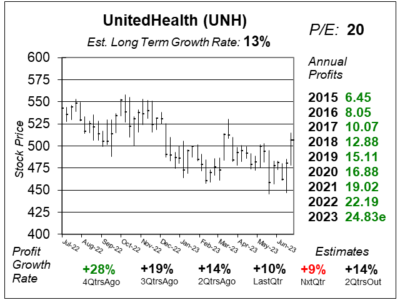

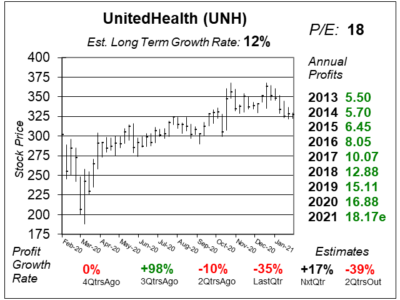

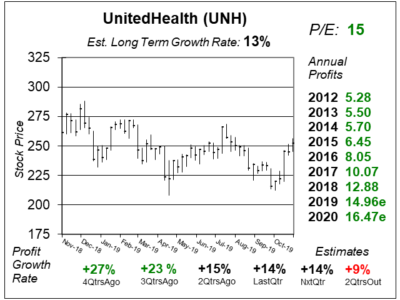

UnitedHealth (UNH) stock has been a laggard this year as investors move their money from value stocks into growth stocks.

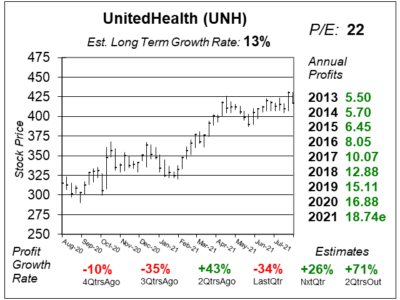

UnitedHealth (UNH) is like a machine as it grows consistently in the double-digits (+10% or more). And now the stock’s on sale.

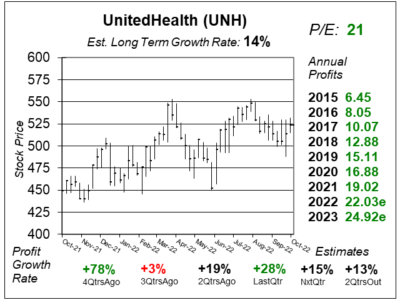

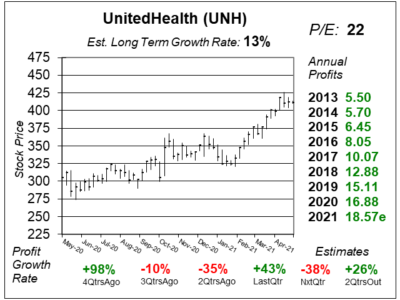

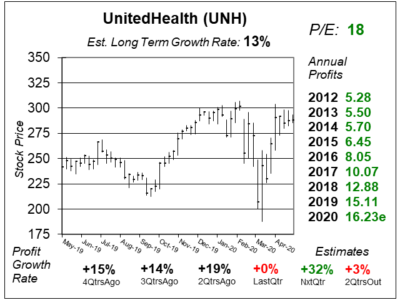

UnitedHealth (UNH) grew profits a solid 19% last qtr as lower COVID-costs helped the medical care ratio fall from 82.8% to 81.5%.

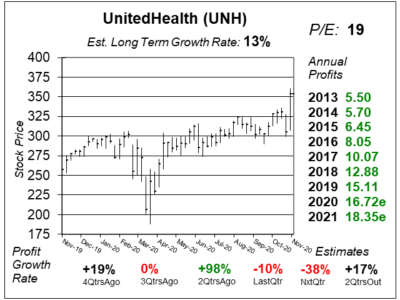

UnitedHealth (UNH) has been a perfect stock during this Bear Market. But after the recent rise in the shares, they seem fairly priced.

The company is a safe ship in this shaky market, as it is a steady grower, offers a share buyback program and pays dividends

If investors are looking for safety, growth and profitability in a highly volatile market, United Health represents a solid combination of that.

Last qtr, UnitedHealth (UNH) experienced lower profits from the health insurance division, but profits grew in preventative care.

UnitedHealth (UNH) is trying to get its own telemedicine company, Change Healthcare, which should reduce expenses.

UnitedHealth (UNH) can improve profits in the upcoming years as it improves its telemedicine capabilities.

Republican’s holding control in the Senate mean no Medicare-for-All, and that’s good news for UnitedHealth (UNH).

I will sell some UnitedHealth (UNH) today to make room for new up-and-coming companies that are making waves.

