The stock market bounced back on Friday as Alphabet (GOOGL) and Microsoft (MSFT) posted positive earnings report. In addition, the Core Personal Consumption Expenditure data for March rose 2.8%, above the 2.7% estimates but was unchanged year-on-year. The latest inflation data showed that price pressures remain sticky.

The stock market bounced back on Friday as Alphabet (GOOGL) and Microsoft (MSFT) posted positive earnings report. In addition, the Core Personal Consumption Expenditure data for March rose 2.8%, above the 2.7% estimates but was unchanged year-on-year. The latest inflation data showed that price pressures remain sticky.

Overall, S&P 500 rose 1.0% to 5,100, while NASDAQ jumped 2.0% to 15,928.

Tweet of the Day

$UNH sharp snapback rally today was one of SPX best performers. Today's rise has helped to regain the prior base which looked to have been violated late last week and is a boost of confidence to suggest a possible false breakdown. Regaining $489 is a minimal first step to think… pic.twitter.com/lXdYtjIPd4

— Mark Newton CMT (@MarkNewtonCMT) April 16, 2024

Chart of the Day

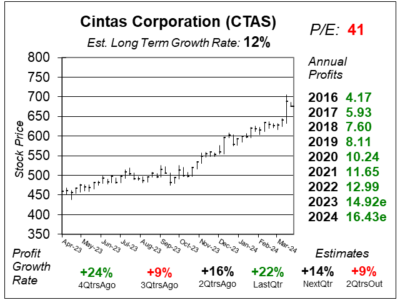

Here is the one-year chart of Cintas Corporation (CTAS) as of April 2, 2024, when the stock was at $676.

Here is the one-year chart of Cintas Corporation (CTAS) as of April 2, 2024, when the stock was at $676.

Cintas Corporation’s stock price jumped after the company reported last quarter’s earnings. Management reported profit growth of 22%, which beat estimates of 14%. In the earnings release, management stated that each of Cintas’ operating segments continue to execute at high levels which led to a robust revenue growth of 10%, high gross margin of 49.4% and increased operating margin of 21.6%. The company benefited from strong volumes, which helped push margins higher and led to greater cost efficiencies. Management raised this year’s profit and revenue outlook. Business is great, and investors know it. Thus, the stock has a very high P/E.

CTAS is on the radar for the Conservative Growth Portfolio. With a P/E of 41, the stock seems to be overvalued at this time.