The Holidays are Here!

The Holidays are Here!

And this is the time to be on the lookout for retail stocks that could brighten up your shopping season.

This month we highlight five of our top retail stocks, and one surprising selection — Amazon (AMZN) — that we wish to avoid.

All the charts and tables shown are from our 2022 Q3 research reports. The stocks have moved in price since.

Happy Holidays from our family to yours,

David Sharek

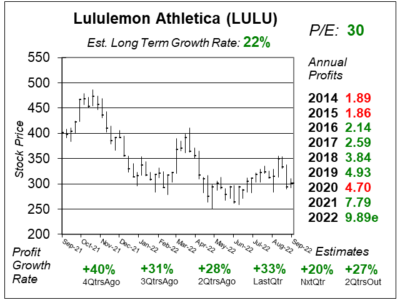

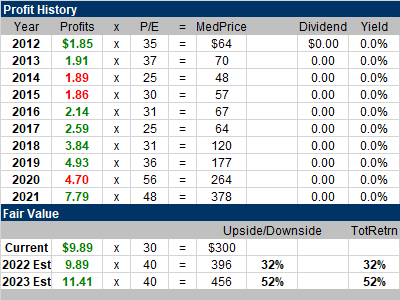

Lululemon (LULU) is a Canadian designer, distributor, and retailer of high-quality athletic appeal and accessories, marketed under the lululemon brand. The brand is known for its technically advanced fabrics, with a superior feel and fit.

Lululemon (LULU) is a Canadian designer, distributor, and retailer of high-quality athletic appeal and accessories, marketed under the lululemon brand. The brand is known for its technically advanced fabrics, with a superior feel and fit.

The company has continued to deliver sparkling results. It delivered remarkable numbers amid the retail apparel recession.

Lululemon is performing amazingly well. I think easing of the supply chain could help profits in the coming qtrs. New products like SenseKnit, Hike, and the sneaker lineup should keep customer traffic high.

LULU is part of my Growth Portfolio. It is currently has a P/E of 30.

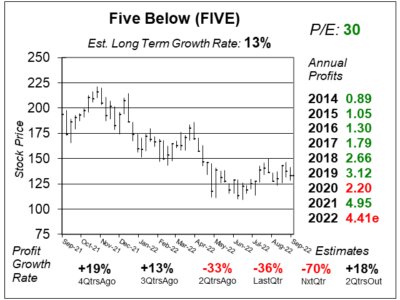

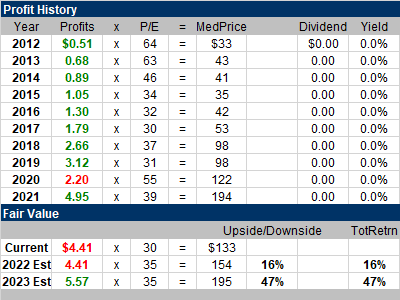

Five Below (FIVE), is a dollar-store concept for kids and teens, that sells merchandise such as toys, games, party items, sports gear, clothes, candy & electronics for between $1 and $5.55 each.

Five Below (FIVE), is a dollar-store concept for kids and teens, that sells merchandise such as toys, games, party items, sports gear, clothes, candy & electronics for between $1 and $5.55 each.

Five Below is seeing slower sales this year due to two factors.

First, stimulus checks were given to Americans in 2021, and many of these folks spend some of that money at Five Below.

Second, the lower income consumer is having trouble with inflation. These people are spending their paychecks on fuel, food, and housing.

Today, factories are operating again and logistic issues have aleviated. So those sneaker stores might have been getting old orders and new orders delivered at the same time. Then these stores wouldn’t need to order new inventory.

FIVE is part of the Growth Portfolio. With a P/E of only 30, this is one of the best bargains in my coverage.

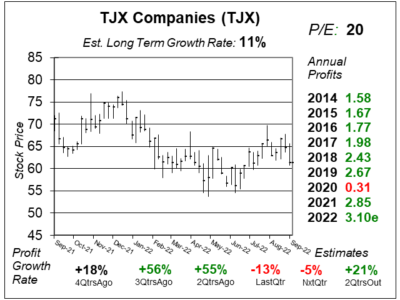

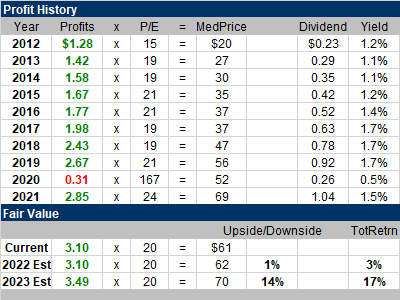

TJX Companies (TJX) is the largest major international off-price retailer in the world. It offers a rapidly changing assortment of quality brand name and designer merchandise that is 20% to 60% below full-price retailers.

TJX Companies (TJX) is the largest major international off-price retailer in the world. It offers a rapidly changing assortment of quality brand name and designer merchandise that is 20% to 60% below full-price retailers.

