The stock market slipped on Thursday, as bond yields surged. The benchmark 10-year yield jumped to 4.18%, which is near its highest level since November 2022

The stock market slipped on Thursday, as bond yields surged. The benchmark 10-year yield jumped to 4.18%, which is near its highest level since November 2022

Overall, S&P 500 declined 0.3% to 4,502, while NASDAQ fell 0.1% to 13,960.

Tweet of the Day

$AMZN Incredible case study of how to (a) make the Street to dramatically lower their EPS estimates, then (b) “beating” these. EPS for this quarter fell -19% to 0.34 EPS since January. Meanwhile, stock rose +53%.

Then, a 0.65 EPS beat!

CFO will get a huge bonus. 👏 👏 👏 pic.twitter.com/cmqawLHych

— Wasteland Capital (@ecommerceshares) August 3, 2023

Chart of the Day

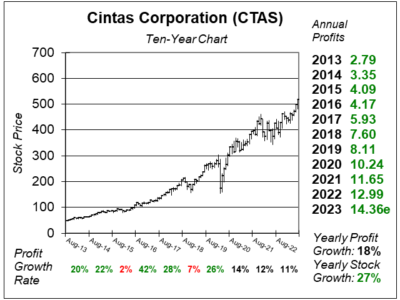

Here is the ten-year chart of Cintas Corporation (CTAS) as of August 4, 2023, when the stock was at $516.

Here is the ten-year chart of Cintas Corporation (CTAS) as of August 4, 2023, when the stock was at $516.

Cintas is the largest uniform supplier in North America, but the company offers so much more to small, medium and large businesses. It has a great system to provide each worker uniforms for two weeks, with one set being used by the employee and the other being laundered.

Cintas is a high quality Blue Chip stock with a dividend, stock buyback program, and a history of growing profits at a double-digit rate. Revenue and profits (EPS) have increased in 50 of the past 52 years, including 39 consecutive years before the Great Recession in 2000.

Cintas continues to deliver solid results, and isn’t feeling any recessionary symptoms on its business. However, David Sharek thinks that a P/E of 36 is high.

CTAS is on the radar for the Conservative Growth Portfolio.