Stock (Symbol) |

Cintas Corporation (CTAS) |

Stock Price |

$434 |

Sector |

| Industrials & Energy |

Data is as of |

| November 11, 2021 |

Expected to Report |

| December 20 |

Company Description |

Cintas Corporation is a provider of corporate identity uniforms through rental and sales programs, as well as a provider of related business services, including entrance mats, restroom cleaning services and supplies, carpet and tile cleaning services, first aid and safety services and fire protection products and services. Its segments include uniform rental and facility services, and first aid and safety services. Its uniform rental and facility service segment offers services, which include rental and servicing of uniforms and other garments, including flame resistant clothing, mats, mops and shop towels, and other ancillary items. Its first aid and safety service segment offers services, which include first aid and safety products and services. Rental processing plants, rental branches, first aid and safety facilities, fire protection facilities, direct sales offices, distribution centers and manufacturing facilities are all utilized by the businesses included in All Other. Source: Thomson Financial Cintas Corporation is a provider of corporate identity uniforms through rental and sales programs, as well as a provider of related business services, including entrance mats, restroom cleaning services and supplies, carpet and tile cleaning services, first aid and safety services and fire protection products and services. Its segments include uniform rental and facility services, and first aid and safety services. Its uniform rental and facility service segment offers services, which include rental and servicing of uniforms and other garments, including flame resistant clothing, mats, mops and shop towels, and other ancillary items. Its first aid and safety service segment offers services, which include first aid and safety products and services. Rental processing plants, rental branches, first aid and safety facilities, fire protection facilities, direct sales offices, distribution centers and manufacturing facilities are all utilized by the businesses included in All Other. Source: Thomson Financial |

Sharek’s Take |

Cintas (CTAS) stock is a great example why you shouldn’t sell a Blue Chip stock because of a short-term downturn. I sold CTAS on May 1, 2020 at $211, and this qtr the stock is $434. The shares have doubled in a year-and-a-half. During a period when travel was restricted due to COVID-19, thus uniforms wouldn’t need to be cleaned as much. In retrospect, I sold when the news was the worst, and then the news — anad the stock price — got better. Now, I look to buy back in, but the stock is always too high. Although I loved Cintas the company, when I sold I felt COVID would damper uniform cleaning. I didn’t understand the company would make that up with sanitizer and personal protective equipment revenue. Good companies adapt. Cintas (CTAS) stock is a great example why you shouldn’t sell a Blue Chip stock because of a short-term downturn. I sold CTAS on May 1, 2020 at $211, and this qtr the stock is $434. The shares have doubled in a year-and-a-half. During a period when travel was restricted due to COVID-19, thus uniforms wouldn’t need to be cleaned as much. In retrospect, I sold when the news was the worst, and then the news — anad the stock price — got better. Now, I look to buy back in, but the stock is always too high. Although I loved Cintas the company, when I sold I felt COVID would damper uniform cleaning. I didn’t understand the company would make that up with sanitizer and personal protective equipment revenue. Good companies adapt.

Cintas is the largest uniform supplier in North America, but the company offers so much more to small, medium and large businessses. On the healthcare side, Cintas offers scrub rental and hygine supplies, including dental equipment. The company’s walk-off mats are something you’ve probably traveled past today, and might come weekly with new mops. Cintas’ first aid products and fire extinguishers as well as alarms are used by hotels and restautants. Cintas is made up of the following business segments as of last qtr:

Cintas has a great system which is to provide each worker uniforms for two weeks, with one set being used by the employee and the other being laundered. Once a week a Cintas rep comes to the facility, drops off clean uniforms and picks up dirty ones. Companies have no up-front investment, as Cintas funds the program setup. In addition to uniforms, Cintas provides floor care, restroom supplies, first aid and safety products, fire extinguishers and testing, and safety compliance training. Here are some fun facts about Cintas:

Cintas is a high quality, Blue Chip stock with a dividend, stock buyback program, and a history of growing profits at a double-digit rate. Revenue and profits (EPS) have increased in 50 of the past 52 years, including 39 consecutive years before the Great Recession (2000). Some of the growth comes from acquisitions of other uniform companies. Analysts gave the stock a Estimated Long-Term Growth Rate of 12%. The stock also yields around 1%. 2020 was the 37th consecutive year of dividend increases (since 1983). CTAS was sold from the Conservative Growth Portfolio. |

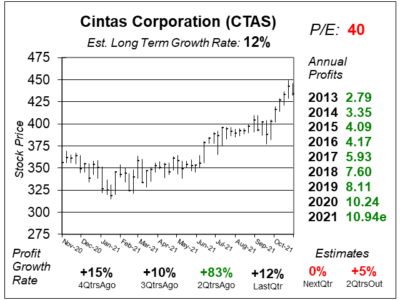

One Year Chart |

This stock is clearly high in my opinion. Perhaps its rallying as investors feel more travel will lead to more uniform cleaning. But this P/E seems high for a 12% grower. Last qtr, CTAS had a P/E of 36. This qtr the P/E is 40. The stock’s up from $390 to $434 since my last report. This stock is clearly high in my opinion. Perhaps its rallying as investors feel more travel will lead to more uniform cleaning. But this P/E seems high for a 12% grower. Last qtr, CTAS had a P/E of 36. This qtr the P/E is 40. The stock’s up from $390 to $434 since my last report.

