The stock market plunged on Friday and ended the week in the red. This was after Federal Reserve Bank of St. Louis President James Bullard stipulated that the central bank would likely to have rate hikes in the near term to ease inflation significantly.

The stock market plunged on Friday and ended the week in the red. This was after Federal Reserve Bank of St. Louis President James Bullard stipulated that the central bank would likely to have rate hikes in the near term to ease inflation significantly.

The S&P 500 was down 1.3% to 4,228, while NASDAQ fell 2.0% to 12,705.

Meanwhile, Fiserv (FISV) has some nice catalysts in Carat and Clover, and processes payments for Zelle.

Tweet of the Day

The TCTM composite thrust model signal count increased to 50% last week, triggering a new buy signal for the S&P 500 with a 93% win rate since 1942, @DeanChristians reports. With the latest alert, the Tactical Composite Trend Model has shifted to a cautious bull outlook.

1/2 pic.twitter.com/XSTFL4JGs6

— SentimenTrader (@sentimentrader) August 16, 2022

Chart of the Day

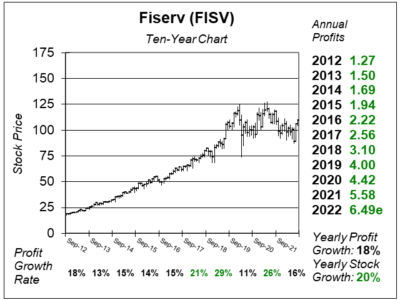

Our chart of the day is the ten-year chart of FISV.

Our chart of the day is the ten-year chart of FISV.

FISV software controls ATM transactions, money transfers, and mobile banking to more than 13,000 banks and credit unions around the world. The company manages nearly 6 million merchant locations, 10,000 financials institutions, 140 million deposit accounts, 80 million online U.S. banking users, via nearly 1000 products and services.

FISV is a dependable mid-to-high teens grower (revenue and profits). But the company was lacking a catalyst to get the stock moving. Now, it might have one in Zelle, a competitor to the Venmo and Cash apps.

FISV is part of the Conservative Growth Portfolio, and with a P/E of just 17 the stock is a good value. David Sharek’s Fair Value stays at 20x profits, or $130 in 2022.