Stock (Symbol) |

Cintas (CTAS) |

Stock Price |

$580 |

Sector |

| Industrials & Energy |

Data is as of |

| January 3, 2024 |

Expected to Report |

| March 27 |

Company Description |

Cintas Corporation develops uniform programs using fabric. Cintas Corporation develops uniform programs using fabric.

The Company helps businesses of all types and sizes, primarily in the United States, as well as Canada and Latin America. Its segments include Uniform Rental and Facility Services, and First Aid and Safety Services. Uniform Rental and Facility Services segment consists of the rental and servicing of uniforms and other garments, including flame-resistant clothing, mats, mops and shop towels and other ancillary items. In addition to these rental items, restroom cleaning services and supplies and the sale of items from its catalogues to its customers on route are included within this segment. First Aid and Safety Services segment consists of first aid and safety products and services. The remainder of its segments, which consists of the Fire Protection Services segment and the Uniform Direct Sale segment, is included in All Other. It provides its products and services to small service and manufacturing companies to corporations. Source: Refinitiv |

Sharek’s Take |

Cintas (CTAS) is a model of certainty and consistency. The company reported solid results last quarter with profits up 16% on 9% revenue growth. In the earnings call, management stated momentum is good and the company is having success cross-selling to existing customers. Profit margins are improving too, due to higher efficiency, even with driving routes. The company’s SmartTruck Technology provides CTAS with key data from their fleet that allows them to refine routing, drive-time, and idle time and helps them to identify opportunities for even greater gains across their business, including lowering fuel consumption. Cintas (CTAS) is a model of certainty and consistency. The company reported solid results last quarter with profits up 16% on 9% revenue growth. In the earnings call, management stated momentum is good and the company is having success cross-selling to existing customers. Profit margins are improving too, due to higher efficiency, even with driving routes. The company’s SmartTruck Technology provides CTAS with key data from their fleet that allows them to refine routing, drive-time, and idle time and helps them to identify opportunities for even greater gains across their business, including lowering fuel consumption.

Cintas is the largest uniform supplier in North America, but the company offers so much more to small, medium, and large businesses. Cintas has a great system which is to provide each worker uniforms for two weeks, with one set being used by the employee and the other being laundered. Once a week a Cintas rep comes to the facility, drops off clean uniforms and picks up dirty ones. Companies have no up-front investment, as Cintas funds the program setup. In addition to uniforms, Cintas provides floor care, restroom supplies, first aid and safety products, fire extinguishers, and safety compliance training. During COVID-19 the company was a big provider of sanitizers and other PPE products. Here are some fun facts about Cintas:

Cintas is made up of the following business segments:

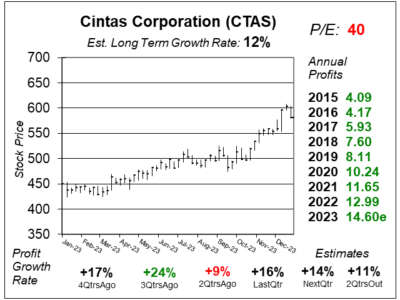

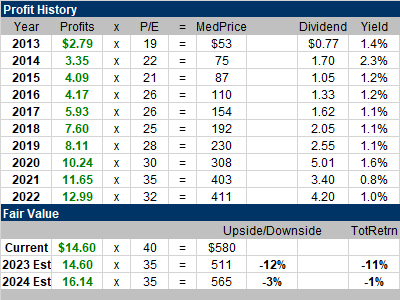

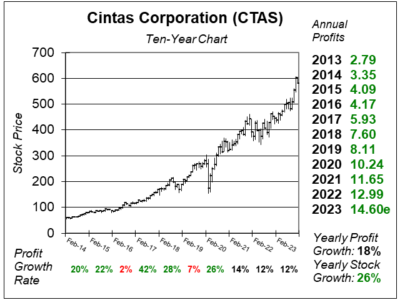

Cintas is a high-quality Blue Chip stock with a dividend, a stock buyback program, and a history of growing profits at a double-digit rate. Revenue and profits (EPS) have increased in 50 of the past 52 years, including 39 consecutive years before the Great Recession (2000). Some of the growth comes from acquisitions of other uniform companies. Analysts gave the stock an Estimated Long-Term Growth Rate of 12%. The stock also yields around 1%. CTAS has raised the dividend ever year since going public, with dividend increases since 1983. CTAS is on the radar for the Conservative Growth Portfolio. With a P/E of 40, the stock seems to be overvalued at this time. |

