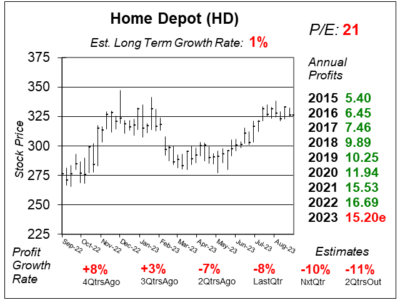

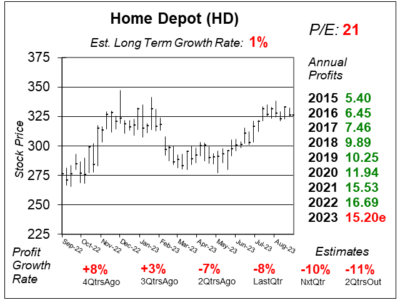

Slow Economy, Lumber Deflation, Theft Weigh on Home Depot’s (HD) Profits

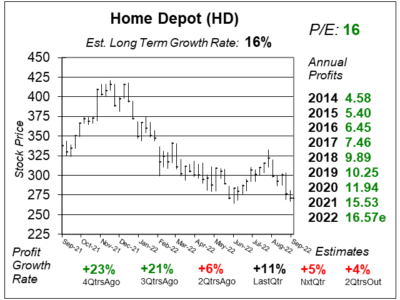

Home Depot (HD) is going through a period of slow growth as high interest rates are causing home building projects to slump.

Home Depot (HD) is going through a period of slow growth as high interest rates are causing home building projects to slump.

Home Depot (HD) expects sales growth to be flat in 2023 due to economic sluggishness. HD stock might go sideways as well.

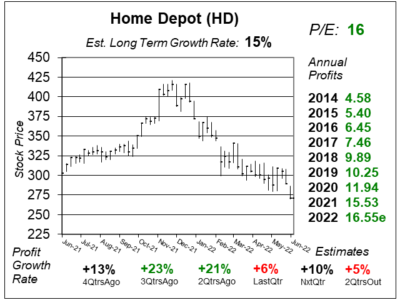

Home Depot i(HD) is getting a boost from home improvement projects, and lower interest rates should lead to more project demand.

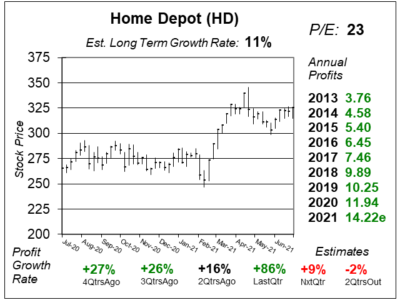

Home Depot (HD) is feeling the effects of the recession, as transactions declined last qtr. But ticket size rose due to price increases.

Home Depot (HD) is continues to see strong demand for home improvement projects. And the stock is a bargain with a 16 P/E.

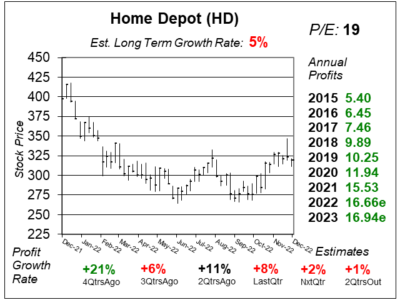

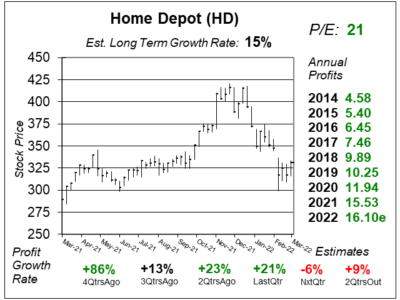

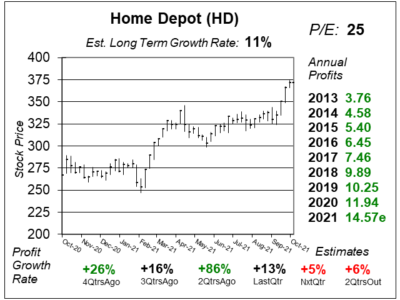

Home Depot (HD) management told analysts to expect slow growth in 2022, but the numbers suggest stronger growth than that.

Home Depot (HD) continues to deliver strong growth as profits grew 23% last qtr on 10% sales growth with +5% same store sales.

Dispite supply chain disruptions, Home Depot (HD) continues to see strong demand for home improvement products.

Home Depot (HD) is expected to keep the momentum going via an expanding economy and infrastructure spending.

Home Depot (HD) has been a great stock this past decade — it went from the $20s to the $220s. Now, the run may be done.

