International Stores are Showing Strong Sales Growth at Costco (COST)

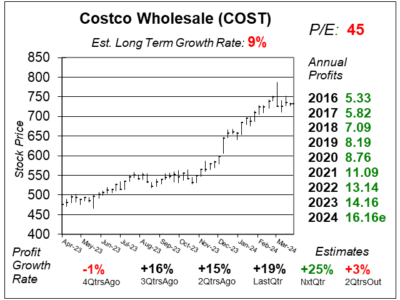

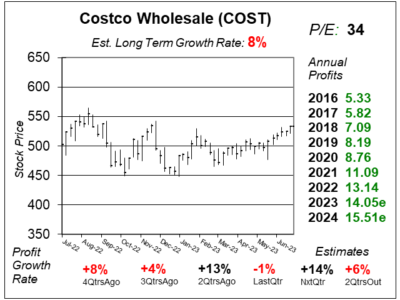

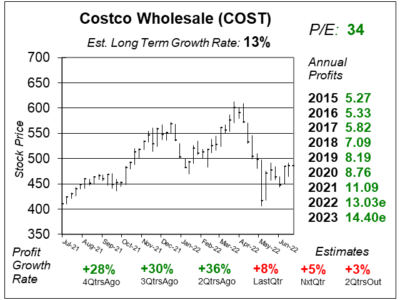

Costco (COST) is growing sales in Canad and other IInternational markets nicely (+9% last qtr). But the stock’s P/E is still too high.

Costco (COST) is growing sales in Canad and other IInternational markets nicely (+9% last qtr). But the stock’s P/E is still too high.

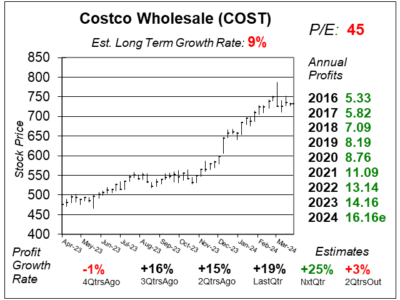

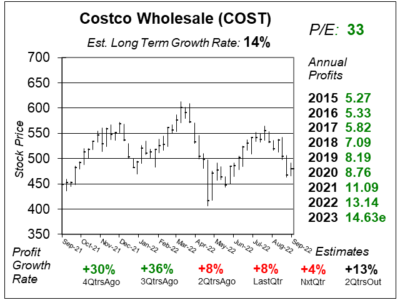

Costco (COST) is paying a special $15 dividend today to its shareholders. But with a high P/E and a soppy chart, it may be time to sell.

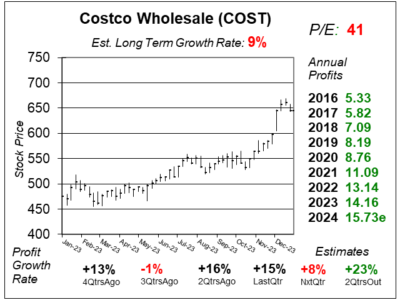

Costco (COST) delivered above average profits last quarter as the company continues to pump out consistent revenue growth.

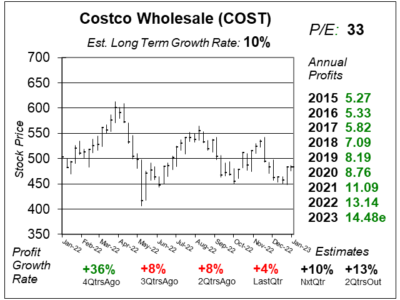

Costco (COST) had a one-time charge against profits last quarter because management discontinued its charter shipping activities.

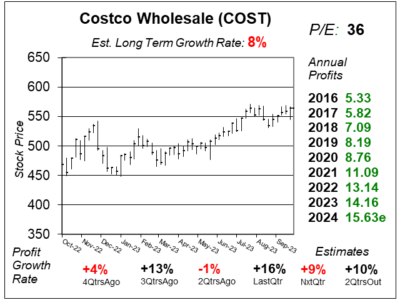

Costco (COST) members are feeling the pinch of a weak economy as they shy away from luxury purchases. Still, profits are good.

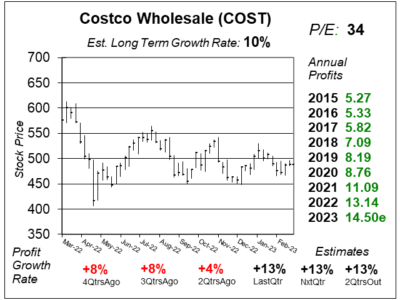

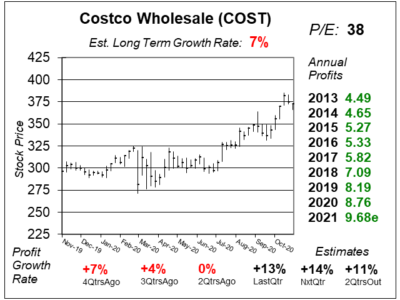

Costco’s (COST) profits have been hampered recently by a strong US Dollar and high shipping costs, and now both are falling.

