Cintas (CTAS) is Like a Machine in Pushing Sales, Profits, & Profit Margins Higher

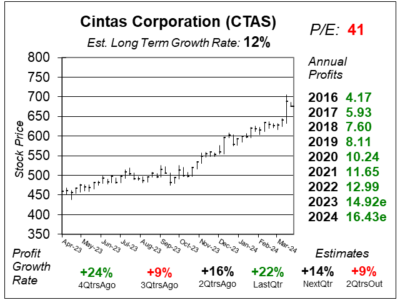

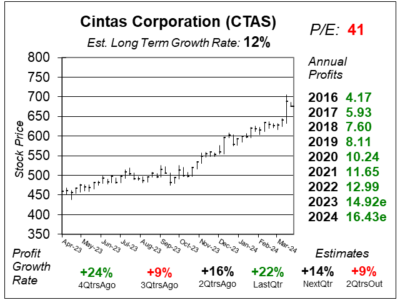

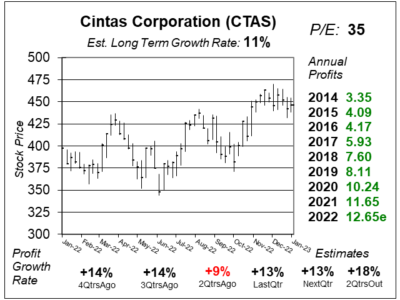

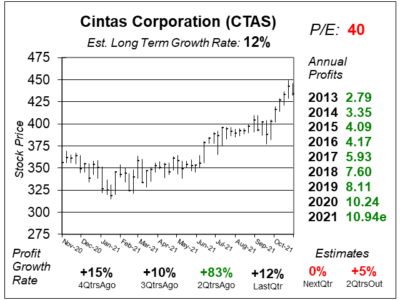

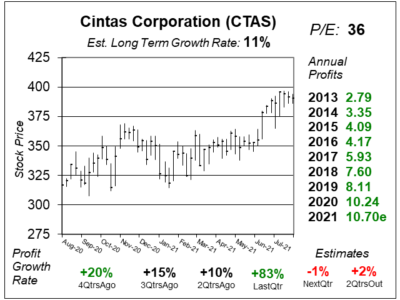

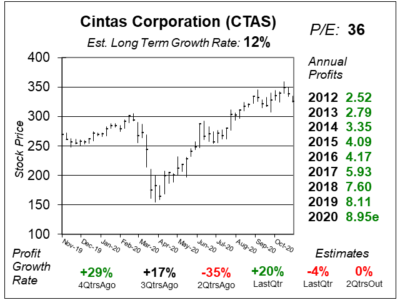

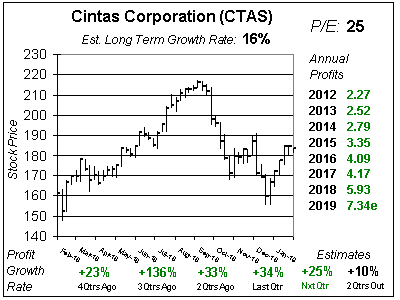

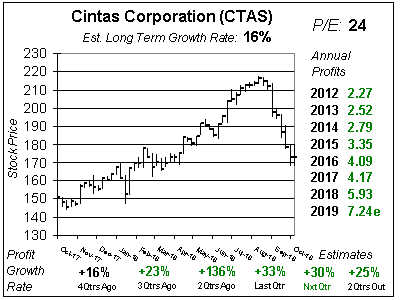

Cintas (CTAS) is like a machine in regards to growing sales, profit margins, and profits. But investors have pushed the stock too high.

Cintas (CTAS) is like a machine in regards to growing sales, profit margins, and profits. But investors have pushed the stock too high.

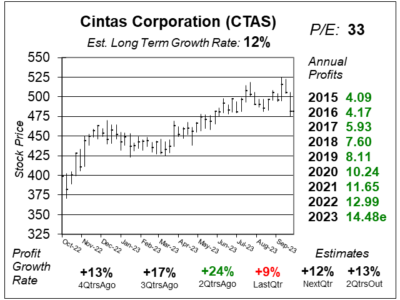

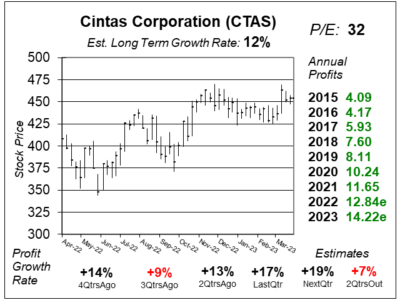

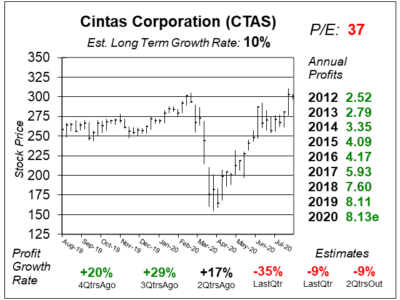

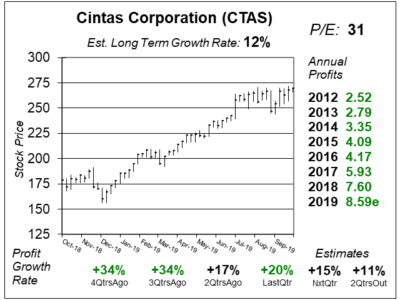

Cintas’ (CTAS) stock continues to grow at a rate it usually does. But with a P/E of 33, this 12%-or-so profit grower seems fairly valued.