One Year Chart |

This stock was pushing higher in 2023 even though there was no fundamental change to the company’s business. This stock went up too much last year. This stock was pushing higher in 2023 even though there was no fundamental change to the company’s business. This stock went up too much last year.

The P/E ratio of 40 also seems high. Est. LTG of 12% is where it should be. Qtrly profit growth bounced back to 16% last quarter. |

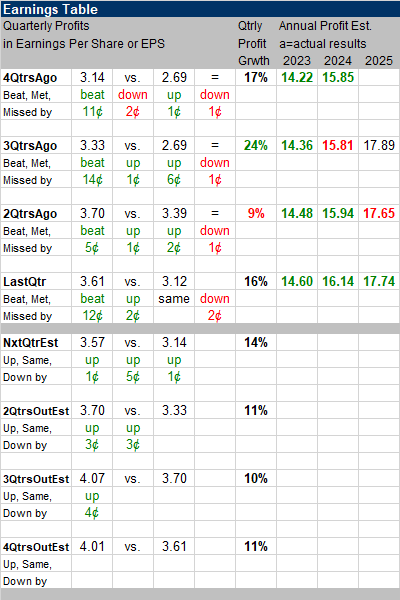

Earnings Table |

In the previous quarter, Cintas Corp. achieved an impressive 16% profit growth surpassing the estimate of 12%. Revenue grew by 9% versus expectations of 8%. Operating margin was 21.0% compared to 20.5% in the year-ago period due in part from lower energy expenses. In the previous quarter, Cintas Corp. achieved an impressive 16% profit growth surpassing the estimate of 12%. Revenue grew by 9% versus expectations of 8%. Operating margin was 21.0% compared to 20.5% in the year-ago period due in part from lower energy expenses.

Revenue growth was driven by new customer acquisitions, successful upselling to the existing clients, and strategic focus on key sectors like healthcare. Opening clean room facilities in North Carolina and Wisconsin expanded CTAS uniform rentals and facility service in pharmaceuticals and biotechnology, contributing to revenue growth last quarter. Annual Profit Estimates are up this qtr. Note CTAS has a Fiscal Year ending on May 31st. Qtrly Profit Estimates are for 14%, 11%, 10%, and 11% profit growth in the next 4 qtrs. Analysts predict Cintas’ revenue will grow 9% this quarter. |

Fair Value |

Before, CTAS often had a P/E ratio around high-20s. Now it’s at 40. That’s kind of expensive. Before, CTAS often had a P/E ratio around high-20s. Now it’s at 40. That’s kind of expensive.

My Fair ue is a P/E of 35. I think the stock is overvalued right now. Also, the company used to pay dividends once per year. In October 2020, the Board of Directors changed the dividend policy to quarterly. |

Bottom Line |

Cintas (CTAS) has been a great stock the past decade, but that hasn’t always been the case. When I look back to the stock since its IPO I see it went public at $1 in 1983, and was in an uptrend until 1998, then went sideways from 1999-2007, declined during the Financial Crisis of 2008/2009, and has been in an uptrend since. Cintas (CTAS) has been a great stock the past decade, but that hasn’t always been the case. When I look back to the stock since its IPO I see it went public at $1 in 1983, and was in an uptrend until 1998, then went sideways from 1999-2007, declined during the Financial Crisis of 2008/2009, and has been in an uptrend since.

Cintas continues to deliver 12%-or-so profit growth. I love this company and want to buy the stock but there’s not much upside at this time. CTAS is on the radar for the Conservative Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |