Five Below (FIVE) Continues to Suffer from Store Theft as the Shares Go Sideways

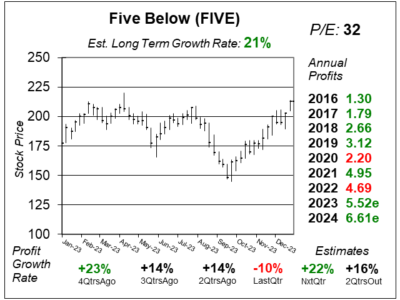

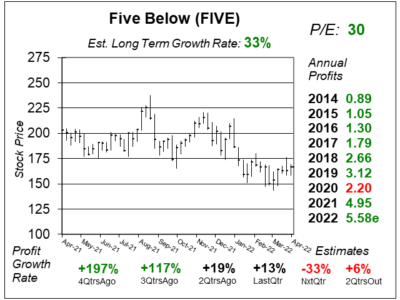

Five Below (FIVE) is growing sales and profits at a solid rate (both 19% last quarter). But investors are concerned about shoplifting.

Five Below (FIVE) is growing sales and profits at a solid rate (both 19% last quarter). But investors are concerned about shoplifting.

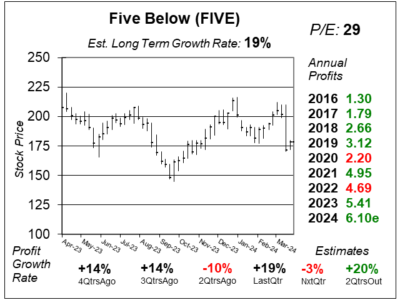

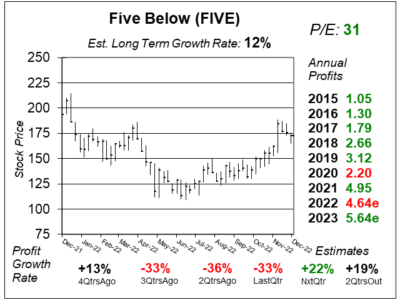

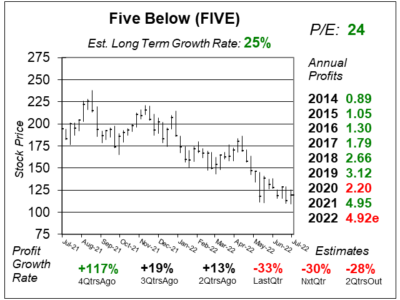

Five Below (FIVE) is growing sales nicely (+14% last qtr) but profits are poor (-10%) as shoplifting is taking down profit margins.

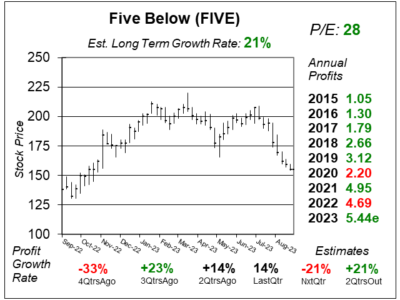

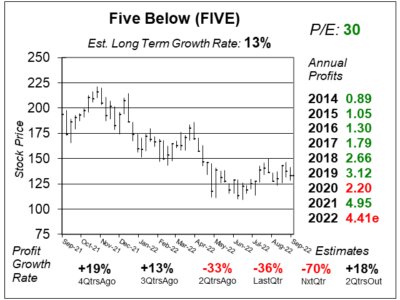

Five Below’s (FIVE) stock has been dropping like many other retailers. But now the stock is at a good place to buy in.

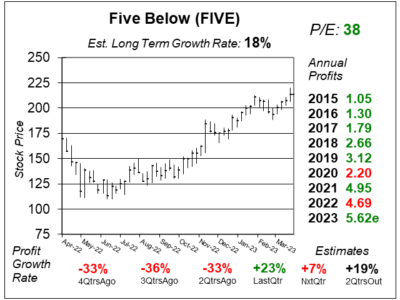

Five Below (FIVE) put together pretty good results last quarter considering how strapped for cash American consumers are.

Five Below (FIVE) has thrived selling items for $5 or less. Now its got higher-priced items with its Five Beyond in-store concept.

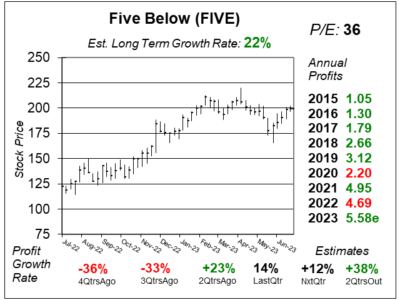

Fun-stuff store Five Belo (FIVE) broke out to a new yearly high today as profit growth is set to return to normal next quarter.

Five Below (FIVE) is dealing with customers having less extra money than last year. But it looks like the stock’s already bottomed.

In what is a recurring theme in the stock market, Five Below (FIVE) stock has lost half its value because Americans got stimulus checks.