TJX stock is holding up well even though retail apparel is in a recession. A lot of the recession is caused by US consumers getting stimulus checks last year and pending them in TJ Maxx, Marshalls, and Homegoods stores.

TJX is seeing a marketplace flush with off-price buying opportunities for high quality brands, due to the recession.

TJX is part of the Conservative Growth Portfolio. Note that during the past decade this stock often had median P/E between 19 and 21. Thus, my Fair Value is a P/E of 20.

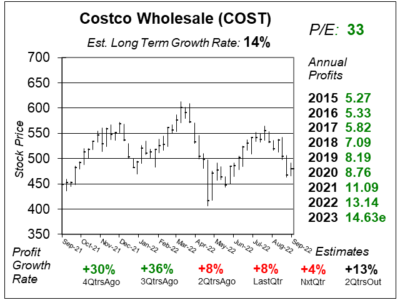

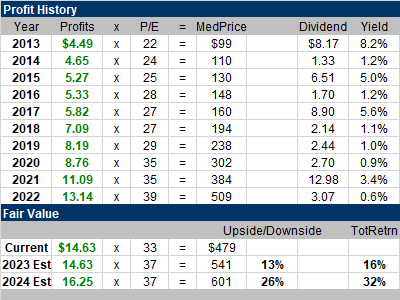

Costco (COST) is the 2nd largest global retailer with 119 million members. The profit Costco makes is mostly made up from the annual membership fees it brings in.

Costco (COST) is the 2nd largest global retailer with 119 million members. The profit Costco makes is mostly made up from the annual membership fees it brings in.

COST is a quality Blue Chip stock with high certainty, a stock buyback program, qtrly dividends and a history of big surprise dividends. This has been a steady winner for many decades, thus investors really appreciate the stock.

COST is a core holding in the Conservative Growth Portfolio. My Fair Value P/E for this stock is 37x or $541, giving the stock 13% upside.

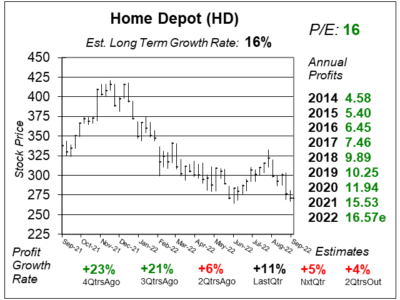

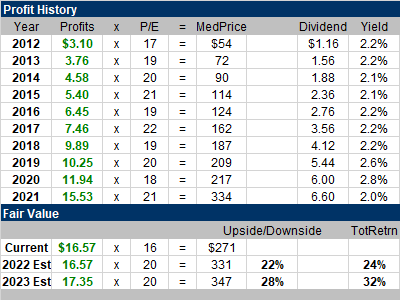

Home Depot (HD) is the world’s largest home improvement retailer, which offers building materials, home improvement products, lawn and garden items, and home improvement installation services. The company does an amazing job growing, while the store count stays consistent.

Home Depot (HD) is the world’s largest home improvement retailer, which offers building materials, home improvement products, lawn and garden items, and home improvement installation services. The company does an amazing job growing, while the store count stays consistent.

Home Depot delivered a solid quarter overall, but the decline in transactions is a concern with the US being in a recession. Weakness in homebuilding could negatively affect the stock, as mortgage rates jumped.

HD is part of the Conservative Growth Portfolio. My Fair Value is a 20 P/E. The stock has a 16 P/E now.

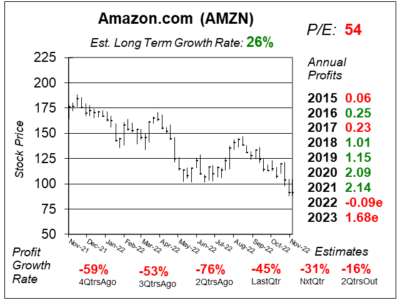

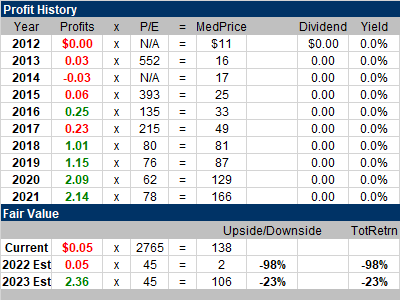

Amazon (AMZN) serves customers through its online and physical stores with a focus on selection, price, and convenience. The company works to deliver hundreds of millions of unique products that are sold by Amazon itself and third-party sellers.

Amazon (AMZN) serves customers through its online and physical stores with a focus on selection, price, and convenience. The company works to deliver hundreds of millions of unique products that are sold by Amazon itself and third-party sellers.

Retail is really hurting this company, especially International. So this is really an Amazon Web Services (AWS) story right now, and that continues to do well and make handsome profit. But sales growth is slowing at AWS, which is another concern.

AMZN isn’t owned in client accounts at this time. Although the table here suggests we think the stock is worthy of a $2 price, that’s rather unrealistic. I do feel the stock could stick around $100 until the company can lower expenses.