Stock (Symbol) |

TJX Companies (TJX) |

Stock Price |

$61 |

Sector |

| Retail & Travel |

Data is as of |

| September 23, 2022 |

Expected to Report |

| November 15 |

Company Description |

The TJX Companies, Inc. (TJX) is an off-price apparel and home fashions retailer in the United States and across the world. The TJX Companies, Inc. (TJX) is an off-price apparel and home fashions retailer in the United States and across the world.

The Company operates through four segments: Marmaxx, HomeGoods, TJX Canada and TJX International. T.J. Maxx and Marshalls chains in the United States (Marmaxx) are collectively the off-price retailer in the United States with approximately 2,432 stores. The HomeGoods chain is an off-price retailer of home fashions in the United States with approximately 850 stores. The TJX Canada segment operates the Winners, HomeSense and Marshalls chains in Canada. Winners is the off-price apparel and home fashions retailer in Canada. HomeSense offers home fashions off-price concept in Canada. The TJX International segment operates the T.K. Maxx and HomeSense chains in Europe. Through its stores and its e-commerce site for the U.K., tkmaxx.com, T.K. Maxx offers a merchandise mix similar to T.J. Maxx. Source: Refinitiv |

Sharek’s Take |

TJX Companies (TJX) stock is holding up well even though retail apparel is in a recession. A lot of the recession is caused by US consumers getting stimulus checks last year and pending them in TJ Maxx, Marshalls, and Homegoods stores. For example, last qtr in America the company had -5% same store sales growth (SSS). But a year ago, SSS were up 21%. So comparisons were tough. Management thinks historically high inflation has impacted consumer spending. The company saw weakness in the home categories, but management was pleased with same store sales in TJ Maxx and Marshall’s. TJX is seeing a marketplace flush with off-price buying opportunities for high quality brands, due to the recession. Just today Nike reported earnings with inventory up 44% from a year ago. NKE management plans to aggressively clear this inventory, some of which will likely go to TJ Maxx and Marshalls. TJX Companies (TJX) stock is holding up well even though retail apparel is in a recession. A lot of the recession is caused by US consumers getting stimulus checks last year and pending them in TJ Maxx, Marshalls, and Homegoods stores. For example, last qtr in America the company had -5% same store sales growth (SSS). But a year ago, SSS were up 21%. So comparisons were tough. Management thinks historically high inflation has impacted consumer spending. The company saw weakness in the home categories, but management was pleased with same store sales in TJ Maxx and Marshall’s. TJX is seeing a marketplace flush with off-price buying opportunities for high quality brands, due to the recession. Just today Nike reported earnings with inventory up 44% from a year ago. NKE management plans to aggressively clear this inventory, some of which will likely go to TJ Maxx and Marshalls.

TJX is the largest major international off-price retailer in the world, which operates in the U.S. since 1976, in Canada since 1990 (Winners), in the U.K. and Ireland since 1994 (where its stores are named as T.K. Maxx). The company offers a rapidly changing assortment of quality brand name and designer merchandise that is 20% to 60% below full-price retailers. TJX is a powerhouse, with 1,200 buyers that sources goods from 21,000 vendors in over 100 countries. It traces its roots back to 1956 when the Zayre discount department store was founded. The company opened its first T.J. Maxx in 1976, and eventually sold the Zayre brand to Ames in 1988, then was renamed to TJX Companies and focused on T.J. Maxx. As of the first quarter ended April 30, 2022, TJX had 4,715 stores, a gain of 26 stores from the prior year. 2019 was TJX’s 24th consecutive year of same store sales increases, but that ended in 2020. During 2020, home accounted for almost 40% of overall sales, up from 33% the prior year. In addition, the company is developing its e-commerce businesses in the U.S. and U.K. TJX brands include:

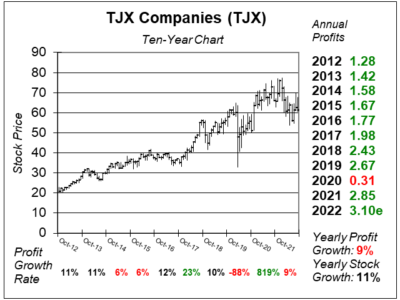

TJX has been an all-time stock market winner as it soared from $0.05 to $61 since 1980. It is currently around a 10-12% grower that also pays a 2% dividend yield. Store expansion of 5%, in addition to mid-single digit same store sales and a large stock buyback program, makes it possible for TJX to grow profits at a low double-digit rate (maybe 10% to 12% per year). Prior to 2020, TJX raised its dividend every year since 1996 at an average rate of more than 20%. In 2020, the company suspended the dividend payout, but has since brought it back. Management bought back 1/4 of TJX shares since 2011. Last year, management repurchased $2.2 billion in stock. TJX is part of the Conservative Growth Portfolio. The stock bottomed in May and is now holding up well in the face of a fierce stock market selloff. |

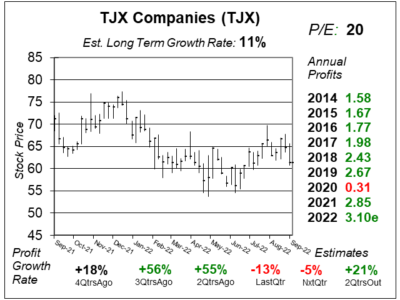

One Year Chart |

TJX stock holding up well. The stock market has been terrible since last week, with many big names falling to52-week lows. This stock bottomed in May. TJX stock holding up well. The stock market has been terrible since last week, with many big names falling to52-week lows. This stock bottomed in May.

Qtrly profit growth has been erratic the past few years as the company had many stores closed last year due to COVID-19. The Est. LTG of 11% is where I think it should be. The stock was a deal last qtr when the P/E was 18. This qtr with a P/E of 20 the stock is within 1% of my Fair Value. |

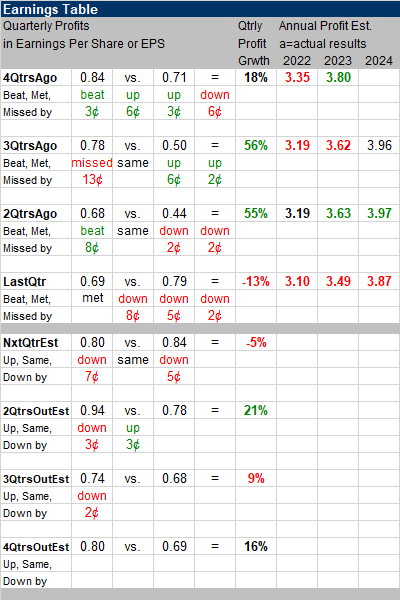

Earnings Table |

Last qtr, TJX Companies delivered -13% profit growth and met analysts’ estimates. Revenue declined 2%, year-on-year. U.S. same-store sales (SSS) fell 5% versus strong 21% growth last year. Revenue was affected by $0.03 foreign exchange impact. Gross profit margin decreased to 27.6% from 29.4% last year due to higher logistical costs. Here are the divisional results during the qtr: Last qtr, TJX Companies delivered -13% profit growth and met analysts’ estimates. Revenue declined 2%, year-on-year. U.S. same-store sales (SSS) fell 5% versus strong 21% growth last year. Revenue was affected by $0.03 foreign exchange impact. Gross profit margin decreased to 27.6% from 29.4% last year due to higher logistical costs. Here are the divisional results during the qtr:

Revenue decline was attributed to weak customer traffic and lower consumer discretionary spending driven by historically high inflation rate and elevated freight costs as well as impact from foreign exchange movements, which cut revenue by 2%. Annual Profit Estimates are lower this qtr. Qtrly Profit Estimates are for -5%, 21%, 9%, and 16% profit growth the next 4 qtrs. For next qtr, management expects U.S. same-store sales to grow 3% to5% versus tough comparison of 16% growth from last year. Profit estimates were lowered due to high inflation which resulted in weak consumer spending. Overseas shipping costs have been declining recently, which bodes well for better profits in future qtrs. |

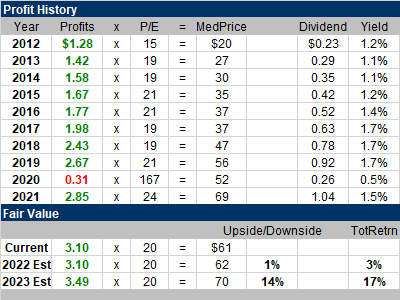

Fair Value |

Note that during the past decade this stock often had median P/E between 19 and 21. Thus, my Fair Value is a P/E of 20. Note that during the past decade this stock often had median P/E between 19 and 21. Thus, my Fair Value is a P/E of 20.

The stock is now right around my $62 Fair Value, with 14% upside when we look to next year’s Fair Value of $70. |

Bottom Line |

TJX (TJX) has been one of the stock market’s finest stocks the past 35 years. This is a well oiled machine that is a juggernaut in the world of fashion. The stock is safe outside of pandemics. TJX (TJX) has been one of the stock market’s finest stocks the past 35 years. This is a well oiled machine that is a juggernaut in the world of fashion. The stock is safe outside of pandemics.

TJX is now battling through a recession for apparel. But that will likely lead to better deals on the shelves for the holiday season. Today after the stock market closed, Nike reported inventory that was up 44% year-over-year, and management said its gonna get rid of it quickly. I think some of those sneakers could end up on the shelves of TJ Maxx and Marshalls. TJX stays at 20th in the Conservative Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 20 of 34 |