Costco (COST) put in an average quarter — by their standards. Overall, everything looked good, which is the norm for this stock.

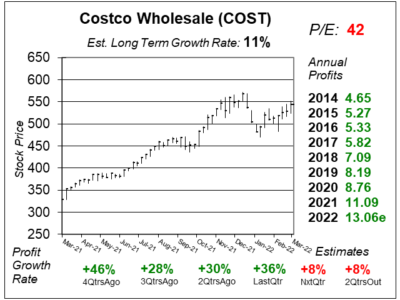

Costco (COST) delivered splendid sales growth of 16% last qtr as consumers felt the pinch of higher food costs due to inflation.

Costco (COST) should benefit from higher inflation, as it can just raise prices. But what’s holding the stock back is a lofty P/E of 42.

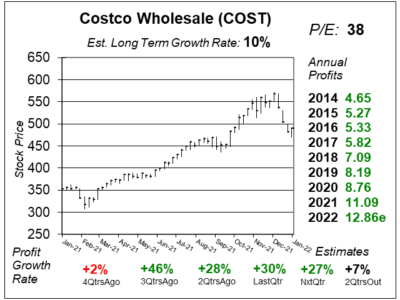

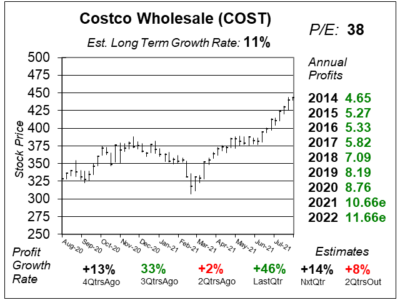

Costco (COST) continues to amaze as it delivered 30% profit growth on 17% sales growth last qtr. But COST is rich with a 38 P/E.

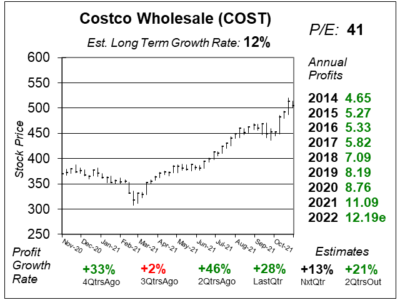

Costco (COST) is executing very well, as sales grew 18% last qtr. But with a P/E of 41 this qtr, the stock seems fairly valued here.

Costco (COST) delivered 46% profit growth last qtr, but comparisons were easy because growth was 0% a year-ago,

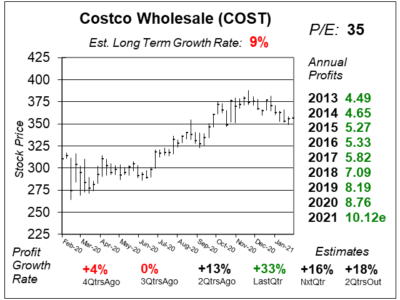

Costco (COST) always seems to be around its All-Time highs, with a lofty P/E, and little upside for short-term investors.

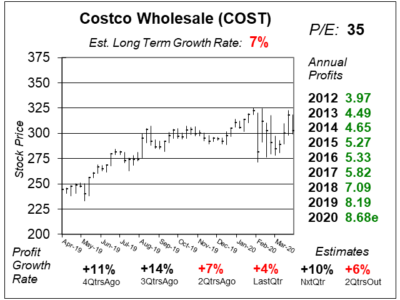

Costco (COST) has a catalyst in ecommerce sales, especially groceries. Last qtr, online grocery sales jumped more than 300%.

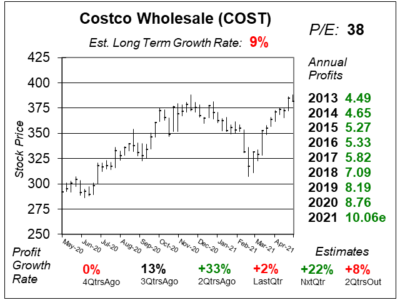

Costco (COST) seems to be in the midst of a strong profit growth period, but with a P/E of 38 the stock is pricey.

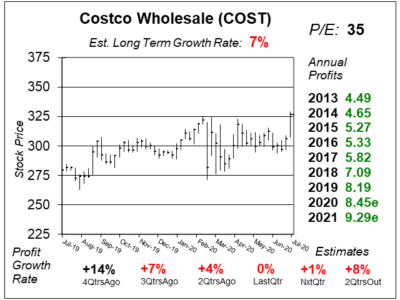

It seems like Costco (COST) should have booming profits due to COVID-19, but profit growth was just 0% last qtr.

Costco (COST) has long lines in its parking lots, but is that translating to profits? And does the stock have upside?