Five Below’s (FIVE) “Triple Double” growth initiative includes doubling profits in three years and tripling the store count by 2030.

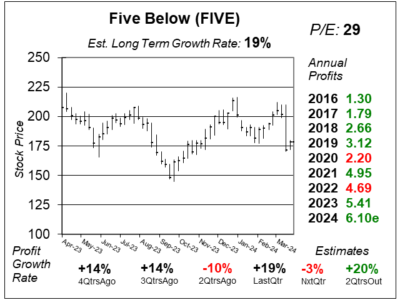

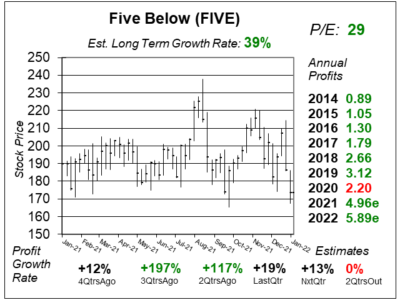

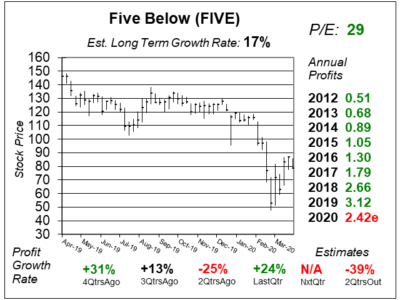

Five Below (FIVE) continues to be one of the best growth stocks in our universe. Now, with a P/E of 29, the stock has good upside.

Higher prices are causing consumers to buy more goods at dollar stores, which could help Five Below (FIVE) tremendously.

Shares of dollar-store Five Below (FIVE) just broke out of a 7-month base, which could signal the stock is headed higher.

Five Below (FIVE) is proving to be an excellent concept, as shoppers are loving the deals the $5-and-above store delivers.

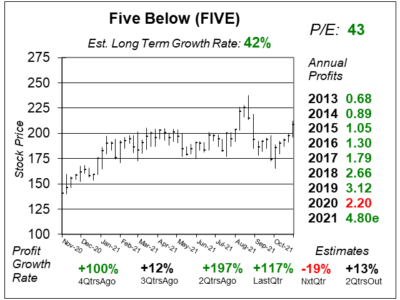

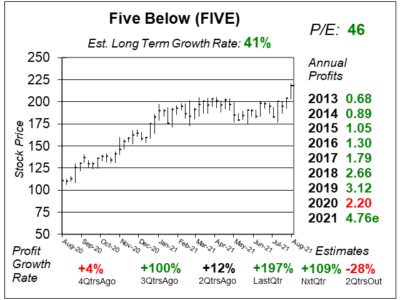

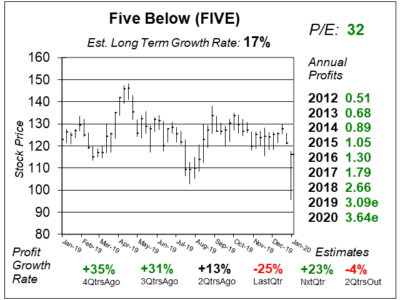

Five Below (FIVE) has found a new level of profitability as the company delivered 100% profit growth as sales rose 26%.

Five Below (FIVE) has plans to take its store count from around 1000 to 2500 long-term. Perhaps the stock will follow suit.

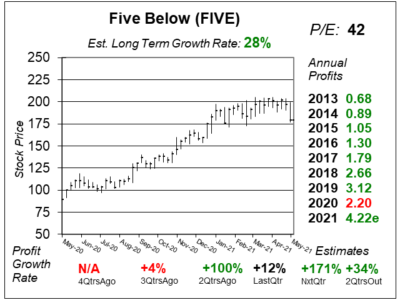

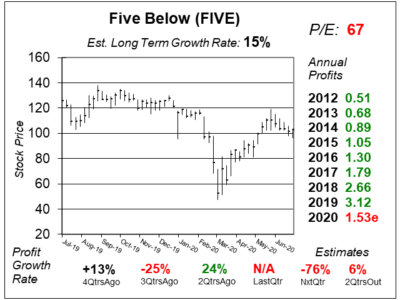

Analysts reduced Five Below (FIVE) 2021 profit estimates due to the Coronavirus. I think analysts are clueless on the numbers.

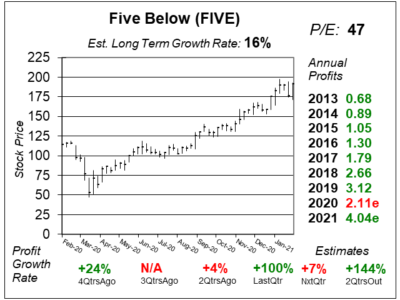

Five Below (FIVE) stock got whipped with the rest of the Retailers as non-essential stores were closed. Now they are opening.