I used to consider the uniform company Cintas (CTAS) a 10% to 12% profit grower. The figures CTAS is delivering now are much higher.

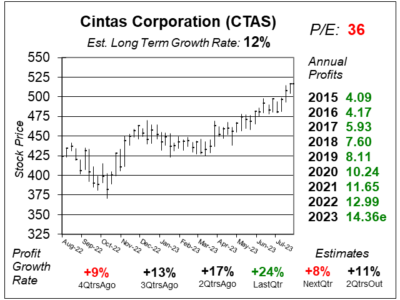

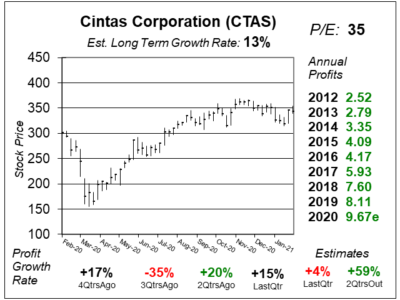

Cintas (CTAS) continues to deliver solid results, with last quarter’s profits up 17%. But the stock may continue to base for a while.

Cintas (CTAS) — the uniform company — has a stock that’s been one of the best during the past decade. Let’s analyze this Blue Chip.

Uniform company Cintas (CTAS) is at the top of my radar of stocks to buy if the market crashes, as it’s has proven to be resilient.

Cintas (CTAS), the uniform company, is a quality Blue Chip stock. But its an 11% grower, and with a 32 P/E the stock isn’t on sale.

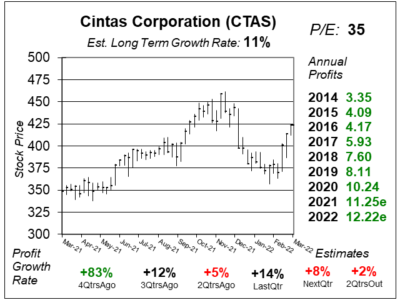

Cinats (CTAS) provides cleaning services to many hotels and restaurants. The company could see robust demand as travel picks up.

I sold Cinats (CTAS) stock around $211 during the height of the COVID-19 crisis. The shares have doubled in price since.

From scrubs to sanitizers, first aid products to PPE, and mops to floor-mats, Cintas (CTAS) is more than a uniform company.

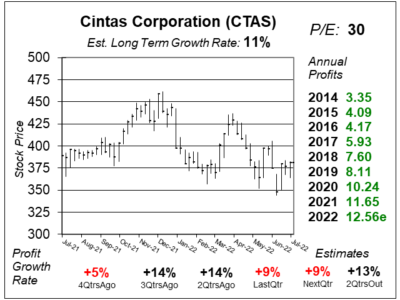

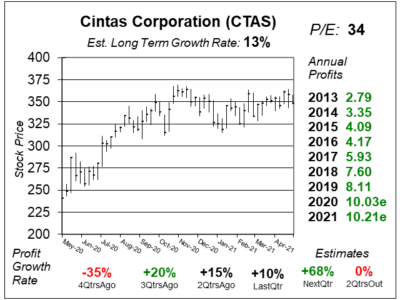

Cintas (CTAS) stock is going sideways as we should see an uptick in uniform rentals, while COVID-19 PPE is expected to decline.

Cintas (CTAS) is expected to see a pickup in demand for its uniform rentals now that the economy is opening up.

Cintas (CTAS) is experiencing strong demand for healthcare scrub cleaning, hand sanitizers, spray disinfectants, and face masks.

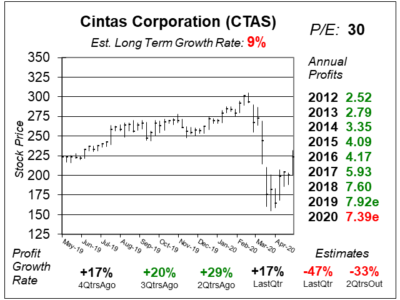

Cintas (CTAS) uniform rental was weak last qtr, but the company did better than expected with scrubs and sanitizer.

Cintas (CTAS), the uniform company, has a lot of uncertainty as hotels and restaurants need less uniform cleaning.

Cintas (CTAS) is a remarkable company that has grown its dividend 36 years, and given investors a ten-bagger in 10 years.

Cintas (CTAS) is still hot with the economy growing and labor force strong. CTAS also boosted profit margins last qtr.

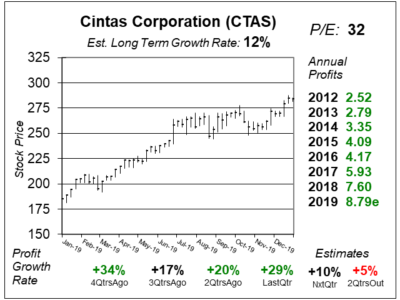

This economy is creating jobs, which means more uniforms from Cintas (CTAS), the largest uniform supplier in North America.

A strong economy is helping Cintas (CTAS) as the unemployment rate is a low 3.6% and work uniforms are in demand.

Cintas (CTAS) has this amazing uniform program where they pay for company uniforms, and the employees get a week’s worth while another set is being cleaned.

Cintas (CTAS) is known for its uniform service, but the stock has been a better one than most investors are aware of.

Cintas Corporation (CTAS) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $3.80 vs. $3.33 = +14%

Revenue Est: +8%