Qtrly Profit Estimates for the next two qtrs are poor. But last qtr, profit growth was supposed to be -1% and the company delivered 12%. Est. LTG of 12% is around where it should be. Last qtr, this number was 11%. |

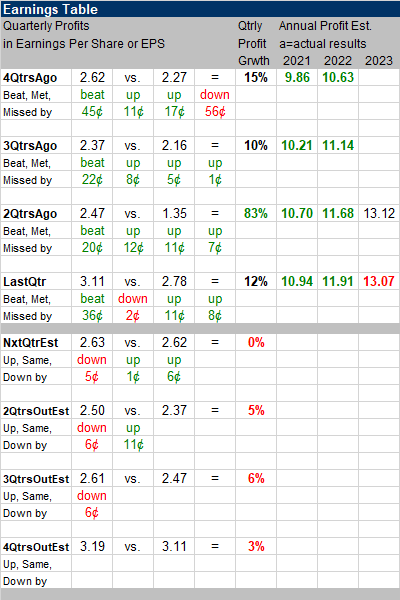

Earnings Table |

Last qtr, Cintas Corp. delivered 12% profit growth and exceeded expectations of -1% loss. Company revenue advanced 9%. Uniform rental services comprised the majority of company sales while fire protection services brought the highest growth, last qtr. Last qtr, Cintas Corp. delivered 12% profit growth and exceeded expectations of -1% loss. Company revenue advanced 9%. Uniform rental services comprised the majority of company sales while fire protection services brought the highest growth, last qtr.

Sales growth was driven by uniform rental and facility services as majority of customers started their operations as well as growth in fire protection revenue due to increased economic activity and reduced COVID-19 cases. Looking back to my CTAS 2020 Q1 report when I sold the stock, 2021 profit estimates had just fallen from $10.66 to $8.66. Now, the company is expected to make $10.94. Annual Profit Estimates have increased for 6 straight qtrs. Qtrly Profit Estimates are for 0%, 5%, 6%, and 3% profit growth the next 4 qtrs. These estimates are poor. But the company might continue to beat the street. |

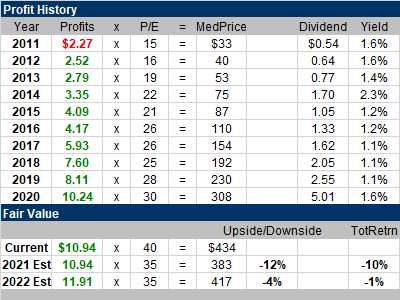

Fair Value |

CTAS usually has a P/E ratio in the high-20s. Now it has a 40 P/E. That could be because investors assume higher profits are coming with the economy opening back up again. CTAS usually has a P/E ratio in the high-20s. Now it has a 40 P/E. That could be because investors assume higher profits are coming with the economy opening back up again.

The current P/E is above My Fair Value P/E of 35. This stock seems overvalued in my opinion. |

Bottom Line |

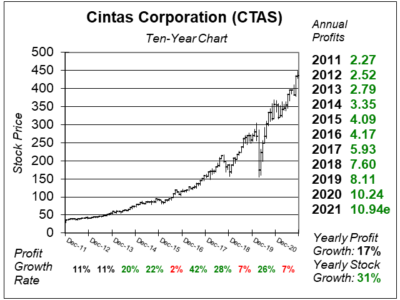

Cintas (CTAS) has been a great stock the past decade, but that hasn’t always been the case. When I look back to the stock since its IPO I see it went public at $1 in 1983, and was in an uptrend until 1998, then went sideways from 1999-2007, declined during the Financial Crisis of 2008/2009, and has been in an uptrend since. So don’t get enamored with this chart and think its past performance will be duplicated. Cintas (CTAS) has been a great stock the past decade, but that hasn’t always been the case. When I look back to the stock since its IPO I see it went public at $1 in 1983, and was in an uptrend until 1998, then went sideways from 1999-2007, declined during the Financial Crisis of 2008/2009, and has been in an uptrend since. So don’t get enamored with this chart and think its past performance will be duplicated.

Cintas should see a boost in uniform cleaning in the upcoming year. But the good news seems to be priced into the stock. CTAS is on the radar for the Conservative Growth Portfolio. The stock is a good example of why you don’t sell good stocks on bad short-term news. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |