The stock market ticked higher on Tuesday as investors assess the latest batch of corporate earnings. In addition, forecasts show that the Federal Reserve may cut interest rates much later than previous expected (i.e. March 2024).

The stock market ticked higher on Tuesday as investors assess the latest batch of corporate earnings. In addition, forecasts show that the Federal Reserve may cut interest rates much later than previous expected (i.e. March 2024).

Meanwhile, the 10-year Treasury yield settled lower at 4.09%, from 4.16% on Monday.

Overall, $&P 500 rose 0.2% to 4,954, while NASDAQ was up 0.1% to 15,609.

Tweet of the Day

Foxconn Chairman Young Liu said global AI server makers continue to face a severe shortage of AI chips, and even if supplies improve in the 2nd half of 2024, it won’t keep up with demand, media report, noting Foxconn gets more Nvidia GPUs than others because it is the world’s…

— Dan Nystedt (@dnystedt) February 5, 2024

Chart of the Day

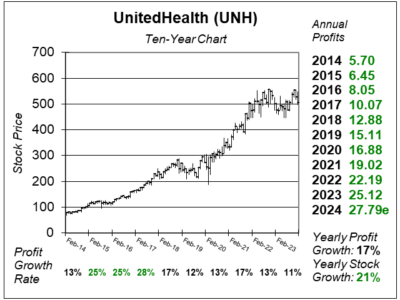

Here is the ten-year chart of UnitedHealth (UNH) as of January 22, 2024, when the stock was at $504.

Here is the ten-year chart of UnitedHealth (UNH) as of January 22, 2024, when the stock was at $504.

UnitedHealth posted strong Q4 results with a 15% profit and revenue growth last quarter, but the health insurer had higher costs due to reduced Medicare Advantage funding. And this Winter, seniors are having more health procedures done. Increased outpatient senior care in orthopedic and cardiac procedures, especially during colder months, drove the medical care ratio (MCR) to rise by 220 basis points to 85.0% from 82.80% a year ago. UnitedHealth just added 100,000 more Medicare Advantage consumers and have a year-end goal of 450,000 to 550,000. But this lower margin business is a concern. Shortly after UNH reported earnings, another health insurer Humana greatly reduced profit guidance for 2024, stating it was an industry wide concern.

UNH is part of the Conservative Growth Portfolio. The stock has good upside this quarter.