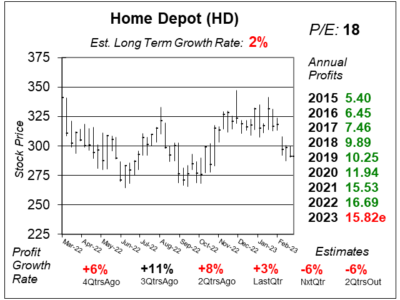

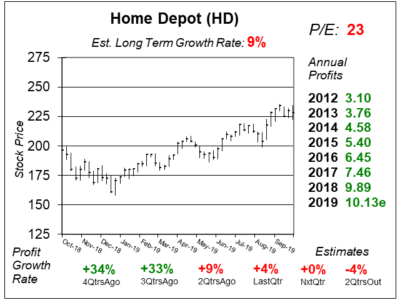

Home Depot (HD) is experiencing slower growth while the stock trends higher. What does lumber have to do with it?

Home Depot (HD) has been hitting new highs as profit growth slowed to just 9% last qtr. Is it time to sell HD?

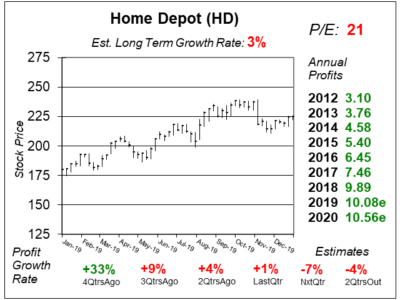

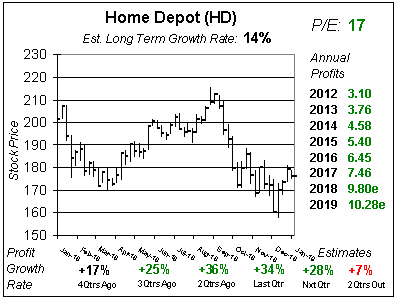

Home Depot (HD) is expected to have just 2% profit growth in 20019, but lower interest rates could help push profit growth into the double-digits.

Home Depot (HD) is executing marvelously, but a slow housing market is bound to put pressure on the stock in 2019.

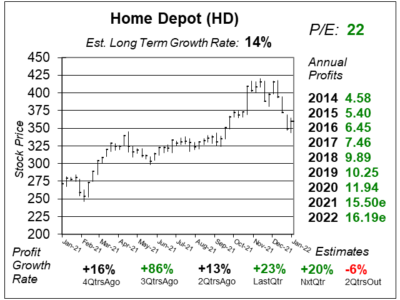

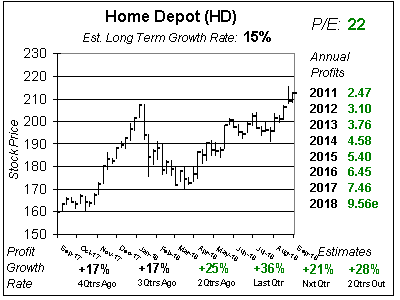

Home Depot (HD) reported profit growth of 36% last qtr, which blew away estimates of 26%. And with a P/E of 22, HD is a good buy.

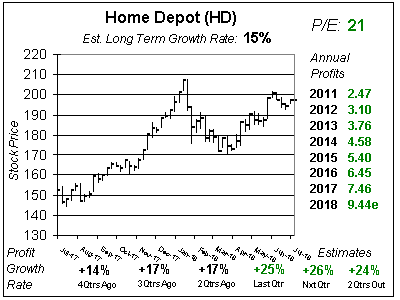

Shares of Home Depot (HD) look great as profit growth accelerated from $17% to 25% last qtr. With a P/E of 21, HD has some upside.

There’s a lot of good things going on at Home Depot (HD). E-commerce sales, big ticket sales and professional sales are leading the charge.

Natural disasters such as wildfires in California and Hurricanes in the Southern US are expected to boost profits for Home Depot in 2018. And a good housing market helps too.

A strong economy is good for housing, and Home Depot (HD) stock has been a winner with strong sales of pipes, power tools, wire, flooring, storage, and patio furniture.

A solid housing market is perfect for Home Depot (HD) as people are willing to spend on improving their homes if the homes are increasing in value.

Retail might be getting its ass handed to it, but Home Depot (HD) just delivered the goods once again — with profits up more than 20% last qtr.

Home Depot (HD) continues to grow profits in the teens as same store sales growth and stock buybacks lead the charge.

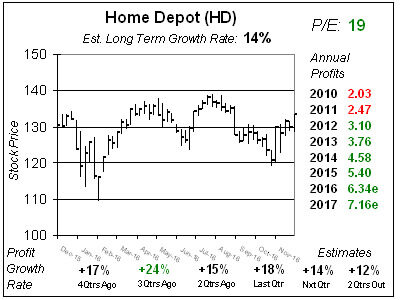

Home Depot (HD) stock isn’t getting as many headlines as it did in the 1990s, but the home improvement chain is growing profits better than you might think.

Home Depot’s (HD) number are solid, but weakening building permits could be a sign of slower growth ahead for the stock.

Home Depot (HD) has a magic formula for increasing profits. That formula is getting more sales per store and buying back orange buckets worth of stock.

Even now, Home Depot (HD) is still growing strong, and is a solid selection for conservative investors.

A strong housing market is good for Home Depot (HD) but the stock has a lot more than that going for it — and one thing going against it.