Costco (COST) is a very hot stock, perhaps because its China store. But so far, the story is more hype than substance.

Costco (COST) stock is flying high as profits are growing good and the company has growth opportunity in China.

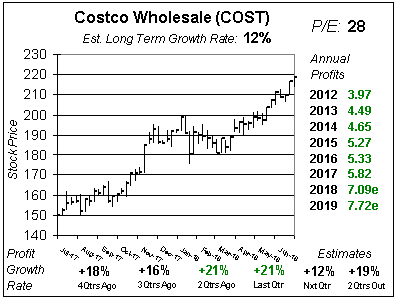

Shares of Costco (COST) are up 34% so far in 2019. Is 11% profit growth enough to keep a 32 P/E stock in an uptrend?

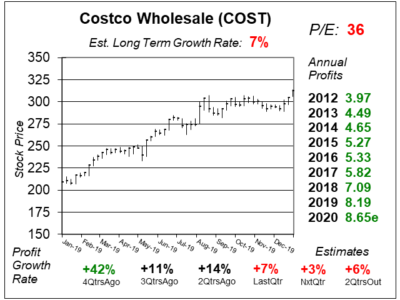

Costco (COST) just whipped analyst profit estimates. Now the question is will that continue? Let’s take a deeper look.

Costco (COST) continues to deliver steady-eddy growth. COST is for investors who want to buy-and-hold safe stocks.

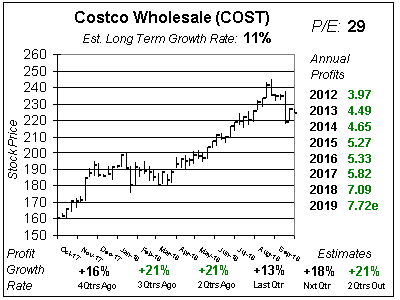

Shares of Costco (COST) have soared from $150 to $225 in the last year. Is COST so high because retail stocks are hot?

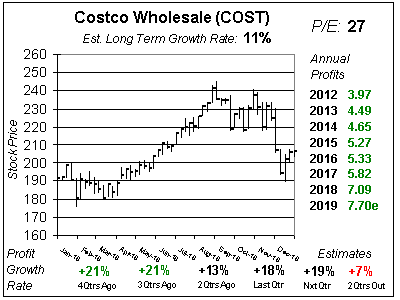

Costco (COST) hit new All-Time highs after it reported solid profit growth of 21% last qtr, as sales increased a solid 12% overall.

When news hit that Amazon was trying to buy Whole Foods, investors sold off grocery stores, including Costco (COST). But since then, Costco hasn’t missed a beat.

Investors slammed shares of Costco (COST) back in June when you-know-who acquired Whole Foods. Is the competition hurting Costco? Hell no.

There’s a lot of hoopla over Amazon taking business from Costco (COST, but the latter still grew profits 18% last qtr — Nice! What has been hurt is COST’s multiple.

Shares of Costco (COST) are down on news Amazon is looking to buy Whole Foods. Meanwhile, Costco’s profits rose a robust 12% last qtr. Time to Buy?

Costco (COST) is paying out another big one-time dividend of $7 to shareholders this week — great! But the company missed profit estimates last qtr.

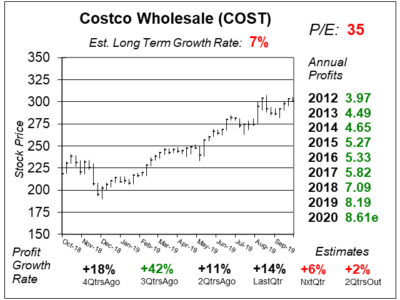

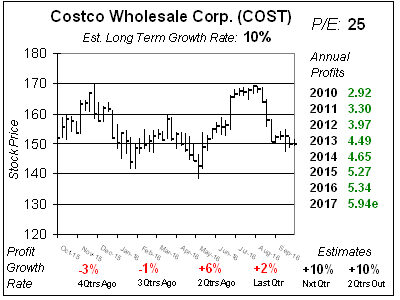

Costco (COST) had been hampered by low gasoline prices and a strong US dollar, but now profit growth is expected to accelerate in 2017.

Warehouse retailer Costco (COST) has been hurt by low gas pump prices and foreign exchange rates. But now profit growth could be back to normal next qtr.

Costco’s (COST) new Costco Anywhere card from Citibank/Visa looks to be a big winner as profits look to accelerate in the coming qtrs.

Costco (COST) isn’t growing much right now — and the P/E is high — but the weakening dollar could be beneficial to profits later in 2016.

Low gasoline prices and a high dollar are hampering Costco’s (COST) earnings growth.

Shares of Costco (COST) aren’t cheap like the items it sells are. Still, this stock provides top-notch safety and stability.

Costco Wholesale (COST) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $3.66 vs. $2.93 = +25%

Revenue Est: +7%