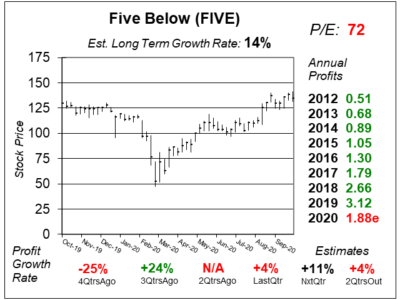

Five Below (FIVE) sees a light Christmas season coming up, and this news sent FIVE shares lower — temporarily.

Five Below (FIVE) is one of the best retailers in America, as it’s successfully been growing its store count 20% per year.

Five Below (FIVE) gets lots of its dollar-items from China. FIVE stock’s been getting whacked. Let’s assess the damage.

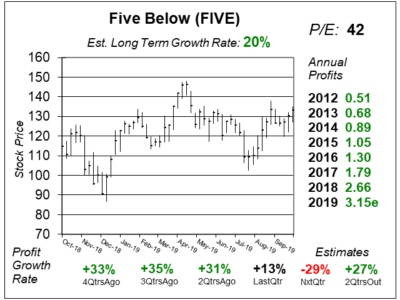

Five Below (FIVE) has been a stock market leader these past years, but growth is expected to slow and the P/E is a lofty 48.

IS there a better retail stock than Five Below (FIVE)? What I really like about FIVE is the company is beating the street — and estimates continue to climb.

Toys-R-Us’ bankruptcy leaves $6 billion in annual toy sales to be scooped up by other retailers, with Five Below (FIVE) getting a chunk.

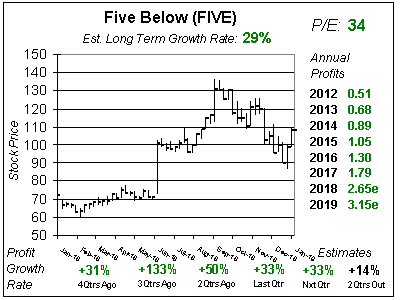

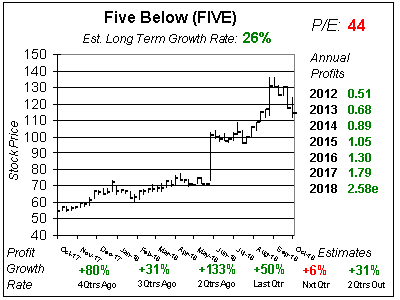

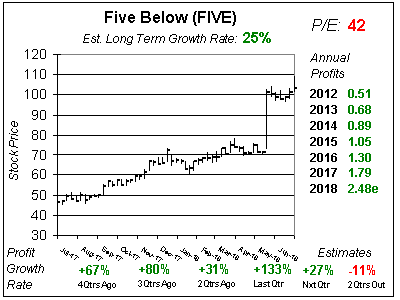

Shares of Five Below (FIVE) soared after hte company delivered 133% profit growth last qtr. But after that move, does FIVE have more upside?

Five Below (FIVE) is one of the best growth stocks around, and the closing of Toys R Us stores could boost results more than projected.

Five Below (FIVE) is a stock most of the investors I talk to are unaware of. Because it’s a kids dollar store. But this stock is one of the retail leaders of today, and looks good going into 2018.

Fidget spinners are the hot craze with kids this year, and sales of the toy helped Five Below (FIVE) blow away profit and sales estimates last qtr. Here’s my take on FIVE.

Five Below (FIVE) has fun dollar stores that appeal to kids and teens. And since the stock hasn’t gone higher in a while, the stock could be due for a run.

The Internet isn’t hurting Five Below (FIVE) as it has a nice niche in the retail space. Kids and teens love to shop for things between $1 to $5 in these fun stores.

Like many bricks-and-mortar retailers, Five Below (FIVE) is working in a challenging environment. But there’s still opportunity for FIVE to grow its stores four-fold.

Kids dollar store Five Below (FIVE) is one of the best retail ideas around, but the stock is still succumbing to the weakness in the Retail sector.

Five Below (FIVE) is a dollar store for kid and teens, but adults are really appreciating the chain’s growth potential.

Five Below (FIVE), one of America’s fastest growing retailers, put out a solid qtr with 26% profit growth and the stock broke out on the news.

Five Below (FIVE) is using the force to withstand the stock market’s wrath. Plus, China currency problems make good cheaper.

Five Below (FIVE) has a catalyst in Star Wars merchandise that could move the stock upward and beyond, thus I will purchase FIVE in the Growth Portfolio.

Five Below (FIVE) is still too high for me to buy, but the profits FIVE is kicking out look great.

Five Below (FIVE) is the hottest little dollar store around, and I think its FIVE is a good buy, and worth a try, below $35.

With temperatures in New York at 13 degrees, today is a perfect day to look at Five Below (FIVE), a stock on my radar.

Five Below (FIVE) is a dollar store focused on teenagers. It’s also one of the fastest-growing retailers around. Here’s my take on FIVE: