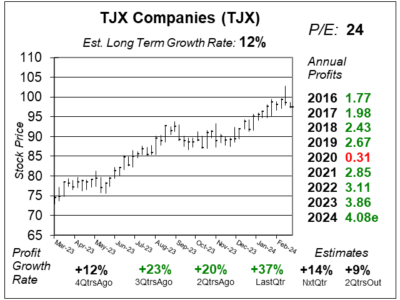

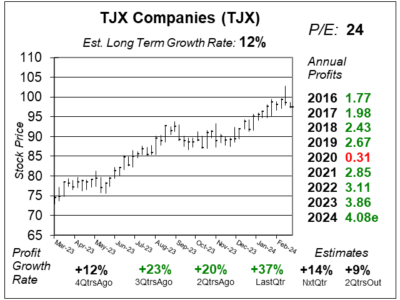

TJX (TJX) Delivered Strong Profit Growth Last Quarter As Profit Margins Jumped

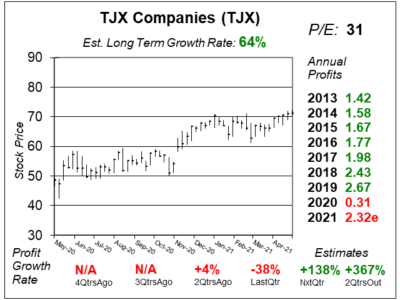

TJX (TJX) had profits surge 37% last qtr as margins rose due to lower freight costs, less theft, strong markups & lower markdowns.

TJX (TJX) had profits surge 37% last qtr as margins rose due to lower freight costs, less theft, strong markups & lower markdowns.

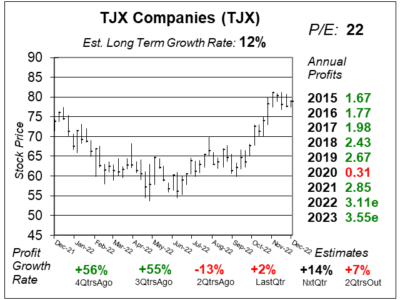

TJX (TJX) delivered solid profit growth last quarter which management says came from an increase in customer traffic across all brands.

TJX (TJX) reported solid results last quarter as higher traffic lead to very strong sales of clothing & accessories at TJ Maxx & Marshalls.

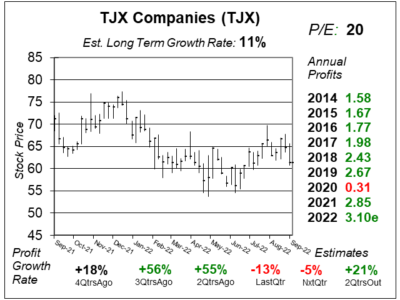

TJX (TJX) reported positive sales growht in apparel, but weak sales in home items. One positive was profit margins increased.

TJX’s (TJX) Marmaxx division — TJ Maxx and Marshalls — delivered solid growth last quarter as US shoppers were looking for bargains.

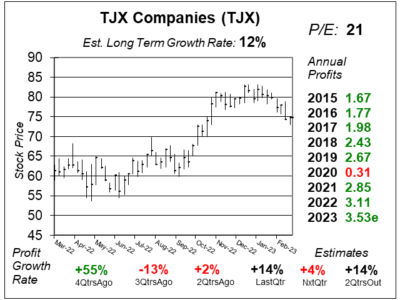

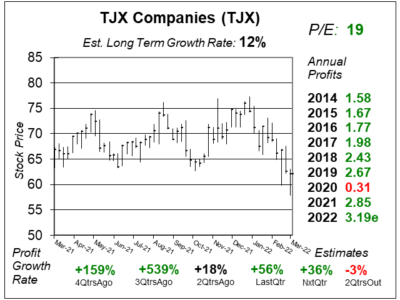

TJX (TJX) stock has been hot lately as investors look ahead to more normalized profit growth (12% or so) in the upcoming quarters.

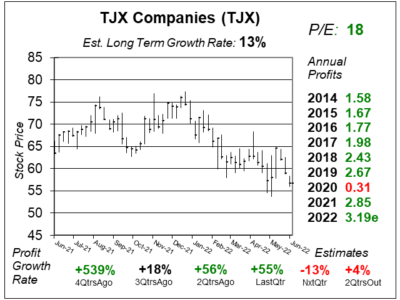

Nike just reported earnings and had excess inventory, that it intends to liquidate. That could mean some good deals for TJX (TJX).

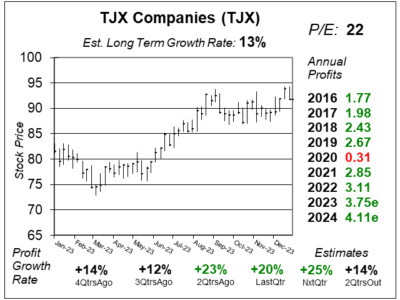

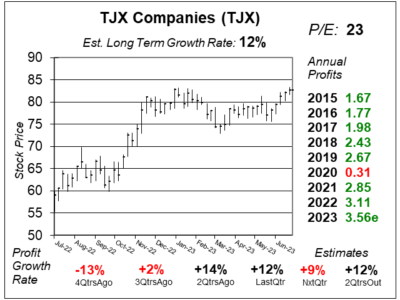

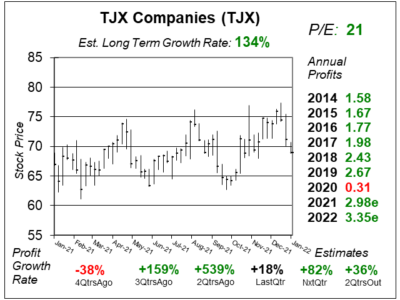

TJX (TJX) — parent of TJMaxx, Homegoods, and Marshals — seems to be undervalued by 20%, with 35% upside when we look to 2023.

TJX (TJX) has higher expenses for labor & freight, which brought down the stock. But now, TJX is a good value with a P/E of 19.

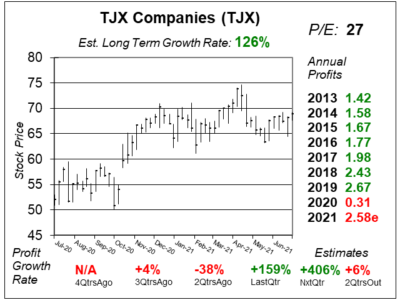

TJX Companies’ (TJX) HomeGoods brand had same store sales over a two-year period of 34% as segment profits surged 52%.

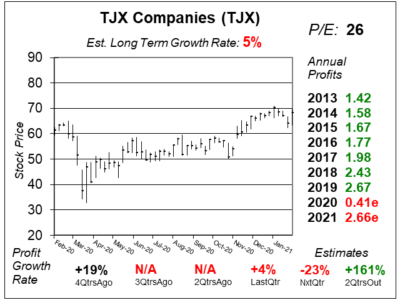

TJX (TJX), parent of TJ Maxx, and Homegoods, had profits decline due to the pandemic. Now the the stage for a 2022 comeback.

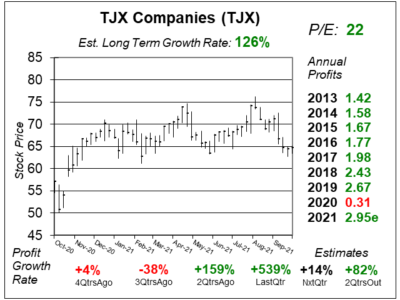

Business is better at TJX (TJX) as sales and profits are growing again. But its tough to get a handle on what the stock is worth.

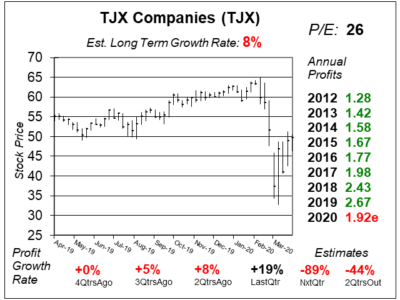

TJX (TJX), parent of TJMaxx, Marshall’s and HomeGoods, is still suffering from COVID closures. But the stock has been hot.

TJX (TJX) reported +4% profit growth last qtr even though many stores were closed. Now, e-commerce might be a catalyst.

TJX (TJX), parent of TJ Maxx and Marshalls, has a secret catalyst that no one is talking about: e-commerce sales.

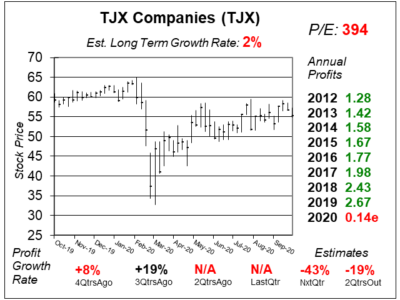

TJX (TJX) is seeing strong demand at its re-opened TJ Maxx and Marshalls stores. But the company has issues to work through.

The coronavirus lockdown is terrible for mall-based retailers, who will close up. TJX (TJX) will snap up the inventory.

TJX (TJX) has invested in a 25% stake in Familia, Russia’s only major off-price apparel and home fashions retailer.

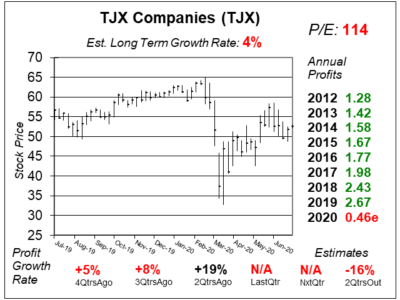

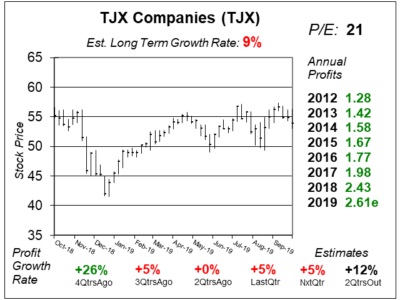

TJX (TJX), parent of TJ Maxx, Marshalls, Winners, HomeGoods and Sierra Trading Co, has had traffic increase 20 straight qtrs.

TJX Companies (TJX), the parent of TJ Maxx and Marshalls, is the perfect stock for your Mom (who probably shops there).

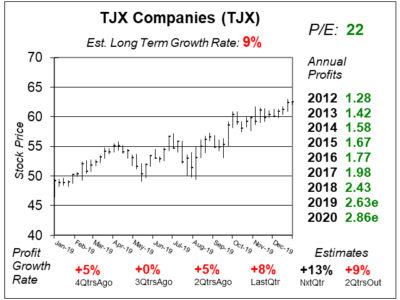

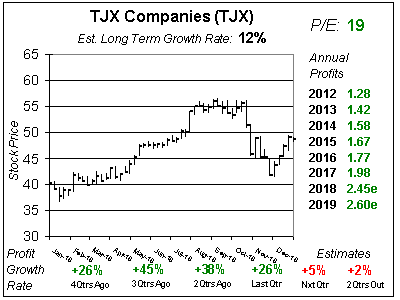

TJX Companies (TJX) is up from around $40 to $55 in the past year, but can TJX continue higher now that profit growth has slowed?

TJX (TJX), parent of TJ Maxx, Homegoods and Marshalls, has been an All-Time stock market winner as its soared from $0.05 to around $50 since 1980.

TJX (TJX) — parent of TJ Maxx and Marshalls — is having a profit party, and the stock can’t stop won’t stop. Even in this crappy market.

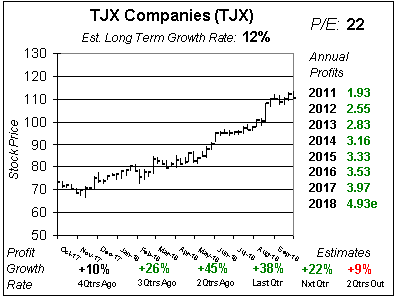

TJX Companies (TJX) — parent of TJ Maxx, HomeGoods and Marshalls — is clicking on all cylinders right now as the stock’s at an All-Time high.

Tax reform is providing a big boost to TXJ’s (TJX) profit estimates. Now 2018 profits are expected to climb 22%, way above 12% growth last year.

With currency exchange turning from a negative to a positive, TJX Stores (TJX) — parent of TJ Maxx — looks to have some good profit growth coming.

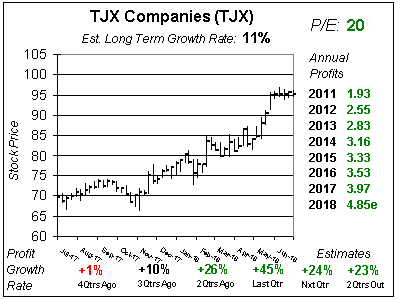

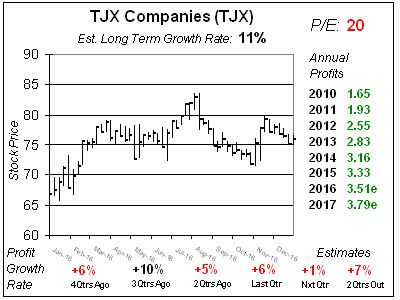

It looks to me like TJX Companies (TJX) has turned up on the one-year chart, and with profit growth expected to average 15% the next 4 qts TJX could continue higher.

TJX (TJX) is having a slow-down in terms of sales and profit growth. And management just lowered next qtr’s estimates. Is it time to sell this long-term winner?

Retail stocks have been under pressure as traffic at the malls are down double-digits. But TJX (TJX) continues to thrive, and the stock is a good buy here.

TJX Companies (TJX), parent of TJ Maxx and Marshalls, continues to be adored by its investors, who give the stock a premium valuation even as profits grow slow.

TJX (TJX) operates TJ Maxx, Marshalls, HomeGoods and Sierra Trading Post. The stock has been an incredible investment, so let’s see if it’s a good buy now.

TJX Companies (TJX) is in my opinion the best storefront retailer in the world. Let’s take a closer look at this retail juggernaut.

Profit growth has been in the single digits at TJX Companies (TJX) the last four qtrs, but that hasn’t stopped TJX stock from going higher.

TJX Companies (TJX) is a model of consistency and safety, but this quality stock is overvalued at this time.

TJX Companies (TJX) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $0.87 vs. $0.76 = +14%

Revenue Est: +6%