Stock (Symbol) |

UnitedHealth (UNH) |

Stock Price |

$536 |

Sector |

| Healthcare |

Data is as of |

| October 18, 2023 |

Expected to Report |

| January 11 |

Company Description |

UnitedHealth Group Incorporated is a diversified health care company that operates Optum and UnitedHealthcare platforms. UnitedHealth Group Incorporated is a diversified health care company that operates Optum and UnitedHealthcare platforms.

The Company’s segments include Optum Health, Optum Insight, Optum Rx and UnitedHealthcare. Optum Health provides health and wellness care, addressing the physical, emotional and health-related financial needs. Optum Health, through its national health care delivery platform, engages people in care settings, including clinical sites, in-home and virtual. Optum Insight serves the needs of health systems, such as physicians and hospital systems, health plans, state governments and life sciences companies. Optum Rx provides a range of pharmacy care services through retail pharmacies, specialty and community health pharmacies and provides in-home and community-based infusion services. UnitedHealthcare segment includes UnitedHealthcare Employer & Individual, UnitedHealthcare Medicare & Retirement, UnitedHealthcare Community & State and UnitedHealthcare Global. Source: Refinitiv |

Sharek’s Take |

UnitedHealth (UNH) delivered a healthy qtr as profit grew 13% on 14% revenue growth. These results allow UNH to keep its momentum as the stock has been on an uptrend since mid-July. Profit continues to decelerate though. It was 19% 4QtrsAgo, 14% 3QtrsAgo, 10% 2QtrsAgo, and now it’s 13%. The medical care ratio (MCR), the percentage of premiums used to pay for health claims, also increased to 82.3% from 81.6% a year ago due to continuing outpatient care demand for seniors. This was a positive sign as UNH warned on earnings earlier in the year because people who postponed elective surgeries were now moving forward with them, which caused the company to lower earnings projections. Now I feel more confident with current estimates. UnitedHealth (UNH) delivered a healthy qtr as profit grew 13% on 14% revenue growth. These results allow UNH to keep its momentum as the stock has been on an uptrend since mid-July. Profit continues to decelerate though. It was 19% 4QtrsAgo, 14% 3QtrsAgo, 10% 2QtrsAgo, and now it’s 13%. The medical care ratio (MCR), the percentage of premiums used to pay for health claims, also increased to 82.3% from 81.6% a year ago due to continuing outpatient care demand for seniors. This was a positive sign as UNH warned on earnings earlier in the year because people who postponed elective surgeries were now moving forward with them, which caused the company to lower earnings projections. Now I feel more confident with current estimates.

UnitedHealth, the nation’s leading health insurer, is comprised of two main divisions, UnitedHealthcare and Optum. Between the two divisions, UnitedHealthcare is the larger of the two, but Optum is going to be a catalyst for this company in the coming years as organizations take preventative measures to keep employees healthy. UnitedHealthcare, which is responsible for the provision of health insurance, is the larger division, while Optum aims to take preventive measures to improve a people’s health. Here’s more on UNH operating segments:

UnitedHealth is a quality conservative stock, with a double-digit growth rate, a dividend, and a stock buyback program. Analysts give the stock an Est. LTG of 13% per year, and the dividend yield is over 1%, thus the total estimated annual return is 14% per year (hypothetically). Management has a long-term 13% to 16% earnings growth objective. In 2022, management returned $13 billion to shareholders via share repurchases and dividends. UNH is part of the Conservative Growth Portfolio. |

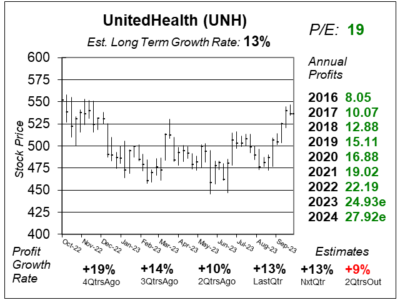

One Year Chart |

Two qtrs ago, the stock came down after news about the company’s high medical care ratio. Thn last quarter, investors were happy with the results and sent the shares higher. This quarter the shares went even higher, and now the stock has formed a cup. Two qtrs ago, the stock came down after news about the company’s high medical care ratio. Thn last quarter, investors were happy with the results and sent the shares higher. This quarter the shares went even higher, and now the stock has formed a cup.

