The stock market closed higher on Tuesday as bond yields declined nearly 13 basis points to 4.65%. Investors are still cautious on the geopolitical risks that may brought by the Israel-Hamas war.

The stock market closed higher on Tuesday as bond yields declined nearly 13 basis points to 4.65%. Investors are still cautious on the geopolitical risks that may brought by the Israel-Hamas war.

Overall, S&P 500 grew 0.5% to 4,358, while NASDAQ was up 0.6% to 13,563.

Tweet of the Day

Hopefully this price action will be the end of all the nonsense talk about a H&S top in the S&Ps. $ES_F $SPY pic.twitter.com/M0xm5koKHe

— Peter Brandt (@PeterLBrandt) October 10, 2023

Chart of the Day

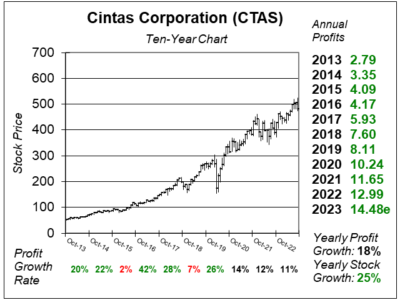

Here is the ten-year chart of Cintas Corporation (CTAS) as of September 27, 2023, when the stock was at $481.

Here is the ten-year chart of Cintas Corporation (CTAS) as of September 27, 2023, when the stock was at $481.

Cintas is the largest uniform supplier in North America, but the company offers so much more to small, medium, and large businesses. It has a great system to provide each worker uniforms for two weeks, with one set being used by the employee and the other being laundered. In addition to uniforms, Cintas produces floor care, restroom supplies, first aid and safety products, fire extinguishers, and safety compliance training. During COVID-19 pandemic, the company was a big provider of sanitizers and other PPE products.

Cintas is seeing a rise in profit margins as energy prices decrease. Last quarter, the uniform cleaning company increased Gross Profit Margin to 48.7%, from 47.5% a year ago, as gasoline and natural gas prices fell. Management also credited the increase in margins to its Smart Truck technology, which uses computers to route trucks. However, the company’s earnings last quarter were more modest. Profit grew 9%, while revenue grew 8%.

David Sharek, Founder of School of Hard Stocks, is not too concerned with slower growth as profits are expected to climb 12% next quarter and 13% two quarters from now. Overall, he considers CTAS to be a 12% profit grower and that is what it seems to be growing at now.

CTAS is on the radar for the Conservative Growth Portfolio. With a P/E of 33, the stock seems to be fairly valued at this time.