About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

UnitedHealth Group Incorporated is a health and well-being company. The Company’s business platforms include UnitedHealthcare and Optum. UnitedHealthcare provides health care benefits to various customers and markets. Optum is a health services business serving the health care marketplace, including payers, care providers, employers, Governments, life sciences companies and consumers. The Company’s business platforms have four segments: UnitedHealthcare, OptumHealth, OptumInsight and OptumRx. OptumHealth is a health and wellness business serving the physical, emotional and financial needs of individuals. OptumInsight provides technology, operational and consulting services to participants in the health care industry. OptumRx is a pharmacy benefit manager. Purchased Catamaran 3/30/15. Source: Thomson Financial

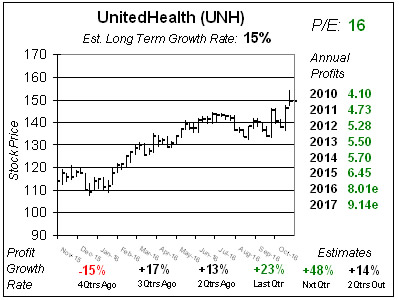

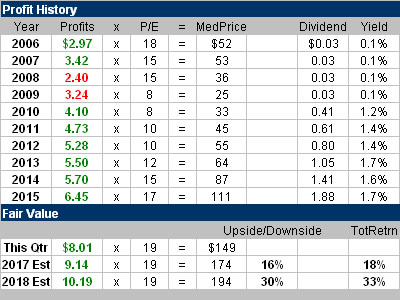

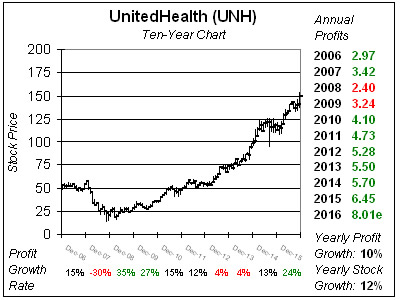

UnitedHealth Group Incorporated is a health and well-being company. The Company’s business platforms include UnitedHealthcare and Optum. UnitedHealthcare provides health care benefits to various customers and markets. Optum is a health services business serving the health care marketplace, including payers, care providers, employers, Governments, life sciences companies and consumers. The Company’s business platforms have four segments: UnitedHealthcare, OptumHealth, OptumInsight and OptumRx. OptumHealth is a health and wellness business serving the physical, emotional and financial needs of individuals. OptumInsight provides technology, operational and consulting services to participants in the health care industry. OptumRx is a pharmacy benefit manager. Purchased Catamaran 3/30/15. Source: Thomson Financial UnitedHealth (UNH) has been a solid stock the past year, benefiting from leaving Obamacare and strong performance from Optum, its health benefits services company. I was about to write about UNH’s strong performance — it was next on my desk — and then the company issued a press release and upped estimates. So basically within one qtr 2017 profit estimates have risen from $9.06 to $9.14 and now $9.30 to $9.60. I lean to the $9.60 because why would you put a range if you didn’t think you could hit the top of that range. With 2016 estimates at $8.01, a profit of $9.60 would be 20% profit growth. And a P/E of 20 would mean a $192 stock. The asking price for UNH after hours is $157 so that equates to 18% upside from here. But you also get three great characteristics with this stock. First, Optum is taking deals from its competition (Caremark) when in the past it typically won deals which were either ties to UnitedHealth healthcare insurance coverage or government ones. Second, leaving Obamacare helps as it was is costing the nation’s largest health insurer around 4% of profits, or $0.35 a share in 2016 profits. Third, this is a very safe stock with clean annual reports. UNH is part of the Dow and has a 2% yield. It also has a plump 15% Est LTG. All-in-all this stock is an excellent selection for most any stock investor.

UnitedHealth (UNH) has been a solid stock the past year, benefiting from leaving Obamacare and strong performance from Optum, its health benefits services company. I was about to write about UNH’s strong performance — it was next on my desk — and then the company issued a press release and upped estimates. So basically within one qtr 2017 profit estimates have risen from $9.06 to $9.14 and now $9.30 to $9.60. I lean to the $9.60 because why would you put a range if you didn’t think you could hit the top of that range. With 2016 estimates at $8.01, a profit of $9.60 would be 20% profit growth. And a P/E of 20 would mean a $192 stock. The asking price for UNH after hours is $157 so that equates to 18% upside from here. But you also get three great characteristics with this stock. First, Optum is taking deals from its competition (Caremark) when in the past it typically won deals which were either ties to UnitedHealth healthcare insurance coverage or government ones. Second, leaving Obamacare helps as it was is costing the nation’s largest health insurer around 4% of profits, or $0.35 a share in 2016 profits. Third, this is a very safe stock with clean annual reports. UNH is part of the Dow and has a 2% yield. It also has a plump 15% Est LTG. All-in-all this stock is an excellent selection for most any stock investor.