The Est. LTG is 13%, same as last quarter. Notice profits also grew 13% last qtr. The P/E is 19, down from 20 last quarter. Note, since we are now in the company’s Fiscal Q4, I’m using 2024 profit estimates to calculate the P/E ratio in this chart. |

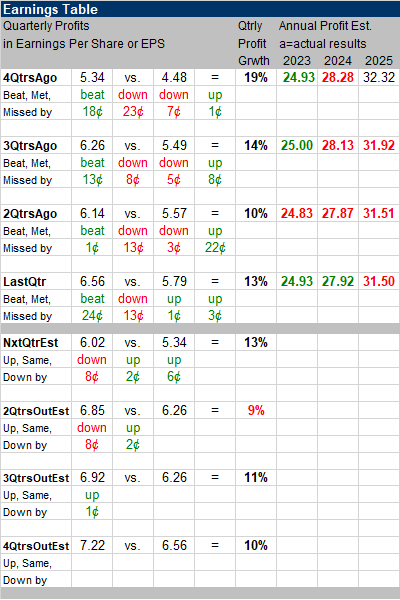

Earnings Table |

Last qtr, UnitedHealth posted 13% profit growth and beat expectations of 9% growth. Revenue grew 14% and beat analyst estimates of 13%. UnitedHealthcare revenue increased 13% while Optum revenue grew 22%. Last qtr was fiscal Q3 for UNH, which is historically the quarter with the least care activity as people seek medical care less during the Summer season. Last qtr, UnitedHealth posted 13% profit growth and beat expectations of 9% growth. Revenue grew 14% and beat analyst estimates of 13%. UnitedHealthcare revenue increased 13% while Optum revenue grew 22%. Last qtr was fiscal Q3 for UNH, which is historically the quarter with the least care activity as people seek medical care less during the Summer season.

Revenue growth was attributed to the growth in the number of people served by UnitedHealthcare and Optum, as well as the company’s expanding scope of services. Care activity trends are led by outpatient care for seniors, particularly in the orthopedic and cardiac procedure categories. Annual Profit Estimates are up for 2023 and 2024. Management also expects the medical care ratio to fall towards around 82.6%, plus/minus 50 basis points. Qtrly Profit Estimates look good with 13%, 9%, 11%, and 10% profit growth expected the next 4 qtrs. Analysts think revenue will grow 11% next quarter. |

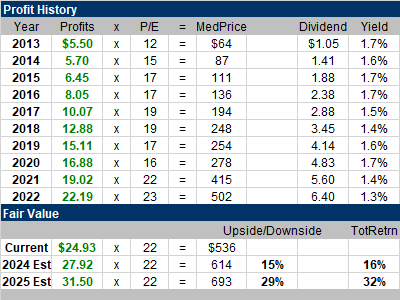

Fair Value |

My Fair Value P/E is 22. The P/E is 19 this quarter. That suggests a 15% upside into 2024. I think that’s fair. This stock has typicaly been a mid-teens grower. My Fair Value P/E is 22. The P/E is 19 this quarter. That suggests a 15% upside into 2024. I think that’s fair. This stock has typicaly been a mid-teens grower. |

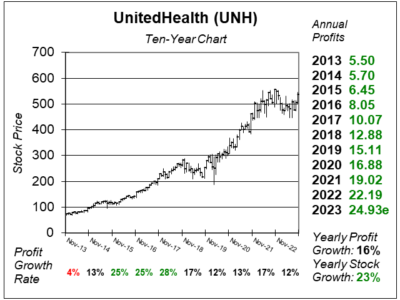

Bottom Line |

UnitedHealth (UNH) is one of the world’s safest stocks. This ten-year chart is almost perfect. Do note, there have been long periods of underperformance prior to this, such as 2005-2013 (when the stock was at or below $60 or so for eight years). UnitedHealth (UNH) is one of the world’s safest stocks. This ten-year chart is almost perfect. Do note, there have been long periods of underperformance prior to this, such as 2005-2013 (when the stock was at or below $60 or so for eight years).

UNH was dealing with higher medical expenses as people were catching up on surgeries. Now that era seems to have passed and profit growth could return to a mid-teens rate next quarter driven by a higher number of customers served and broadening of services offered. UNH ranks 12th in the Conservative Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 12 of 31 |