UnitedHealth (UNH) upped profit estimates for this qtr — during the Coronavirus. Now analysts expect 32% profit growth.

Democrats can’t count votes in Iowa. How could they run Healthcare for America? You know who could? UnitedHealth (UNH).

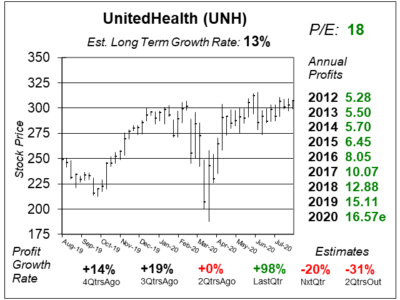

UnitedHealth (UNH) could go from $250 to $350 by 2021 if Donald Trump is reelected President a year from now.

UnitedHealth (UNH) is under political pressure to cut healthcare costs. UNH’s answer is Optum, which keeps people healthy.

Political pressure from politicians is hurting UnitedHealth (UNH). But I’m more concerned about expectations of slowing growth.

UnitedHealth (UNH) is a rare quadruple-play as its a safe stock with double-digit profit growth, a dividend, and a stock buyback plan.

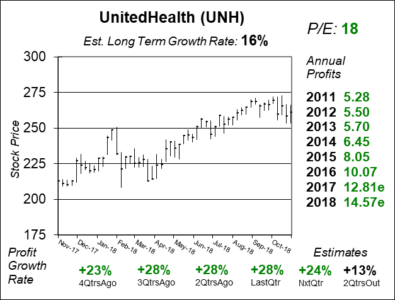

The nation’s largest health insurer, UnitedHealth (UNH) is looking good for 2019 as profits are expected to expand 14% for the year.

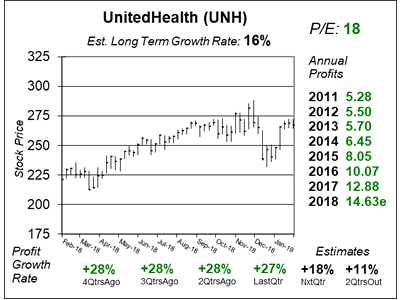

UnitedHealth (UNH) continues to deliver solid results with 28% profit growth last qtr, and the stock reaches yet another All-Time high.

UnitedHealth (UNH) has beaten the street, upped estimates, and delivered at least 23% profit growth the last 7 qtrs. And along the way the stock has continued to shine.

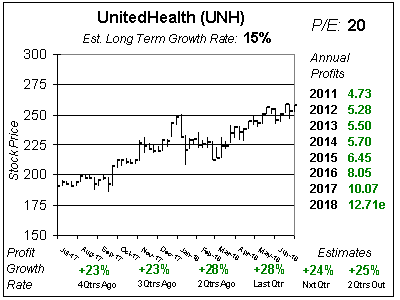

To me it looks like UnitedHealth’s (UNH) 2018 profit estimates received a 16% boost from an expected lower tax rate in 2018. That could give the stock fuel to move higher.

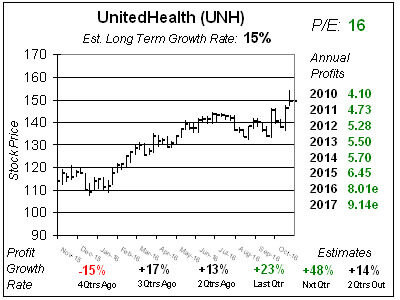

UnitedHealth’s (UNH) momentum continued to roll last qtr as the nation’s largest health insurer delivered 23% profit growth. Here’s my outlook for 2018.

UnitedHealth (UNH) is like a machine. Keeps medical costs well managed, grows membership, gets rid of money-losing things like Obabacare. And grows profits.

UnitedHealth (UNH) has a lot going for it: strong profit growth, beating estimates, upping future estimates, low P/E, nice yield, safe stock, at new highs.

United Health (UNH) is doing fabulously well, and the reason for that is the company keeps ratcheting up profit estimates. Buh-bye Obamacare.

Yesterday I had UnitedHealth (UNH) on my desk about to write that UNH upped earnings estimates, but before I could upped estimates — again.

United Health (UNH), the nation’s largest health insurer, is leaving Obamacare and that will surely help UNH’s profits.

With its high level of safety, and strong profit growth, United Health (UNH) appeals to both growth and value mutual funds.

UnitedHealth (UNH) is expected to have 20% profit growth in 2016 and sells for a reasonable 15x earnings.

UnitedHealth (UNH) is taking a breather and this is a good time for conservative investors to collect the stock.

United Health (UNH) is up around 50% during the past year, and I feel the stock has gotten ahead of itself.